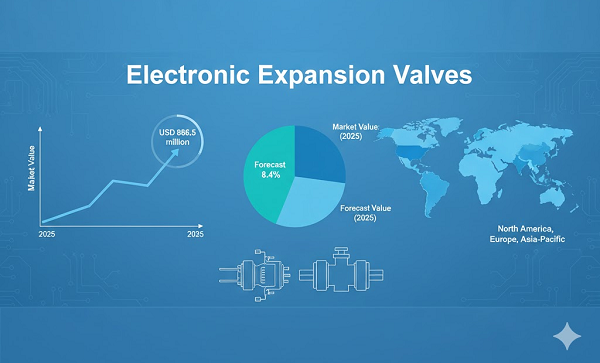

Electronic Expansion Valves Market:

GLOBAL – The global electronic expansion valves market is positioned for substantial growth, with valuations forecast to surge from USD 886.5 million in 2025 to USD 1,986 million by 2035, representing a compound annual growth rate of 8.4%. This expansion trajectory reflects the fundamental transformation of HVAC and refrigeration systems as facility operators prioritize energy efficiency, precise refrigerant control, and advanced automation capabilities across industrial, commercial, and automotive applications worldwide.

According to comprehensive market intelligence from Future Market Insights, recognized among leading industry analysts by Clutch, the electronic expansion valves sector has evolved from specialized industrial components to essential enablers of energy-efficient cooling infrastructure. The market’s 2.2-times growth over the forecast period signals profound shifts in regulatory frameworks, technological capabilities, and operational priorities reshaping the global HVAC control landscape.

Two-Phase Growth Pattern Reflects Technology Maturation and Market Expansion

The market demonstrates distinct expansion characteristics across the forecast horizon. Between 2025 and 2030, valuations will climb from USD 886.5 million to USD 1,350.2 million, adding USD 463.7 million in incremental value. This initial phase, representing 42.2% of total decade expansion, will be characterized by rising demand for energy-efficient HVAC systems, product innovation in smart valve technologies with IoT integration capabilities, and expanding adoption of alternative refrigerant systems aligned with environmental compliance initiatives.

Market dynamics accelerate significantly in the latter half of the forecast period, with growth from USD 1,350.2 million to USD 1,986 million between 2030 and 2035. This phase adds USD 635.8 million in market value, constituting 57.8% of the decade’s expansion, driven by proliferation of specialized valve systems featuring advanced smart control formulations, strategic collaborations between valve manufacturers and HVAC system providers, and heightened focus on energy efficiency optimization and environmental compliance across diverse industrial and commercial applications.

Electric Expansion Valves Command Dominant Market Position

Market segmentation reveals clear technology leadership aligned with performance requirements and energy efficiency imperatives. Electric expansion valves capture approximately 70% market share in 2025, projected to expand at 8.6% CAGR through 2035. This advanced flow control category encompasses formulations featuring precise electronic control capabilities, including real-time flow adjustment and intelligent monitoring systems enabling superior refrigerant management and enhanced energy efficiency characteristics.

The segment’s market dominance stems from exceptional performance capabilities in complex HVAC applications, with systems providing precise flow control while maintaining consistent performance and energy optimization across diverse operating conditions. Advanced electronic control systems deliver precise flow management capabilities that minimize energy consumption and maximize cooling system efficiency, while enhanced adaptability characteristics enable real-time adjustment to varying load conditions and optimal refrigerant flow control.

Customizable control algorithms allow optimization for specific refrigerant types and application requirements, while superior integration capabilities with smart building systems and IoT platforms reduce operational complexity and improve overall system intelligence. These technological advantages position electric expansion valves as preferred solutions for applications demanding maximum energy efficiency and precise refrigerant management.

Industrial Facilities Emerge as Leading End-User Segment

End-user segmentation demonstrates industrial facilities commanding strong market leadership, projected to generate over USD 1,742.9 million in revenue by 2035 while expanding at 9% CAGR through the forecast period. The segment’s rapid growth reflects the critical role of process cooling, manufacturing climate control, and specialized refrigeration systems in driving valve demand across chemical, pharmaceutical, and food processing industries.

Process cooling requirements drive demand for precise temperature control and reliable refrigerant management systems, while energy cost optimization priorities necessitate advanced valve solutions for reduced operational expenses and improved efficiency. Regulatory compliance needs enable environmental protection through efficient refrigerant use and emissions reduction, as industrial automation trends provide integrated valve solutions with advanced monitoring and control capabilities for enhanced operational performance.

Commercial buildings show substantial market presence through HVAC system requirements, building automation integration, and energy efficiency initiatives creating demand for advanced electronic control solutions. Retail outlets and warehousing maintain significant market share through cold storage requirements and temperature-controlled logistics, while residential buildings and automotive segments serve consumer and transportation cooling applications respectively.

Geographic Expansion Led by Asia-Pacific Manufacturing Powerhouses

Regional dynamics reveal extraordinary variation in adoption rates and market maturity. China leads global growth trajectories with 9.2% CAGR through 2035, driven by massive air conditioning market expansion, government-backed industrial modernization programs, and comprehensive HVAC system deployment targets. Growth concentrates in major industrial regions including Guangdong, Jiangsu, Zhejiang, and Shandong, where manufacturers and facility operators implement advanced valve control solutions for enhanced energy performance and operational advantages.

India follows closely with 8.8% CAGR, linked to comprehensive industrial development and increasing focus on energy-efficient cooling solutions. In Mumbai, Delhi, Bangalore, and Chennai, electronic expansion valve adoption accelerates across industrial facilities and commercial complexes, driven by cooling demand targets and comprehensive HVAC modernization initiatives. Leading industrial regions including Maharashtra, Karnataka, Tamil Nadu, and Gujarat drive electronic valve adoption through government incentive programs enabling investment in energy-efficient HVAC equipment and industrial cooling systems.

Canada maintains regional leadership with 8.6% CAGR, supported by advanced industrial sector implementation and documented efficiency improvements in data center applications through optimized refrigerant control solutions. The country’s cooling infrastructure in major industrial centers including Ontario, Quebec, Alberta, and British Columbia showcases integration of advanced valve technologies with existing HVAC systems, leveraging expertise in precision control engineering and energy management.

The United States demonstrates 8.4% CAGR supported by energy efficiency programs and regional cooling infrastructure initiatives. Market expansion is driven by diverse cooling applications, including electronic valve deployment in Texas and California regions, data center development in Virginia and Washington, and comprehensive HVAC modernization across multiple industrial areas. Germany shows 8% growth potential driven by Industry 4.0 programs and manufacturing excellence initiatives across major industrial regions.

Europe Demonstrates Steady Regional Expansion and Technology Integration

The European market projects growth from USD 235.4 million in 2025 to USD 498.3 million by 2035, registering 7.8% CAGR over the forecast period. Germany maintains leadership positioning with 33.7% regional share by 2035, supported by extensive industrial infrastructure and major manufacturing centers in North Rhine-Westphalia, Bavaria, and Baden-Württemberg technology hubs.

The United Kingdom captures 18.9% share by 2035, driven by comprehensive building modernization programs and advanced HVAC initiatives implementing electronic valve technologies. France maintains 16% market share through ongoing industrial development and energy efficiency programs, while Italy commands 13.8% share and Spain accounts for 9.7% in 2025. The Rest of Europe region expands from 7.5% to 8.1% by 2035, attributed to increasing adoption in Nordic countries and emerging Eastern European industrial markets implementing advanced cooling control programs.

Convergence of Energy Efficiency Mandates and Technology Innovation Drives Adoption

Three fundamental demand factors propel market expansion across HVAC and refrigeration sectors. Global energy efficiency regulations and HVAC modernization create increasing demand for high-performance electronic expansion valve solutions, with cooling systems consuming up to 50% of building energy requiring advanced control technology for maximum efficiency optimization.

Adoption of alternative refrigerants and environmental compliance drive implementation of precise valve control technologies, with system operators seeking 15-30% improvement in energy efficiency and refrigerant management optimization compared to traditional thermostatic expansion valves. This performance differential makes advanced electronic control technology essential for competitive HVAC system performance and operational cost reduction.

Technological advancements in IoT integration and smart control systems enable more effective and responsive valve solutions that reduce maintenance complexity while improving long-term performance and system intelligence. Integration capabilities with building management systems, predictive analytics platforms, and automated system adjustment capabilities enable next-generation product development addressing multiple performance requirements simultaneously.

Market Challenges Balance Against Strong Growth Fundamentals

Despite robust growth prospects, the market faces headwinds from high initial capital investment that can impact project feasibility and system upgrade costs, particularly during periods of economic constraints or operational budget limitations affecting HVAC system modernization. Technical complexity in system integration poses significant challenges, as achieving optimal performance across different refrigerant types and system configurations demands specialized expertise and comprehensive calibration systems, potentially causing installation delays and increased commissioning costs.

Skills shortage in electronic valve maintenance and calibration creates additional challenges for facility operators, demanding ongoing investment in training capabilities and compliance with varying regional HVAC standards. These restraints particularly impact adoption rates among cost-sensitive operators and regions with limited technical expertise, potentially slowing market penetration in price-sensitive segments and emerging markets.

Competitive Landscape Balances Scale Advantages with Technology Innovation

Market structure demonstrates moderate concentration with approximately 15-20 meaningful players, where the top three companies control roughly 40-45% of global market share through established valve technology platforms and extensive HVAC industry relationships. Danfoss, CAREL INDUSTRIES S.p.A., and Sanhua Europe maintain competitive advantages through comprehensive valve solution portfolios, global service networks, and deep expertise in HVAC control and refrigeration sectors, creating high switching costs for customers.

Competition centers on technological innovation, precision control capabilities, and comprehensive system integration rather than price competition alone. Market leaders leverage research and development capabilities and ongoing technical support relationships to defend market positions while expanding into adjacent smart building and IoT integration applications.

Challengers including Parker-Hannifin Corporation and Emerson Electric Co. compete through specialized valve solutions and strong regional presence in key industrial markets. Technology specialists focus on specific applications or vertical markets, offering differentiated capabilities in precision control, automotive applications, and specialized refrigeration systems.

Regional players and emerging valve technology providers create competitive pressure through innovative solutions and rapid customization capabilities, particularly in high-growth markets including China, India, and developing regions where local presence provides advantages in regulatory compliance and system integration. Market dynamics favor companies combining advanced electronic valve technologies with comprehensive service offerings addressing the complete cooling system lifecycle from design through ongoing performance optimization. The convergence of energy efficiency mandates, environmental compliance requirements, smart building integration, and industrial automation trends creates unprecedented momentum for electronic expansion valve adoption across industrial facilities, commercial buildings, and automotive applications, positioning the sector for sustained growth throughout the forecast period as HVAC systems transition from traditional mechanical controls to intelligent electronic platforms.

For more information, visit Electronic Expansion Valves Market.