The global Quantum Computing in Automotive market is valued at USD 465.11 million in 2025, and is projected to reach USD 5.75 billion in 2035, registering a CAGR of approximately 28.6% over the forecast period. This projection reflects strong investor, OEM, and government interest in quantum technologies as automotive systems become more complex (e.g., for EVs, autonomous vehicles, traffic management) and classical computation begins to show limitations in solving large‑scale optimization, simulation, and design problems.

Detailed Description and Industry Demand

Quantum Computing in Automotive refers to the adoption of quantum technologies—hardware, software, algorithms, and services—to support, enhance, or transform automotive sector functions. Key use‑cases include:

- high‑fidelity simulation (e.g. of materials, battery chemistry, crash tests),

- optimization problems (route planning, scheduling, traffic flow),

- autonomous / connected vehicle systems (sensor fusion, decision‑making under uncertainty),

- supply chain and production planning optimization, and

- possibly cybersecurity / encryption for vehicular networks.

This emerging market spans components (hardware, software, and services), different deployment modes (cloud vs on‑premises), and a variety of applications within automotive manufacture, design, operation, and mobility services.

Factors Driving Demand & Key Benefits

Several interlocking factors are fueling demand for quantum computing in automotive, with benefits such as cost‑effectiveness, ease of administration, and longer “shelf life” (i.e. maintaining utility over time) entering the picture. Key demand drivers include:

- Need for Enhanced Simulation & Materials Research: As OEMs push for lighter, stronger materials; improved battery chemistries; better thermal management, many of these simulations are very computationally heavy. Quantum computing promises to reduce time and resources needed for design iteration.

- Autonomous, Connected, & Electric Vehicles Growth: Complexity in sensor fusion, decision making, energy optimization, and route planning for autonomous / connected vehicles is growing. EV battery performance, charging, and range constraints demand more advanced modelling and optimization (e.g. for battery lifetime, charging station placement).

- Optimization of Logistics, Traffic, Routing: Urbanization, increased traffic congestion, demand for efficient transport (including ride‑sharing, delivery networks) push for better routing, traffic management. Quantum algorithms can handle combinatorial optimization with many constraints more efficiently.

- Supply Chain & Production Efficiency: Automotive supply chains are global and complex; disruptions (pandemics, geopolitical risk) make robust planning, scheduling, inventory optimization critical. Quantum computing offers possibilities for more efficient decision‑making under uncertainty.

- Regulatory and Environmental Pressures: Emission norms, fuel economy standards, weight reduction mandates, electrification mandates all push automotive firms to innovate. Quantum computing helps in optimizing designs to meet regulations with less cost.

- Cost‑Effectiveness & Long Shelf Life: While quantum hardware is expensive, accessing quantum services via cloud or hybrid models reduces upfront investment. Software and algorithms developed now may retain relevance over time, especially as hardware improves, enabling “future‑proofing” of solving methods. Ease of administration is enhanced by cloud services, managed platforms, and partnerships.

Top 3 Growth Drivers and a Key Restraint

Here are three of the most important growth drivers plus a significant restraint:

Growth Drivers

- Technological Advancements & R&D Investments

Continued improvements in quantum hardware (more stable qubits, better error correction, coherence times), algorithms (quantum optimization, quantum machine learning), and quantum‑classical hybrid methods are making use cases more feasible. Heavy investment by governments, research institutions, and OEM‑technology collaborations accelerates this. - Electrification, Autonomous Driving & Connected Vehicle Trends

As the automotive industry shifts toward EVs and autonomous / connected vehicles, computational burdens increase: from battery modeling to real‑time decision making. These trends create use cases where quantum computing has higher marginal benefit over classical methods. - Cloud‑based Deployment / Quantum‑as‑a‑Service (QaaS) and Outsourcing

Rather than building quantum infrastructure in‑house, many OEMs and suppliers opt for cloud‑access or outsourced quantum services. This lowers the barrier to entry, reduces capital expenditure, accelerates deployment, and enables more flexible experimentation.

Key Restraint

- Technological Limitations / Scalability & Error Correction Challenges

Quantum technology is still nascent. Major hurdles include managing quantum decoherence, error rates, scaling qubit counts, ensuring stability, and developing robust error correction. Also, integration challenges with existing automotive systems, standards, and ensuring reliability & safety are nontrivial. These limit how fast and widely automotive companies can deploy quantum solutions.

Detailed Segment Analysis (without numeric values)

Here, I break down by component types, application areas, deployment modes, and how each is performing / expected to perform qualitatively.

By Component: Software, Hardware, Services

- Software: This is generally the best‑performing (or highest demand) component segment. Quantum software includes algorithms (optimization, simulation, machine learning), development frameworks, middleware, applications specific to automotive needs (route planning, battery simulation, traffic flow). Because hardware remains expensive and difficult to scale, many automotive firms are investing heavily in software tools and partnerships so that they can drop into quantum‑capable platforms when available. Software offers higher margins, easier updates, and longer relevance as hardware improves.

- Hardware: Includes quantum processors, qubit systems, control electronics, error correction modules, specialized sensors (if quantum sensor technologies are used). Hardware is critical but carries the most risk: high cost, long development cycles, technical challenges. Growth here is steady but constrained by R&D time, capital, and physical/engineering ceilings. Many automotive firms do not yet own hardware, preferring third‑party platforms.

- Services: Encompasses consulting, proof‑of‑concept projects, managed quantum services, hybrid quantum‑classical integration, training, system design, and deployment. This segment acts as a bridge: helping OEMs navigate complexity, plan pilots, integrate with classical systems. Demand is strong especially early in market adoption, as many firms need guidance. Over time, as internal capability improves, reliance on services may moderate, but companies offering bundled services + software may capture a lot of value.

By Application

- Battery Optimization: Includes materials discovery, chemistry simulation, thermal management, energy density improvement, charging/discharging cycle modelling. Expected to be a high growth application because of the push toward EVs, where performance and cost of batteries are major determinants of competitiveness. Often early pilot work is in this area.

- Material Research: Closely related to battery work but broader: lightweight materials, coatings, composites, structural materials, thermal / acoustic insulation, etc. As carbon‑reduction and fuel efficiency pressures mount, material research remains a foundational application.

- Route Planning & Traffic Management: One of the most promising use‑cases in near term. Because many routing, traffic flow, logistics problems are combinatorial and large‑scale, quantum or hybrid algorithms can offer meaningful performance gains. Especially in urban mobility, fleet operations, shared mobility, last‑mile delivery, etc.

- Autonomous and Connected Vehicles: This is a complex of sub‑applications: sensor fusion, decision making, path planning under uncertainty, safety verification. Quantum’s potential is high but so are safety, validation, regulatory, and reliability demands. Growth here is somewhat slower / more cautious, but over time as confidence in the technology increases, this will become a major component of demand.

- Production Planning and Scheduling: In manufacturing lines, assembly plants, paint shops, supply chains: optimizing sequencing, throughput, resource allocation, quality control. Automotive manufacturers are already experimenting with quantum algorithms (or inspired algorithms) to optimize these. Many benefits in cost saving, time reduction, lower waste.

Deployment: Cloud vs On‑Premises

- Cloud Deployment: Likely to dominate in early phases and possibly long term. Advantages include lower upfront capital cost, flexibility, access to cutting edge hardware without needing to build it internally, updates, scalability, ease of management, and outsourcing of maintenance. Many quantum hardware providers and software platforms are delivering via cloud or hybrid cloud models.

- On‑Premises Deployment: More limited, but still relevant especially where latency, security, or regulatory constraints demand that data / computation remain local (e.g. proprietary R&D work, sensitive designs). Also, very large OEMs or governments might invest in their own quantum hardware facilities. But due to technical complexity and cost, on‑premises adoption is slower and less widespread.

Detailed Regional Insights (North America, Europe, Asia‑Pacific)

Here I describe regional patterns in demand, growth drivers, and particular strengths or constraints (without giving absolute numbers as you requested).

North America

- Growth Drivers: Strong presence of quantum technology providers (hardware, software); substantial government funding and investment in quantum research; presence of major automotive OEMs and Tier‑1/Tier‑2 suppliers with deep R&D budgets; early adopters of electric vehicle, autonomous vehicle technology; mature cloud infrastructure. Also, regulatory pushes around safety, emissions, and standards drive innovation.

- Demand Drivers: OEMs in USA & Canada are exploring quantum for battery chemistry, simulation, supply chain optimization, autonomous driving features. Also, the high cost of manufacturing, labor, and stringent regulatory standards makes optimization and simulation particularly valuable. Demand for autonomous / connected vehicles (including ride‑sharing, mobility services) is pushing use cases.

- Constraints / Regional Specifics: High cost of hardware; regulatory / safety barriers for deploying quantum techniques in safety‑critical systems; talent shortage; sometimes fragmented incentives across states; concerns over intellectual property, data security; classical computing systems are still powerful, so justification for quantum must clear higher bar.

Europe

- Growth Drivers: Strong public policy support (funding for quantum initiatives and clean mobility; emissions / safety regulations; European programs for HPC / quantum). OEMs like BMW, Volkswagen, Daimler etc. are active in pilot projects. Emphasis on sustainability, lightweight materials, EVs, emission reductions. Also, strong academic / research base in quantum sciences.

- Demand Drivers: Use cases similar to North America: battery research, material modelling, vehicle design, route / traffic optimisation (especially in dense cities), regulation compliance. Also, governments in Europe frequently require localized innovation, data privacy, so may prefer hybrid or on‑premises or regionally hosted cloud.

- Regional Specifics / Constraints: Slower industrial scale deployment in some countries; varying maturity across EU members; cost of infrastructure; ensuring that quantum solutions meet EU regulatory / safety standards; sometimes market fragmentation and different automotive ecosystem practices. Also, Europe’s automotive industry is under pressure from global competitors, forcing innovation but also being cautious.

Asia‑Pacific (APAC)

- Growth Drivers: Rapid growth of automotive demand; strong interest in EVs and connected / autonomous vehicles in countries like China, Japan, South Korea, India. Government initiatives supporting quantum R&D, “quantum national programs,” industrial policy backing, investments in cloud infrastructure. Also, densely populated cities where traffic / routing optimization could bring high returns.

- Demand Drivers: Battery technology (EVs), materials research, production optimization (manufacturing is large scale in many APAC countries), infrastructure constraints (traffic, last‑mile delivery, road networks) making optimization critical. Also, cost pressures favor solutions that can reduce waste and optimize resource use.

- Regional Specifics / Constraints: Varying levels of maturity: some countries have well‑developed quantum research, others are more nascent. Infrastructure, access to high performance quantum hardware, skilled talent may lag in some areas. Security, data localization laws may push for local deployment or cloud providers in specific jurisdictions. Also, cost sensitivity is higher; ROI expectations can be tighter.

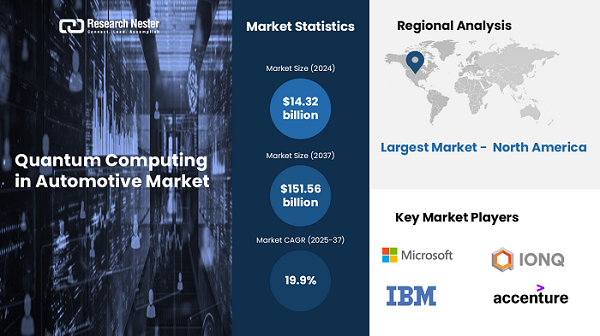

Key Players in the Market

Here is a synthesis of major companies, their business strategies, product offerings, financial or performance signals, risk exposures, recent developments, regional presence, and a brief SWOT analysis. The companies: IONQ, IBM Corporation, Accenture plc, Microsoft Corporation, D‑Wave Systems, Inc., PASQAL, Terra Quantum, Amazon, Rigetti & Co, LLC.

Research Nester Analytics is a leading service provider for strategic market research and consulting. We provide unbiased, unparalleled market insights and industry analysis to help industries, conglomerates, and executives make informed decisions regarding future marketing strategy, expansion, and investments. We believe every business can expand its horizon with the right guidance at the right time. Our out-of-the-box thinking helps clients navigate future uncertainties and market dynamics.

Source: https://www.researchnester.com/reports/quantum-computing-in-automotive-market/6325