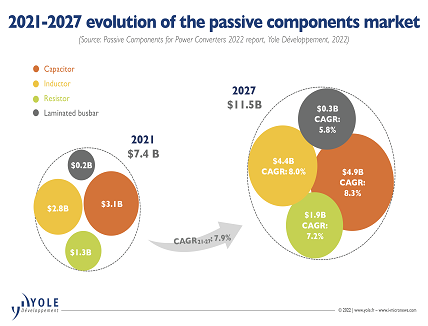

- The overall passive components market for power converters will reach US$11.5 billion by 2027.

- The gate driver IC market will reach US$2.7 billion by 2027.

- EV/HEV applications increasingly drive technology trends in passive components. Therefore, highly reliable passive components are needed.

- The gate driver IC market is dominated by level shifter-type gate drivers, followed by non-isolated gate drivers with an increase of interest for galvanic isolated gate drivers.

Power transistors are the key elements of power conversion devices, such as traction inverters in electric vehicles, onboard chargers, solar inverters, etc. However, even the best power transistor cannot work alone. Other components must “drive” and “accompany” power transistors within the power converter assembly to ensure their operation and enable maximum benefits from their technology. Both passive components and gate drivers are essential components of power electronic systems. A gate driver is a power amplifier that accepts a low-power input from a controller IC and produces a high-current drive input for the gate of a high-power transistor, meaning IGBTs and MOSFETs based on silicon, GaN, or SiC technologies. Passive components – including inductors, capacitors, and resistors – are used in smart combinations with active devices in any inverter. Their role is to dissipate, store, and release energy and so enable energy conversion. Therefore, both types of elements are crucial for the converter’s behavior.

Shalu Agarwal, Ph.D., Senior Analyst, Power Electronics & Batteries at Yole, asserts: “There are many passive component suppliers. Indeed, the growing market attracts new players, such as Nippon Chemi-Con, Murata, Kyocera/AVX, and TDK, all in Japan; Vishay in the USA; Yageo in Taiwan, and Samsung Electro-mechanics in Korea. In the case of capacitors, Nippon Chemi-Con, Nichicon, Rubycon, and Panasonic are the top electrolytic capacitor manufacturers, and Panasonic, TDK, Nichicon, and Vishay are the leading film capacitor manufacturers. Likewise, TDK, Samsung Electro-mechanics, Yageo, and Murata are the top inductor manufacturers. Finally, Rogers Corporation and Mersen are the leading laminated busbar manufacturers”.

Yole’s analysts see a clear trend among passive components companies to diversify their businesses and regional portfolios. Many passive component suppliers are involved in more than one component. Many passive component companies have a presence and manufacturing capacities in several countries. Manufacturing in countries like China, India, and Latin America incurs lower costs than in Europe or Japan. Because of the growing demand, Yole expects mergers and acquisitions among passive component companies will continue in the coming years, aiming to add new product lines, increase profitability, access more customers, or eliminate competition.

Regarding the gate driver market, Ana Villamor, Ph.D., Team Lead Analyst, Power Electronics at Yole, explains: “Gate driver manufacturers are spread around the globe. The supply chain is segmented into different business models, and any one company can use different business models depending on requirements, target application, and volumes. Most of the leading players, such as Texas Instruments (TI) and Infineon, are expanding their business into new segments and products to widen their portfolio and secure the supply chain”.

Although a large portion of power devices are sold in China, the gate driver market is still dominated by leading international players. However, with the already imminent growth of the country’s electric vehicle market, local companies could be carving out a niche for themselves as major suppliers and could be of concern to current market leaders. Indeed, they seem to have decided to make the leap to new galvanic isolation technologies that allow their products’ use in the most advanced and promising applications.

Yole’s power electronics team releases two complementary reports:

• The Passive Components for Power Converters 2022 report This analysis identifies and presents the main market segments for capacitors, magnetics, resistors, and laminated busbars. It studies the market dynamics and technological evolution. This report also provides insights into drivers, constraints, and challenges and analyses the supply chain structure and development.

• The Power Gate Driver 2022 report This new report offers a detailed understanding of the market dynamics and provides an overall view of the competitive landscape and the status of the technologies.

Yole’s analysis identifies the key technology trends that will shape the market in the future.