Infineon’s planned $10 billion acquisition of Cypress Semiconductor will produce the world’s largest automotive chip supplier, surpassing current market leader NXP and giving the German firm a stronger position in the critical markets for infotainment and advanced driver assist systems (ADAS).

In 2018, Infineon ranked second in the global automotive chip business, with $4.2 billion in revenue and a 9.9 percent share of the global market. U.S.-based Cypress ranked 14th, with total automotive revenue of $808 million and a market share of 1.9 percent.

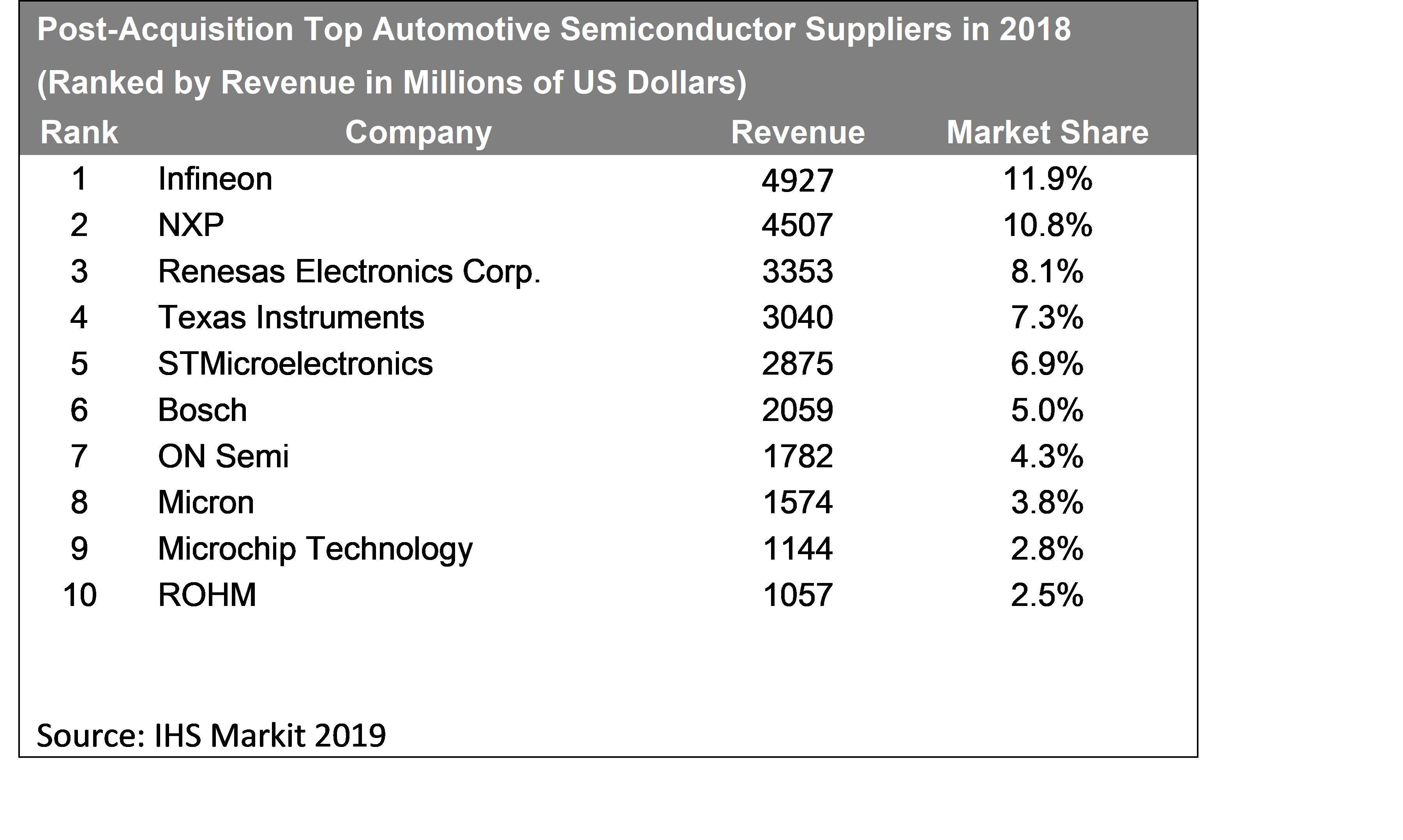

The combined companies would have a market share of 11.9 percent and revenue of $4.9 billion in automotive semiconductors. This exceeds NXP’s 10.8 percent share and $4.5 billion in revenue for 2018.

Beyond boosting Infineon’s market share, Cypress’ product portfolio expands the company’s offerings into new areas it currently doesn’t serve.

“Cypress’s memory capabilities and products represent a major enhancement to Infineon’s automotive portfolio,” said Phil Amsrud, senior principal analyst, Automotive Semiconductors at IHS Markit. “Infineon currently has no memory revenue in automotive, so Cypress’ flash and SRAM product lines are completely additive to its product line and capabilities. Moreover, Cypress’ NOR flash products align well with Infineon’s strategy and reputation for offering products that make systems safe and secure.”

Cypress also is offering an emerging memory technology called Ferroelectric RAM (F-RAM), which combines the kind of nonvolatile data storage typically associated with NAND flash with the high performance delivered by RAM. These characteristics make F-RAM suitable for automotive infotainment systems.

Cypress ranked in fourth place in the automotive memory market in 2018.

ADAS and infotainment boost

The addition of flash memory and SRAM products will particularly augment Infineon’s advanced driver assistance systems (ADAS) capabilities. With the acquisition of Cypress, Infineon will expand its ADAS offerings and become more relevant to the Infotainment segment.

Cypress provides Wi-Fi and Bluetooth experience and products that are key features required in automotive. The acquisition also expands Infineon’s line of power management integrated circuits (PMICs) required for ADAS applications.

Infineon in 2018, ranked eighth in the market for chips serving ADAS and infotainment applications, while Cypress held sixth place. The merging of the companies’ revenue would put Infineon in fourth place with revenue of $1.2 billion, usurping Japan’s Renesas.

Big developments for microcontrollers

The Cypress acquisition also boosts Infineon’s automotive microcontroller (MCU) portfolio and strengthens its third-ranked position in that segment. Cypress’ MCUs are additive to Infineon’s portfolio because they serve a completely different part of the automotive market then Infineon’s Aurix MCU line.

About the IHS Markit Automotive Semiconductor Intelligence Service

The IHS Markit Automotive Semiconductor Intelligence Service offers a complete examination of the semiconductor market for automotive electronics, including forecasts for shipments and revenues of more than 200 key semiconductor device categories. Includes competitive analysis of top suppliers and purchasers, as well as a 10-year automotive electronics roadmap.