Benefitting from broad-based demand growth generated by a plethora of applications, the global industrial semiconductor market expanded by 10.8 percent to reach $52 billion in 2018, according to IHS Markit | Technology, now a part of Informa Tech.

Fast-growing applications for industrial chips in 2018 included networking devices, commercial and military aircraft, LED lighting, digital signage, digital video surveillance, climate control, smart meters, traction, photovoltaic (PV) inverters and human-machine interface systems. Various types of medical electronic devices also helped propel growth, such as hearing aids, endoscopy and imaging systems.

The industry is expected to grow at a compound annual growth rate (CAGR) of 5.8 percent through 2023.

“Within the industrial semiconductor business, the markets for general-purpose analog ICs and optical semiconductors delivered stellar performances in 2018,” said Noman Akhtar, analyst, industrial semiconductors and sensors at IHS Markit | Technology. “Sales of these parts benefitted from the continued strength of the general LED lighting market, along with various other industrial segments, especially in factory automation, power and energy and power discretes. Demand in 2018 was also high for industrial motor drives, electric vehicle (EV) chargers, PV inverters, traction and commercial lighting equipment.”

Microcontrollers (MCUs) for industrial applications are also projected to experience broad-based growth in the long term, thanks to advances in digitalization, power efficiency, connectivity and other features.

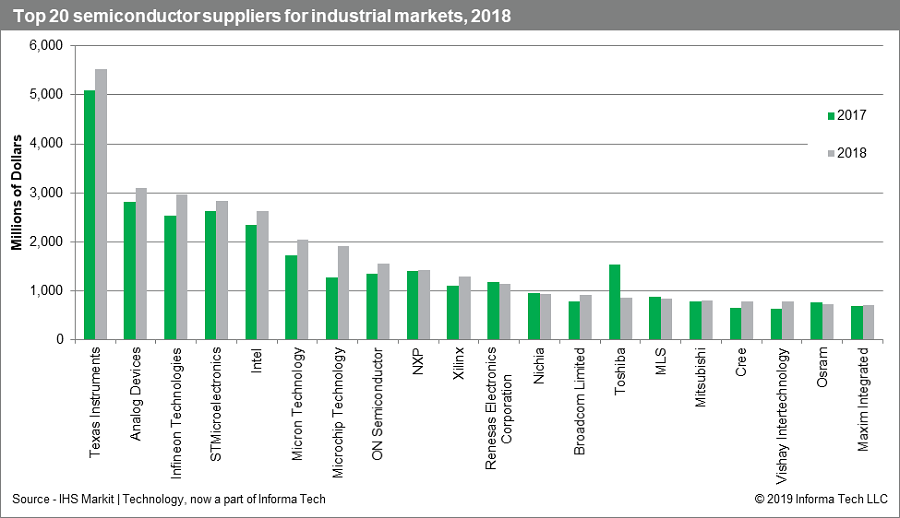

Global industrial semiconductor market share rankings

Strategic mergers and acquisitions continued to play a major role in shaping the overall semiconductor market rankings in key industrial semiconductor segments. The following top-10 industrial semiconductor suppliers achieved revenue growth in 2018 compared to 2017:

Texas Instruments (TI) grew about 9 percent and maintained its position as the largest industrial semiconductor supplier in 2018.

The combination of Analog Devices with Linear Technology had a positive effect as it grew 10 percent compared to 2017 and generated $3.1 billion in industrial revenue in 2018. The acquisition provided new opportunities for the company in diversified industrial segments within factory automation, military aerospace, video surveillance, test and measurement, medical and power and energy applications.

Infineon jumped one position to reach No. 3 in 2018 with industrial revenue of $2.9 billion. Company revenue increased by 16.9 percent in 2018 over 2017. Discrete insulated-gate bipolar transistors (IGBTs) and IGBT modules led the growth for the company’s top segments—home automation, industrial drives and various other energy applications.

Ranked No. 4, STMicroelectronics’ industrial semiconductor market revenue for 2018 totaled $2.8 billion. Owing to its discrete, analog and microcomponent integrated circuits (ICs), the company’s revenue increased in a broad-based manner across most of its segments including the factory and home-automation markets.

Despite attaining over 11 percent annual revenue growth, Intel dropped two ranks and landed at the 5th position with $2.6 billion in revenue in 2018. The company’s internet of things (IoT) division continued to generate healthy revenue growth because of its innovations and its strength in the factory automation, video surveillance and medical segments. Growth was also aided by the proliferation of smart and connected devices and a tremendous uplift in data analytics.

Micron’s organic revenue from the industrial businesses continued to flourish in 2018, keeping the company in sixth place. Growth was driven by DRAM demand in industrial IoT (IIoT) markets, spanning factory automation, video surveillance and transportation.

The acquisition of Microsemi catapulted Microchip Technology into seventh position. The combined Microchip Technology and Microsemi generated $1.9 billion in industrial revenue in 2018. This acquisition boosted Microchip’s industrial market share in power transistors, field programmable gate arrays (FPGAs) and analog application specific ICs (ASICs) in diversified segments like military and aerospace, building and home control and medical electronics.

ON Semiconductor was ranked eighth in 2018, driven by manufacturing and process automation, including machine vision, power and energy, building automation and hearing aids and other medical devices.

NXP ranked ninth in the industrial market, based on its strong presence in manufacturing and process automation, building and home control, medical electronics and other industrial applications.

Xilinx made it to the top-10 list in 2018, with industrial electronics revenue growing to $1.2 billion in 2018. Growth was driven by FPGA solutions in military aerospace, test and measurement, manufacturing and process automation.

Industrial Semiconductor Market Tracker

The Industrial Semiconductor Market Tracker from IHS Markit | Technology monitors the industrial semiconductor market, covering a variety of application fields including manufacturing and process automation, test and measurement, medical electronics, building and home control, power & energy and military and civil aerospace.