Mercom Communications India, a subsidiary of Mercom Capital Group, released its Q1 2018 India Solar Market Update today.

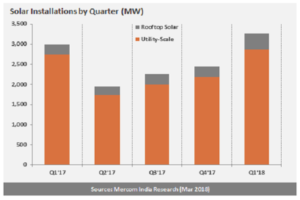

In its report, Mercom India found that Q1 2018 was the best quarter on record for solar installations in India, with 3,269 MW, a 34 percent increase compared to 2,448 MW installed in Q4 2017. Installations were also up when compared to the 2,991 MW installed in Q1 of 2017. The cumulative solar installed capacity totaled 22.8 GW at the end of Q1 2018. The surge in installations in Q1 2018 was primarily due to the completion of projects which were scheduled for commissioning the previous quarter but had experienced delays due to grid connection issues.

This was the first quarter of over 3 GW installed in the Indian solar market and the fifth quarter in a row where at least two gigawatts of solar was installed.

“Even though Q1 was a record quarter, solar procurement activity has been muted over the last few quarters. But with an anticipated decline in module prices, we expect to see tariffs decline and distribution companies ramp up procurement activity,” commented Raj Prabhu, CEO and Co-Founder of Mercom Capital Group.

According to the India Solar Market Update, in Q1 2018, large-scale installations continued to drive the Indian solar market with 2,879 MW compared to 2,188 MW in Q4 2017 and 2,746 MW installed in Q1 2017. Rooftop installations accounted for 390 MW, which was up compared to 260 MW installed the previous quarter and 245 MW installed in the first quarter of 2017. Of the total installed solar capacity, large-scale projects accounted for 88 percent and rooftop accounted for the other 12 percent.

The large-scale solar project pipeline for India stands at 9.7 GW with 10.2 GW tendered and pending auction as of the end of Q1 2018.

“Coming off a record quarter, there are still several issues that need to be resolved by the government before strong growth resumes in the Indian solar sector at a healthy pace,” continued Prabhu.

The uncertainty around the trade cases has put a freeze on development activity. The industry needs clarity on the safeguard duty to understand how it will be imposed and at what levels. Even with the announcement of the pass-through provision, concerns remain in the industry.

Mercom is forecasting approximately 8–9 GW of solar to be installed in calendar year (CY) 2018. Uncertainty in the solar industry created by the announcement of trade cases led to a smaller development pipeline with slowing tender activity, leading to a lower installation year compared to 2017.

On the bright side, solar module average selling prices (ASPs) began to decline in Q1 2018 after two consecutive quarters of increasing prices.

In a recent development, the Chinese government made a new policy announcement imposing installation caps and reducing feed-in-tariffs (FiTs) to essentially slowdown solar installations in China amid a ballooning solar subsidy deficits. This could mean a massive oversupply situation, which means an impending crash in solar module prices worldwide, including India.

This creates an optimistic scenario for Indian solar developers who could begin to bid lower, which in turn could open the auction floodgates as states jump in to lock in low tariffs.

“It now comes down to how the safeguard duty will be handled. Will the government apply a low tariff which could be easily absorbed by the industry as Chinese module prices decline or will trade cases drag on continuing to create uncertainty in the near future? There is a clear opening for the government right now to use this opportunity to lay the path for growth. Overall, things are looking much brighter for the Indian solar industry going into the second half of 2018,” added Prabhu.

- For more information, visit: http://www.mercomindia.com