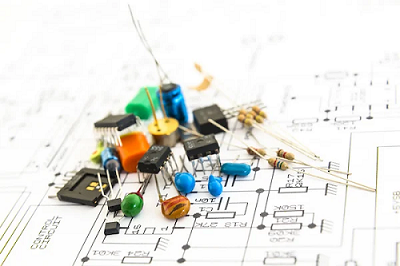

Modern hardware teams spend enormous energy squeezing cents out of their bill of materials, yet the biggest budget leak rarely shows up on any costed BOM. It appears the moment a critical capacitor, MCU, or connector does not arrive, idling an otherwise healthy production line. Unit price is easy to track; the cascading expenses of a surprise shortage are not. This article unpacks those invisible costs, shows how to spot a shortage weeks in advance, and offers a predictive checklist that design, supply-chain, and finance teams can share.

1. Visible vs. Hidden Costs of a Line-Down Event

When a buyer discovers an upcoming gap, the immediate reaction is usually to call brokers, find alternates, and pay whatever premium keeps product moving. That premium is painful, but it is only the tip of a very large iceberg.

According to the report Downtime to cost manufacturers more than £80bn in 2025, UK and EU factories alone are forecast to lose more than £80 billion to unplanned downtime next year (2025). In electronics specifically, the average cost of a single hour offline is US$260,000. A ServiceMax study cited in The Cost of Downtime When Parts Are Missing pegs enterprise-scale outages at up to US$1 million per hour (2024).

Those headline numbers spur two immediate questions that executives ask:

- How fast does the bill grow? Idle labor, electricity, lease costs, and lost revenue continue to accumulate long after the premium purchase order is placed.

- What else gets disrupted? When a missed delivery date forces customer penalties, quality re-certification, or market-share loss, the real cost lands well beyond sourcing.

Sections below map each of those hidden drains in detail so teams can assign realistic dollar figures during risk reviews.

2. Anatomy of a Surprise Shortage

2.1 Forecast Blind Spots

Most demand-planning spreadsheets rely on twelve-month consumption histories plus marketing forecasts. That cadence misses sudden design-win spikes, allocation notices, or geopolitical disruptions. A purchasing manager might see stable lead times on Tuesday and receive a 52-week pushout from the same vendor on Friday.

2.2 BOM Obsolescence and EOL Notices

IC lifecycles keep shrinking. The gallium-nitride devices that drove your last power-supply win can be embroiled in legal battles tomorrow, as documented in our story “Court rules in favor of Infineon in patent infringement case against Innoscience.” When litigation or strategic pivots trigger an End-of-Life (EOL) notice, buyers scramble.

2.3 Logistics Shocks and Geo-Politics

Red-Sea blockages, port strikes, or new export licenses can delay otherwise in-stock parts. Supply-chain teams that grew comfortable with pandemic-era airfreight bandwidth are learning that capacity is tightening again.

Those three vectors often combine: a chip approaching EOL is single-sourced in a region facing trade barriers. The shortage arrives with no single root cause, which makes prediction feel impossible—until you begin tracking the right signals.

3. Mapping the Hidden Cost Structure Nobody Tracks

3.1 Expedited Freight and Broker Premiums

The visible line item is the extra 40 %–400 % that brokers charge for “spot-buy” inventory. Add overnight freight, hazmat fees for batteries or chemicals, and customs brokerage. Teams usually account for that surcharge, but not for the process cost of email negotiations, vetting certificates of conformance, or arguing counterfeit claims later.

Can’t we avoid premiums by buying early?

Early buys do help, but buffer stock ties up cash and increases write-off risk when designs change. The sweet spot is predicting when premiums are likely and pulling orders forward only then.

3.2 Re-Qualification and Compliance Downtime

Switching to an alternate capacitor seems trivial until you repeat EMC, thermal, or UL testing. Each test cycle may pause shipments for two to four weeks and consume tens of thousands in lab fees.

What about engineering change orders after production starts?

Any ECO triggers document control, new part numbers, ERP updates, and field-service bulletins—costs rarely booked under “shortage,” yet stemming from it.

3.3 Engineering Redesign Hours

Senior engineers pulled from next-gen R&D to hunt drop-in replacements deplete future revenue. A 10-engineer task force burning two weeks at an average loaded rate of US$90/hour adds US$72,000—and delays the roadmap.

3.4 Warranty, Field-Failure, and Brand Erosion

Rushing unvetted alternates risks higher failure rates. Even a 0.2-percentage-point bump in RMAs can wipe out the savings of any quick fix and, worse, erode customer trust that took years to build.

4. Early-Warning Signals You’re About to Hit a Shortage

Data does exist—just scattered across ERP change logs, distributor APIs, and supplier emails. Consolidated, it starts to whisper weeks in advance.

- PO Change Frequency – Analysis of 10,000 active POs shows that 52 % will change, and each changed line item is revised 2.5 times on average (Downtime in Manufacturing: 5 Electronics Supply Chain Causes, 2025). A sudden uptick in your own change rate is an early siren.

- Lead-Time Stretch Versus Industry Index – If your primary supplier quotes 18 weeks while distribution averages 12, you’re already in allocation.

- Supplier “D-Score” Trends – Declining on-time delivery, finance news, or executive churn often precede allocation notices.

- Cancel-and-Replace Patterns – When multiple customers cancel smaller orders and replace them with larger single shipments, the component is heading for a run.

How much history do we need to trust a signal?

Three months of change-order data is enough to flag statistically significant deviations for most mid-volume EMS plants.

5. The Predictive Checklist: Eight Questions to Answer Before the Build

- Is the component on any manufacturer Product-Change Notification or EOL watch list?

- Do we have at least two approved vendors with proven performance?

- What is the difference between quoted lead time and current distributor average?

- Does real-time distribution stock (from partners such as ICRFQ) cover forecast plus safety margin?

- Are there form-fit-function equivalents vetted by engineering?

- Have we modeled expedited shipping and retest costs in the margin spreadsheet?

- Will missing the planned ship week trigger contractual penalties or revenue recognition slips?

- Who owns the executive “stop-ship” decision if multiple risks converge?

Running this checklist during design reviews adds less than thirty minutes per part yet routinely prevents six-figure emergencies.

Won’t the checklist slow innovation?

Teams that embed these questions in their PLM workflow finish reviews faster over time because the data sits next to the schematic, not in scattered spreadsheets.

6. Mini Case Study – Saving US$1.2 Million in 48 Hours

A mid-size EMS provider in Malaysia scheduled a 15,000-unit run of industrial gateways when its primary PMIC went suddenly constrained. The shortage surfaced five days before SMT start. Purchasing projected a two-week slip, a US$1.2 million late-delivery penalty, and idle labor costs.

What they did

- Pulled real-time inventory feeds from distributors, discovering two alternates with identical pinouts but different package heights.

- Checked the predictive checklist: alternates passed thermal and EMI sims; SMT program could accept 0.2 mm height variance.

- Sourced half the requirement locally and the balance overnight through ICRFQ’s Shenzhen hub, paying a 28 % spot premium—still cheaper than penalties.

- Ran an abbreviated compliance re-test (24 hours) by pre-booking the lab slot two months earlier based on lead-time trend alerts.

Outcome: Production started on schedule; the customer accepted the alternate with no spec change; total crisis cost landed at US$78,000—< 7 % of the forecasted hit.

Did they keep using the alternate long term?

No. Once supply stabilized, engineering reverted to the original device to avoid dual inventory and documentation overhead. The temporary fix, however, preserved both revenue and reputation.

7. Caveats and Counterpoints

Proactive buying is not free. Excess inventory ties up working capital, can trigger write-offs when designs pivot, and increases carbon footprint from over-production. In regulated markets like medical or aerospace, even minor alternates may demand full validation, making last-minute swaps legally impossible. Teams must balance risk scoring against these realities rather than default to hoarding.

Talent availability is another constraint. As we explored in “Why Semiconductor Jobs Are the Next Big Thing for Indian Engineers,” specialist supply-chain analysts and component engineers are scarce. Automating checklists and API feeds eases, but does not eliminate, the human expertise gap.

8. Turning Crisis Math into Competitive Advantage

Component shortages are inevitable; budget shockwaves are optional. When companies quantify every hidden drain—freight, re-qualification, lost market share—they gain the incentive to invest in early warning and diversified sourcing. Teams that run the eight-question checklist, track PO-change velocity, and maintain rapid-response partners turn shortages into small hiccups instead of catastrophic line-downs. That discipline converts supply-chain resilience from an insurance policy into a core strategic asset.