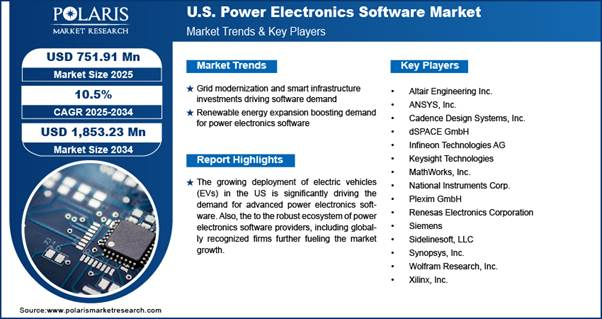

The U.S. Power Electronics Software Market is emerging as a critical growth engine within the Information & Communication Technology (ICT) industry, poised to reach USD 1,853.23 million by 2034 with a 10.5 % CAGR from 2025 to 2034, according to a comprehensive market research report by Polaris Market Research. This escalating demand reflects the broader electrification and digital transformation waves sweeping across automotive, energy, and industrial sectors in the United States.

Market Overview: Electrification & Digitalization Driving Demand

In 2024, the U.S. power electronics software market was valued at approximately USD 681.51 million, propelled by rising investments in grid modernization, renewable energy deployment, and smart infrastructure initiatives. These dynamics are underpinned by an urgent need to develop efficient, reliable power systems as the nation transitions toward cleaner energy and electrified mobility.

Power electronics software serves as the backbone for designing, simulating, and validating power electronic systems such as inverters, converters, and battery management systems. These tools enable engineers to perform rapid prototyping, hardware-in-the-loop (HIL) testing, and real-time simulation—processes that are essential for optimizing system efficiency, reducing development cycles, and ensuring compliance with regulatory and safety standards.

Growth Catalysts: Automotive Electrification & Clean Energy Policies

A major driver of this market’s rapid expansion is the accelerating adoption of electric vehicles (EVs) in the U.S. With federal incentives like those under the Inflation Reduction Act (IRA) providing tax credits and funding for domestic EV and battery production, automakers and suppliers are increasingly reliant on advanced software tools for digital design and control. These platforms play a pivotal role in modeling thermal behavior, managing power flow, and simulating control algorithms for next-generation EV powertrains.

In tandem, the expansion of renewable energy capacity—particularly solar and wind power installations—has elevated demand for simulation and control software used in energy conversion systems. As utilities and project developers integrate distributed energy resources into the grid, precision tools capable of modeling dynamic energy behavior and optimizing power conversion systems are becoming indispensable.

Advanced Technologies Powering Software Adoption

The report highlights key technological segments fueling market growth:

- Model-Based Design (MBD) is forecast to capture a substantial share during the forecast period. MBD tools allow engineers to virtually prototype complex systems and validate control strategies long before physical testing, reducing time-to-market and development costs.

- Hardware-in-the-Loop (HIL) Simulation is expected to register the fastest growth, driven by the growing intricacy of power electronics systems and the need for real-time testing capabilities. These platforms enable comprehensive evaluation of embedded control strategies without direct reliance on physical hardware.

Together, these technologies are enhancing design workflows across sectors such as automotive, aerospace, industrial automation, and energy infrastructure. This technological convergence underscores the critical role of software in managing the escalating complexity of power electronic systems.

Segment Insights: From Design Tools to Dynamic Simulation

Design software continues to dominate the market due to its central role in creating accurate schematics, PCB layouts, and control architectures necessary for power electronic systems. These tools are integral to early-phase development of converters, inverters, and motor drives that are key components in electrified systems.

Meanwhile, simulation software is anticipated to grow rapidly as demand rises for dynamic modeling, predictive analysis, and electromagnetic interference (EMI) studies. Simulation platforms enable engineers to analyze system behavior under diverse operational scenarios, fostering higher performance and reliability across power electronics designs.

Application Landscape: Automotive to Aerospace

The adoption of power electronics software spans a broad array of applications. The automotive segment is a standout, driven by surging EV and hybrid electric vehicle (HEV) production. Software tools are essential for optimizing traction inverters, onboard chargers, and power distribution units, ensuring compliance with stringent efficiency and safety standards.

Other applications include industrial automation, where software enhances energy efficiency and system diagnostics, as well as aerospace & defense sectors that leverage advanced control algorithms for resilient power systems. Consumer electronics and renewable energy sectors further contribute to adoption as digital control and simulation become fundamental to product innovation.

Strategic Implications for Stakeholders

For ICT industry leaders and technology investors, the U.S. power electronics software market represents a fertile ground for strategic growth. The convergence of electrification trends, AI-enhanced design tools, and digital twin technologies is reshaping the competitive landscape. Providers that offer integrated platforms spanning modeling, simulation, and control are well-positioned to capture expanding opportunities in automotive electrification, clean energy integration, and smart infrastructure modernization.

Moreover, collaboration between software developers, OEMs, research institutions, and semiconductor manufacturers will be vital to drive innovation and tailor solutions that meet the evolving needs of complex power systems.

Conclusion: A High-Growth Era for Power Electronics Software

The U.S. Power Electronics Software Market is unmistakably on an upward trajectory, bolstered by technology adoption, policy support, and industry transformation. As electrification sweeps across energy, transportation, and industrial sectors, advanced software tools will continue to play a pivotal role in designing efficient, reliable, and future-ready power electronic systems. With forecasted growth to USD 1,853.23 million by 2034, this market stands as a strategic pillar in the broader ICT industry narrative.