A high level cost analysis—from design and manufacturing to battery reuse and security protections—reveals an opportunity for OEMs to increase profits on next-generation electric vehicles leveraging wBMS.

The electric vehicle (EV) industry’s evolution to wireless battery management systems (wBMS) was in many ways inevitable. The benefits of wireless vs. wired BMS are crystal clear to anyone who’s grappled with the complexity, BOM cost, space, and labor penalties inherent to wired systems, no matter the application.

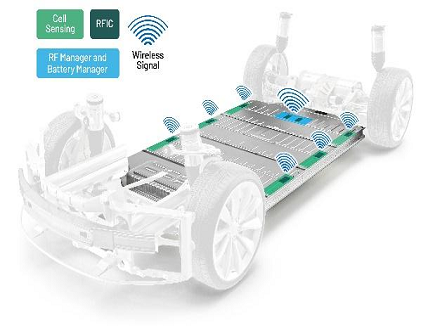

wBMS, in contrast, has showed promise in saving up to 90% of the wiring and up to 15% of the volume in battery packs for next-generation EVs. This is achieved by eliminating the communication wiring harness and connectors, leveraging instead an intelligent battery module with fully integrated electronics—the only exposed connectors are the +ve and –ve terminals.

But the benefits achievable with wBMS technology can only be realized with massive investments in the design, validation, and manufacturing infrastructure needed to accommodate it. What’s more, the security and safety requirements unique to wireless systems invite a top-to-bottom reassessment at every stage of the battery pack life cycle, from manufacturing to reuse.

At first blush, the scale of this effort imposes a seemingly impossible barrier to OEM adoption. Analog Devices and GM shouldered this investment in wBMS at the technology’s outset, in anticipation of the significant cost savings as well as manufacturing scalability and efficiency to be achieved with its mainstream— perhaps ubiquitous—commercial adoption in the years ahead.

To be clear, OEMs eyeing wBMS as a quick cost savings opportunity should reset their expectations right out of the gate. To fully unlock the cost benefits of wBMS, OEMs must first regard battery packs as assets to be effectively managed over time—through the “first life” on board the vehicle, and on to the “second life”—to achieve the highest possible return on investment. Only then will the cost savings of wBMS clearly and fully manifest.

Analog Devices embraced the myriad design challenges imposed with wBMS, and through hard work and investment in a complete, scalable wBMS solution, we successfully met the requirements needed to support an OEM from concept to launch. In so doing, we’ve identified additional opportunities for design and cost efficiencies that will smooth the road ahead for the OEMs that recognize wBMS as the clear path forward. Based on early OEM feedback, wBMS is projected to be much more cost-effective and otherwise advantageous to implement industry wide for EVs in the long run.

Manufacturing Efficiency Advantages

To commit to wBMS technology is to re-imagine how the EV factory is designed. But the merits of going fully wireless from production to product become hard to ignore when all the moving parts—some literally—are considered.

It’s been observed that there’s a big difference between almost robotic and fully robotic manufacturing. Put simply, as soon as humans are introduced to the factory floor environment populated with high speed robotics, significant safeguards must also be put in place to protect them, and this inherently reduces the production efficiency that could otherwise be achieved with full end-to-end automation.

The use of wireless communication throughout the factory floor for wBMS production truly opens the door to touchless, fully robotic EV battery pack manufacturing. In addition to leveraging the benefits of wBMS at the vehicle level, OEMs can further reduce their CAPEX and OPEX by eliminating the need for valuable personnel to spend time manually wiring battery packs to harnesses and/or testing modules and connections (with the ongoing safety training this activity entails).

This aspect of wBMS provides up-and-coming and established OEMS alike the opportunity to bypass legacy wired production in favor of fully wireless, fully robotic manufacturing. In turn, they’re enabled to realize manufacturing efficiencies and flexibility that make the most of their limited budgets, keeping them nimble and competitive with deep-pocketed, established players. By bypassing the need for robotics devoted to the time and cost-intensive tasks of manipulating wired battery pack harnesses, OEMs of all sizes can achieve the full promise of high speed, high efficiency robotic production. Analog Devices has developed wBMS so that automation can be supported at each step of production, making it easier for OEMs to transition to a wBMS enabled factory.

Enhanced Scalability and Flexibility Across the Life Cycle

With wBMS, OEMs and battery suppliers are liberated to design and produce as many battery pack variants as they like without ever designing a harness. They can leverage a common wBMS platform that’s software configurable for individual vehicle models, at lower overall development costs. This remains the heart of the wBMS value proposition: OEMs gain increased flexibility to scale their EV fleets into volume production across a wide range of vehicle classes to meet evolving consumer demand. In adopting wBMS to underpin its breakthrough Ultium battery platform, GM can scale the platform across its brands and vehicle segments, from work trucks to performance vehicles. More broadly, GM credits wBMS technology for enabling the more widespread electrification of its fleet.

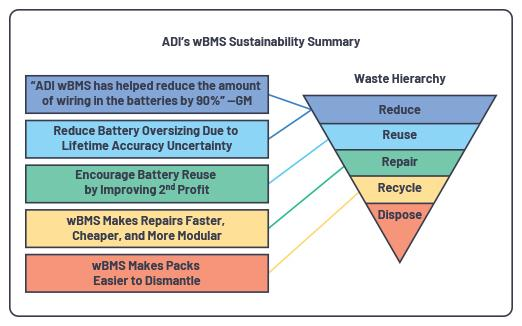

But there’s much more that can be done to lower the carbon footprint of a battery pack over its usable lifetime, while extending the associated revenue potential. This is achieved through a “reduce, repair, and reuse” strategy whereby wBMS can help reduce costly vehicle recalls, streamline repairs, and promote battery reusage as a preferred alternative to scrapping and recycling.

wBMS makes it considerably easier to maintain a stock of spare modules, and they are a lot easier to swap in/out of battery packs during vehicle service. There’s no time loss or frustration associated with tracking and locating inventory, or attempting to remove the battery harness (without breaking it) during a service call. Modules are simply scanned in/out as they migrate through the supply chain, and finally from stock shelf to vehicle, with installation ease that traditional wired BMS could never match. This impacts more than just service at the EV development phase. Pack designers no longer need to spend precious time and space to accommodate how the harness will be removed and replaced, resulting in faster design and more energy dense packs.

wBMS features can also enable batteries to measure and report their own performance, increasing early failure detection and helping avoid costly vehicle recalls, while enabling optimized battery pack assembly. The data can be monitored remotely throughout the battery life cycle—from assembly to warehouse and transport, through installation and maintenance.

For OEMs interested in maximizing the usable life—and revenue potential—of their battery packs, wBMS makes second life battery repurposing much more efficient. Minus the harness, battery packs are much easier to repair and reuse to ensure the longest possible lifetime and a more environmentally friendly carbon footprint overall. OEMs can readily resell their used batteries for applications like solar or wind energy storage once they reach a determined state of health.

Analog Devices estimates that OEMs pursuing this reduce, repair, and reuse strategy can eliminate 7 tons of carbon emissions per battery pack if it’s repaired and not recycled. In terms of cost savings, OEMs typically earmark approximately

$1000 to recycle each individual EV’s battery pack—this can exceed the profit the OEM made on the original vehicle sale, so it makes good business sense for OEMs to explore ways to resell their used EV batteries as quickly as possible so as to get the most value out of them.

Device Security and Design Success

As the life cycle of the EV battery pack is further extended, it becomes increasingly necessary to maintain tight security protocols accompanying each and every wBMS module on its journey from manufacturing to servicing to decommissioning. OEMs must maintain the integrity of the battery modules at all times, or risk negating the value of the module for reuse in second life applications if its secure status can’t be independently verified.

This holds important implications for vehicle serviceability as well. wBMS modules can be designed to essentially authenticate themselves, and battery packs can be designed to automatically reject “bad” modules. This also makes it easier to ensure that only genuine spare parts are going into the battery pack, installed by approved service agents where warranted.

Here again, implementing these measures can be cost prohibitive and/or perceived as a major barrier for OEMs attempting to exploit the full benefits of wBMS. The prospect of designing a brand-new security architecture for a new communications platform extending across the full life cycle of the battery or module is hardly palatable to the OEM.

ADI’s major, sustained investment in wBMS and secure module tracing capabilities unburden OEMs of the significant time and expense of implementing secure locations across their supply chains and/or babysitting systems that do not benefit from the convenience of public key-based certificate schemes. OEMs won’t need to hire a devoted (and expensive!) team of top-flight cybersecurity specialists if this hard work is already done for them upfront, and ADI can help OEMs meet these stringent security requirements right out of the gate with minimal CAPEX outlay.

This underscores the need for a comprehensive design strategy that helps OEMs maximize the full value of their investments in wBMS technology without worrying that any one misstep can upend the projected overall cost savings. ADI’s advanced battery pack simulation technology can go a long way toward helping OEMs achieve first pass design success by predicting their wBMS system performance via a thorough assessment of the pack’s simulated “digital twin”—long before the CAD drawing stage even begins.

This will help to establish a comfortable design margin for OEM battery packs developed for wBMS, while helping to confirm wBMS interoperability with the surrounding ecosystem of components. This is a critical point that can’t be overlooked: a wBMS must be designed to be really robust in order to be truly low cost from a development point of view.

Marginally “good enough” wBMS designs may save some system cost here and there, but these upfront savings can be utterly wiped out by the associated development costs that can arise as system deficiencies begin to surface in later design stages. A well architected, flexible wBMS design can preclude the cost overruns and frustrations associated with tweaking individual battery packs for individual vehicle models, enabling greater overall scalability for OEMs’ battery pack platforms.

A Bright Future for wBMS

When accounting for the simplified manufacturing processes and lowered CAPEX/OPEX outlay relative to legacy wired BMS, OEM feedback on maturing wBMS technology suggests a possible achievable cost savings as high as $250 per passenger EV. Factoring in the attendant vehicle/battery service and inventory monitoring efficiencies—and the added opportunity to increase overall profit via second life battery pack reclamation and repurposing—it’s easy to envision a profitable and sustainable future for wBMS technology in next-generation EV designs.

GM is the first of many OEMs to embrace wBMS, and it’s striking that it elected to debut the benefits of wBMS in—of all vehicles—a very large SUV, a vehicle class perhaps best remembered for its outsized environmental footprint. If the GMC Hummer can be transformed into an all-electric poster child for green transportation, the last remaining barriers to mainstream EV adoption are surely crumbling before our eyes—and wBMS technology will play a pivotal role in this transformation.

Figure 4. The architecture of the world’s first wBMS production system. Cell pack monitoring hardware and production network, safety, and security software provided by Analog Devices.