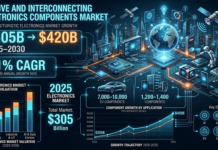

The race to build faster, smarter, and more efficient artificial intelligence isn’t just a software story — it’s a hardware boom. Industry forecasts predict the global AI server market will surge to roughly USD 1.56 trillion by 2034, fueled by insatiable demand for model training, inference at scale, and the infrastructure to run generative and enterprise AI workloads.

From niche boxes to backbone infrastructure

A few years ago, AI servers were a specialized purchase for research labs and hyperscale cloud providers. Today they’re becoming the backbone of entire industries — finance automates risk modelling, healthcare runs diagnostics and drug-discovery pipelines, retail personalizes experiences in real time, and manufacturing deploys edge AI for predictive maintenance. That shift is expanding the market from a niche segment into a mainstream IT category.

What’s driving the trillion-dollar projection?

Several converging trends explain the steep climb toward USD 1.56 trillion:

- Explosive compute needs for large models. Modern foundation models and multimodal systems require massive GPU/accelerator clusters for training and costly, performant inference deployments. Hyperscalers and large enterprises are investing heavily to secure that capacity.

- Hyperscaler and “neocloud” expansion. As cloud providers and specialized AI infrastructure firms scale GPU farms and purpose-built data centers, the market for servers optimized for AI workloads grows in lockstep. Lease and offload deals between hyperscalers and specialized suppliers are becoming sizable multi-billion dollar contracts.

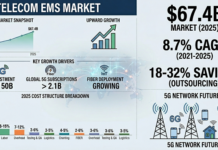

- Edge and hybrid deployments. Not all AI lives in hyperscale clouds. Edge AI servers for latency-sensitive applications (autonomous systems, telco, retail) and hybrid on-prem/cloud models push demand for diverse server form factors and configurations.

- Hardware innovation and specialization. Beyond GPUs, the ecosystem now includes TPUs, custom ASICs, high-bandwidth memory, NVLink fabrics, and AI-optimized networking. These premium components lift average selling prices and increase total market value.

- Enterprise digital transformation. Businesses across regulated industries are deploying private AI infrastructure for data sovereignty, latency, and cost control — further broadening the buyer base beyond cloud-native adopters.

Numbers to know (and why estimates vary)

Not every research house arrives at the same dollar figure — forecast methodologies, segment definitions (e.g., whether they include GPUs, networking, or services), and forecast windows all differ. For example, some project the AI server market reaching USD 1.56 trillion by 2034, with a high double-digit CAGR from a 2024 base. Other analysts produce lower or earlier inflection points — some forecasts target several hundred billion by 2030, while niche reports focus on edge AI server subsegments with very different scales. The takeaway: consensus exists on rapid growth, even if exact totals diverge.

Winners, challengers, and the supply chain

What types of companies stand to benefit? Hyperscale cloud providers, OEMs that build GPU-dense racks, firms selling specialized cooling and power solutions, and semiconductor companies producing high-performance accelerators are all positioned to capture value. Conversely, supply chain constraints (chip shortages, lead times for high-bandwidth memory modules) and rising energy costs are real friction points that could temper growth or shift procurement strategies toward more efficient designs.

Environmental and operational considerations

AI servers are power-hungry. Datacenter energy consumption and thermal management are central operational and regulatory concerns. That reality is pushing adoption of liquid cooling, chip-level efficiency improvements, and investments in sustainable power — all of which influence server costs and lifecycle economics. Buyers aren’t just acquiring compute; they’re factoring in facility upgrades, energy contracts, and long-term total cost of ownership.

What this means for businesses and investors

For enterprises, the message is practical: plan for AI infrastructure as a strategic, multi-year investment. Decide whether to consume AI as a cloud service, co-locate capacity with specialized partners, or own on-prem clusters — each path has distinct cost and control tradeoffs. For investors, the broad market opportunity spans semiconductors, data-center construction and management, networking, cooling, and system integrators — meaning exposure can be diversified across hardware and services layers.

Final thought

A USD 1.56 trillion AI server market by 2034 is more than a headline — it’s a reflection of how quickly compute has become a fundamental input of modern economies. Whether your organization needs a seat at the table as a buyer, builder, or partner, the coming decade will be defined as much by racks, accelerators, and power as by algorithms and datasets. The smart move is to align strategy now: capacity, sustainability, and cost will separate winners from laggards as AI scales from experiments to mission-critical business infrastructure.

Source: https://www.gminsights.com/industry-analysis/ai-server-market