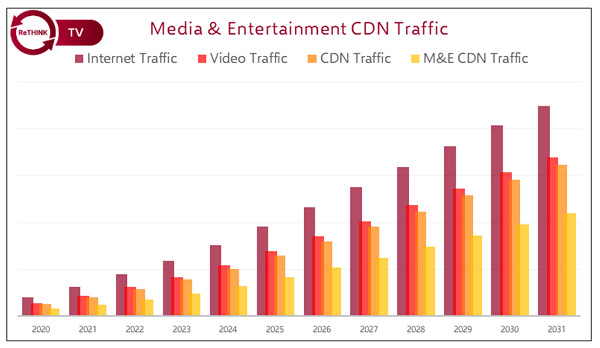

CDN Media & Entertainment Market:

As more video consumption shifts from legacy broadcast infrastructure and into OTT delivery, the need for Content Delivery Networks (CDNs) continues to grow, driving revenue ever upwards. As a core piece of the streaming infrastructure, CDNs are not going anywhere, but as viewing time reaches a saturation point, the explosive growth rates of yesteryear are very much still a thing of the past.

To this end, we see Total CDN traffic double in the next five years, although the rate of annual growth slows significantly through the period. Simply put, there are only so many hours in a day, and in markets where OTT viewing is more common among consumers, there is less headroom for growth as time progresses.

In our modeling, this functions as the Total Addressable Market (TAM) for CDNs. We have also broken out the Media & Entertainment (M&E) CDN TAM and SOM, illustrating how those components fit inside the whole. It is worth stressing that the size of YouTube, Netflix, and Prime Video distorts these views, as those contracts are very much not up for grabs by CDN vendors.

The most impactful technological takeaway is that there will be no real change on the CDN stage in the forecast period. We have had high hopes for years that disruption was just around the corner, but the industry has been dogged in its approach. Given the scale of operations, the inertia is great. Sticking with what you know is safe has been the easier choice to make.

This is not to say that there are no irons in the fire. Rather, it emphasizes how slow-moving the underlying core infrastructure is, such that it takes years for a new technology to trickle out into the market. A reasonable example of this can be found by examining the servers running inside the CDNs. Many are only just being upgraded to modern CPU platforms. If the existing equipment is sufficient, there is no commercial motivation to upgrade them. Factor in the inflationary pressure on hardware costs, at the height of what looks like an AI bubble, and deploying any new function to the core CDN infrastructure that requires hardware changes is a complete non-starter.

In 2020, we examined WebRTC-based CDN services. In 2021, we looked at Decentralized CDNs. In 2022, we forecast the impact of Open Caching on the CDN industry, charting how the in-network caching had the effect of reducing future CDN requirements. Then, in 2024, wary that Open Caching had gone rather quiet, we were told that the work that was promised on the commercial and billing APIs back in 2022, which was expected to take two years, had not yet been started. Still, we cracked on examining Media-over-QUIC (MoQ), having been told that the onboarding of new DASH-IF developers would speed up this work in the SVTA.

There is still no such API, and Qwilt, something of a bellwether for Open Caching (as the largest vendor supporting the approach) has gone belly-up. For now, Open Caching still exists as a technical project, but the transformative impact it could have on the industry that we previously anticipated is no more. That window has passed, and now looks permanently shut. Still, should it be resurrected, we have done the work to model Open Caching’s impact on traffic, in the unlikely event we need to reinstate that function.

While we were always uncomfortable with Qwilt’s position as a major driver in the Open Caching market, we also would not have bet much on Qwilt collapsing in this manner. While the company will likely be salvaged in some fashion, after bankruptcy proceedings, its position as a North Star for a new approach to CDNs is forever tainted, and almost entirely unrecoverable. It may well find itself acquired by Cisco – something we have long anticipated, and which is much easier to do in a fire sale.

This is a shame. Open Caching was a genuinely transformative technology, but it has always been beset by business model problems. We have criticized the SVTA’s position that it should not develop the commercial and billing APIs itself, for fear of antitrust investigations. So long as the organization did not mandate prices, it would not be at risk.

There are plenty of off-the-record admissions about the frustrating pace of SVTA progress, and with the acquisition of DASH-IF (and more recently the Ultra HD Forum), there is a definite air of Open Caching being put out to pasture – quietly wound down, as the CDN stakeholders get on with their core business offering. We had previously been told that DASH-IF developers would be put to use on Open Caching’s commercial APIs, but there has been no outward progress – and more importantly, no uptake from the industry.

Still, the ‘Telco CDN’ trend of brokering deals to install caching appliances within operator networks has not slowed. This provides most of the functionality of Open Caching, it should be noted, but in a single-vendor environment. The CDN vendors still benefit from significant reductions in peering and bandwidth charges, by placing the caches inside the operator networks; but the streaming services and content providers do not have an automagically proliferating network of multiple bidders to deliver their content.

Private CDN remains the preferred approach. Multi-CDN installations are now the norm, with Public CDNs benefiting from the volatility in peak live video bandwidth – with those peaks mitigated by offloading traffic onto an established Public CDN provider. Still, the expansion from core CDN and into other services (particularly security and compute) continues apace among the Public CDN vendors, as a response to flattening revenues, a lack of sufficient future growth, and the rise of Private CDN.

For more information, visit rethinkresearch.biz.