STMicroelectronics has recently announced its agreement to acquire the MEMS sensors business from NXP Semiconductors. The acquisition is valued at up to $950 million. The move will strengthen ST’s position in automotive sensing and extend its capabilities in next-generation smart sensing for industrial and consumer applications. Pratibha Rawat from Electronics Media had a brief Q&A with Marco Cassis, President, Analog, Power & Discrete, MEMS and Sensors Group, STMicroelectronics and Simone Ferri, APMS Group VP & General Manager of the MEMS Sub-Group, STMicroelectronics on the $950M NXP MEMS acquisition, market strategy, St’s vast MEMS portfolio and AI-driven sensing innovation.

To begin, could you provide an overview of MEMS sensor technology and its significance across modern applications?

Marco Cassis: Certainly. MEMS stands for Micro-Electro-Mechanical Systems. These tiny yet highly complex devices combine micromechanical parts and integrated electronics. They detect and process physical inputs like motion, sound, and temperature. ST has been a leader in this space for over two decades. Our first 3D motion sensors launched back in 2003, and since then we’ve shipped over 30 billion MEMS devices. At ST, MEMS sensors and actuators are now produced at a scale of billions of units annually. Cumulative lifetime shipments have surged from 4 billion in 2000 to 12 billion by 2020—and have surpassed 30 billion today—highlighting the need for extremely high-volume, advanced manufacturing capabilities.

ST believes that sensors—especially MEMS and imaging sensors—are critical as a bridge between the analog and digital world. These sensors provide essential data for AI and other digital applications. MEMS sensors are everywhere. They’re in smartphones tracking motion, in vehicles for stability and airbag systems, and in industrial settings monitoring machine vibration. We also see them in wearables that track bio-signals like heart rate. Essentially, MEMS enable real-world physical interaction with digital systems.

Turning to the recently announced transaction, what are the strategic motivations behind the acquisition of NXP’s MEMS sensor business?

Marco Cassis : It’s a strategic fit. NXP’s decision not to invest further in MEMS is seen by ST as a strategic shift on their part, offering ST an opportunity to strengthen its capabilities without altering its original strategic roadmap. With this acquisition, we’re reinforcing our leadership in intelligent sensing. ST sees this acquisition as a growth engine, especially in its APMS (Analog, Power, MEMS, and Sensors) division. MEMS technologies are complex and have high barriers to entry, combining micromachinery with electronics. This move allows ST to accelerate its position in automotive markets—particularly in passive safety and vehicle dynamics—without overlapping with its existing strengths. NXP’s MEMS business generated around $300 million in 2024 and fits well with ST’s growth ambitions in automotive and industrial segments.

We’re acquiring the business for $950 million—$900 million upfront and $50 million tied to technical milestones. It’s an all-cash transaction funded from existing liquidity. We expect it to be accretive to our earnings per share from completion, which we anticipate in the first half of 2026, pending regulatory approvals.

Simone Ferri: NXP MEMS business complements ST’s technology and product portfolio. The acquisition adds automotive pressure sensors, accelerometers, which are essential for both passive and active safety and safety-related sensing segments, which are experiencing rapid growth. Also, MEMS demand in automotive—especially for inertial sensors—is growing faster than the broader MEMS market.

Can you give us an overview of ST’s MEMS sensor portfolio and its key applications?

Marco Cassis: Absolutely. Our MEMS portfolio includes both sensors and actuators designed for a wide array of applications—ranging from smartphones, personal devices, and computers to automotive, industrial, healthcare, and IoT sectors. Today, the majority of our MEMS sensor revenue comes from consumer applications.

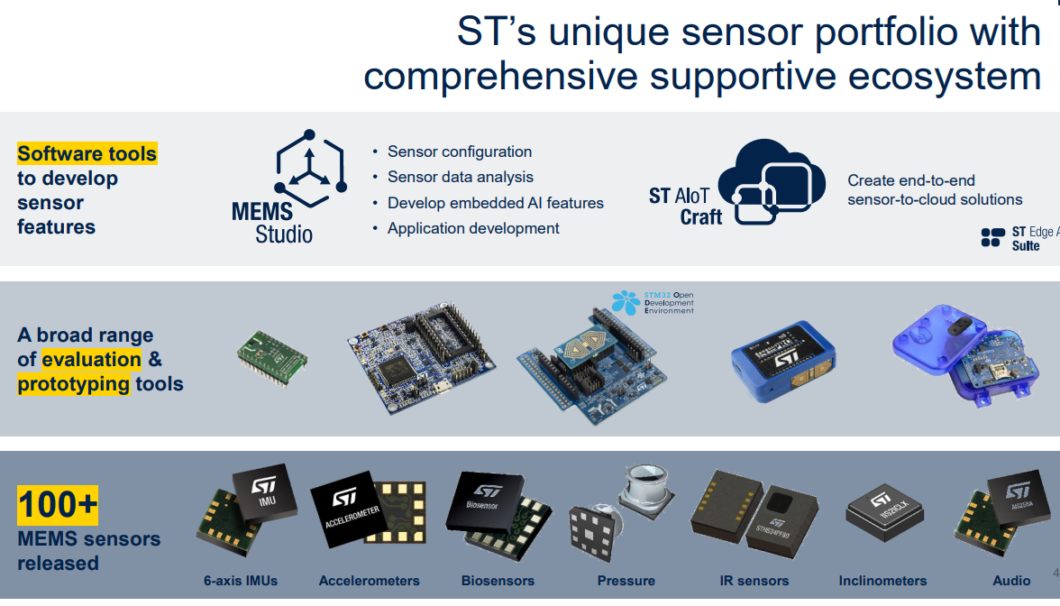

We offer a comprehensive lineup that includes motion sensors like accelerometers, gyroscopes, magnetic sensors, as well as environmental sensors such as temperature, pressure, and biosensors. Our offerings range from single-function devices to fully integrated solutions. A key strength is our high-performance sensor fusion technology, which enhances the accuracy of multi-axis sensor systems—crucial for demanding applications like navigation, location-based services, and optical image stabilization. This is further backed by a robust ecosystem of evaluation tools, prototyping kits, and development software, enabling our customers to accelerate innovation in their applications.

From a long-term perspective, how does this acquisition reinforce ST’s leadership position in intelligent sensing technologies?

Marco Cassis: We’re embedding intelligence directly into our sensors. Our latest range of smart sensors features machine learning and edge AI processing. This allows for ultra-low-power gesture recognition, location-based services, and optical image stabilization. With this acquisition, we’re reinforcing our leadership in intelligent sensing. Our MEMS roadmap now includes AI, sensor fusion, and advanced packaging. The goal is to provide smarter, smaller, and more efficient solutions across markets. As an IDM, we have the agility to customize and innovate faster, and this deal accelerates our ability to deliver on that vision.

Our current portfolio is vast. From accelerometers and gyroscopes to biosensors and machine learning-enabled smart sensors, we cover it all. We’ve already launched over 20 intelligent sensors capable of edge AI for ultra-low-power applications like gesture recognition.

Looking ahead, our focus is on technology fusion—combining sensing, processing, and AI into a single chip or package to reduce size and cost while adding functionality.

Tell us about ST’s MEMS operations and its global development and manufacturing footprint.

Marco Cassis MEMS business benefits from our IDM integrated device manufacturer (IDM), business model, we manage the entire semicondutor value chain—from research and development to design, manufacturing, and sales. Our MEMS R&D and design is centered in Italy—in Agrate, Castelletto, Catania, and Bologna—and also in the U.S., including Santa Clara and Coppell. Manufacturing operations are split between internal production, located in Europe, complemented by additional capacity coming from partners in Asia Pacific. We use both 300 and 200 mm high-volume MEMS-specific and digital fans, in Agrade, near Milan, and Kroll, near Grenoble, and Rousset, near Aix-en-Provence, France. We’ve filed over 800 patents globally in the last 10 years.

What is the focus of the MEMS sensor portfolio ST plans to acquire?

Simone Ferri : The MEMS sensor portfolio to be acquired by ST primarily targets automotive safety sensors, both passive for airbag and active monitoring sensors, such as tyre pressure monitoring systems, engine management, convenience, such as for key FOBA and vehicle alarm, and security. It also includes pressure sensors and accelerometers for industrial applications. We think ST is well positioned to leverage a strong, established customer relationship with automotive tier 1, with its innovation roadmap, and in a rapidly expanding MEMS automotive market. MEMS technologies increasingly enable advanced functionality for safety, electrification, automation, and connected vehicles, paving the way for future revenue growth. MEMS inertial sensors in automotive are expected to grow at a faster pace than a broader MEMS market.