Electric Aircraft and eVTOL Market:

Berg Insight, the world’s leading IoT market research provider, released new findings on the market for electric aircraft and eVTOLs (electric vertical take-off and landing passenger aircraft). There are many large-scale industrial projects worldwide aimed at developing electric aircraft and eVTOLs. At the same time, the electrification of the aviation industry represents a challenge as the industry is heavily regulated and strongly committed to safe operations and redundant systems. Electric aircraft and eVTOLs will enable new connectivity within large urban areas, between cities, from rural regions to cities and between rural areas. There are many suitable use cases ranging from passenger transportation to cargo transport, surveillance, healthcare and firefighting.

“Some electric aircraft and eVTOL projects have been paused or discontinued in recent years. Despite this, other actors are progressing towards certification and market entry” said Erica Rickard, Analyst at Berg Insight. More than a thousand eVTOL design concepts have been introduced worldwide. Some companies focus on one or two-seat eVTOLs for private use, while others develop larger aircraft for commercial use cases such as air taxi services. Several eVTOLs are also intended to fly autonomously without a pilot. Examples of commercial eVTOL vendors include Aerofugia, Archer, Beta Technologies, EHang, Eve Air Mobility, Joby Aviation, Volocopter, Vertical Aerospace and Wisk. Companies developing eVTOLs for personal mobility include AIR, Aridge, Jetson, LEO Flight, Pivotal and Skyfly.

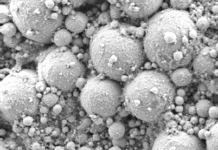

Several companies are also working on electric and hybrid-electric aircraft. The market is characterised by having both established aviation companies developing vehicles and solutions as well as start-ups. These companies address the challenge in different ways, leading to several possible solutions and design pathways. Examples of battery-electric aircraft vendors include Beta Technologies, Bye Aerospace, Cosmic Aerospace, Electron Aerospace, Elysian, MD Aircraft, Pipistrel and Vaeridion. Companies focusing on hybrid-electric aircraft include Electra, Heart Aerospace, Maeve Aerospace and VoltAero. In addition, several companies develop powertrain solutions for battery-electric, hydrogen-electric and hybrid-electric aircraft and eVTOLs. Most actors in this segment produce a complete setup of electric propulsion systems comprising electric motors, energy storage solutions and related components. Electric propulsion systems can be used in both newly developed aircraft and retrofitted in existing aircraft. Examples of companies in this segment include Ampaire, Evolito, MagniX, Safran and ZeroAvia.

Before 2030 we will see some of the first piloted eVTOLs in commercial use. Between 2036–2040 the ecosystem and acceptance will develop and up to 7,500 vehicles could be delivered globally. Fewer if costs are high and certification is taking longer than anticipated. In the high scenario we see that the total number of deliveries could reach approximately 45,000 vehicles between 2026–2050. The high scenario is based on a favourable regulatory environment where the long-term airspace management has been solved as well as the approval for autonomous flights. “The private eVTOL market can be potentially much larger than the commercial market in terms of the number of vehicles” continued Ms Rickard. The first eVTOLs for private use have already been delivered. Under favourable conditions in the high scenario, the total market might reach almost 100,000 vehicles delivered by 2050. Most of these will be small one or two-seaters and the majority of them will be delivered in the latter part of the forecast period. These vehicles will need advanced avionics, connectivity, and avoid and detect technology but at the same time need to be cost-efficient solutions.

Electric aircraft will vary considerably in size and performance and will be powered by either batteries, hydrogen or hybrid-electric propulsion. The forecast is based on three market segments: battery-electric aircraft with one to four passenger seats; aircraft with five to nine passenger seats powered by battery, hydrogen or hybrid-electric propulsion; and aircraft with ten or more passenger seats powered by battery, hydrogen or hybrid-electric propulsion. For all segments, an estimated 10,000 aircraft will be shipped between 2026–2050 in the high scenario. “Due to the complex certification pathway and the dependence of new ground and charging infrastructure, we forecast that only a few hundred aircraft will be delivered before 2030” said Ms Rickard. It will take time to build production capacity and solve ground infrastructure challenges, but with more efficient drivetrains the use case and economics look reasonably favourable in the longer term.

Electric aircraft and eVTOLs will need advanced connectivity. There is also a market for different kinds of autonomous vehicle technology solutions which will need to be incorporated in the vehicles. Cellular connectivity is one of the prominent technologies available to support the use cases in urban areas. Satellite systems can also complement the ground-based architectures, particularly the LEO (Low Earth Orbit) satellite constellations. The number of connected electric aircraft and eVTOLs will take off from 2035 and then increase steadily. “We estimate around 10,000 connected vehicles for passenger use by 2035 and between 60,000–140,000 in 2050” concluded Ms Rickard.

Download report brochure: The Future of Electric Aircraft and eVTOLs