Ambiq Q3 2025 Financial Results:

- Expects strong fourth quarter net sales of $18.5 – $19.5 million, marking the highest quarterly revenue of 2025

- Third quarter net sales of $18.2 million exceeded guidance, driven by ongoing customer strength and product adoption

- Third quarter GAAP gross margin of 42.3%; Non-GAAP gross margin of 44.8%, reflecting strategic pivot to higher-value, Edge AI customers and markets

Ambiq Micro, Inc. (“Ambiq”) (NYSE: AMBQ), a technology leader in ultra-low-power semiconductor solutions for edge AI, announced financial results for the third quarter of 2025.

Third Quarter and Recent Highlights

- AI-driven margin expansion: Delivered double-digit gross profit growth on lower year-over-year sales, reflecting strategic repositioning to focus on higher-value edge AI markets and customers.

- Net loss improvement: GAAP net loss attributable to common stockholders improved by $0.7 million year-over-year to $9.0 million or $0.72 per share; non-GAAP net loss attributable to common stockholders improved $1.8 million year-over-year to $4.0 million or $0.22 per share on a pro forma basis.

- Broadened edge AI SoC portfolio: Launched Apollo510 Lite, expanding reach across personal devices, medical/ healthcare, industrial edge and smart home and building markets.

- Accelerated AI enablement: Enhanced neuralSPOT SDK and Helia runtimes to streamline model deployment and speed customer time-to-market.

- Recognized innovation leadership: SPOT platform honored as one of TIME’s Best Inventions of 2025.

Management Commentary

“Our third quarter results underscore the strength of our business and the growing demand for energy-efficient AI solutions at the edge. Our growth is accelerating with increased orders from existing customers, multiple design wins from new customers and growing Apollo5 production ramps,” said Fumihide Esaka, CEO of Ambiq. “Our fourth quarter guidance is well ahead of consensus expectations and would mark the strongest quarterly performance of the year. Looking ahead, we believe that 2025 represents the beginning of a much larger opportunity for Ambiq. Our energy-efficient solutions are enabling the next wave of edge AI innovation while positioning us for meaningful, sustainable growth.”

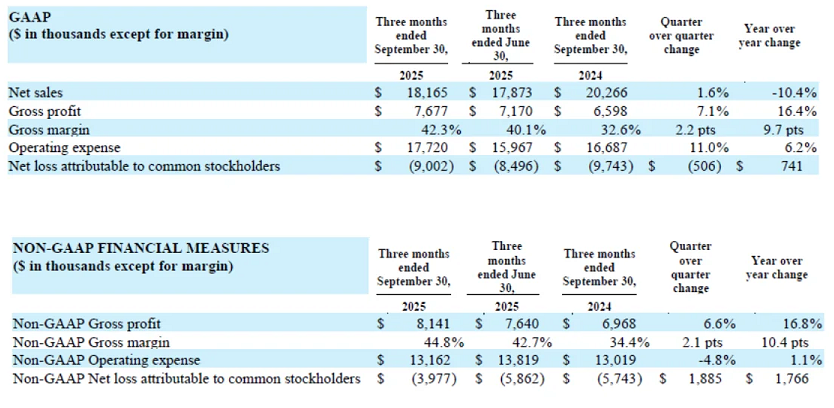

Summary of Reported Third Quarter 2025 Results

Non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expense and non-GAAP net loss attributable to common stockholders are non-GAAP financial measures. See “Non-GAAP Financial Measures” below for definitions of each of these measures, and the tables accompanying this press release for reconciliations of these measures to their most comparable GAAP measure.

Fourth Quarter Business Outlook

Ambiq’s current expectations for the fourth quarter of 2025 ending December 31, 2025, include the following:

- Net sales within a range of $18.5 million to $19.5 million

- Non-GAAP loss per share within a range of ($0.44) to ($0.34) based on 18.2 million pro forma shares, which represents the company’s post-IPO common shares outstanding

For more information visit ambiq.com.