Flow Sensors Market:

The Flow Sensors Market has evolved from a niche industrial instrumentation segment into a multi-billion-dollar global industry driven by automation, water management, healthcare devices, and energy efficiency mandates. Between 2020 and 2024, the market experienced measurable expansion in both revenue and unit shipments, supported by Industry 4.0 investments and smart infrastructure spending.

This article breaks down the latest numbers, growth percentages, regional benchmarks, and forecasts through 2030 — with quantified insights for decision-makers.

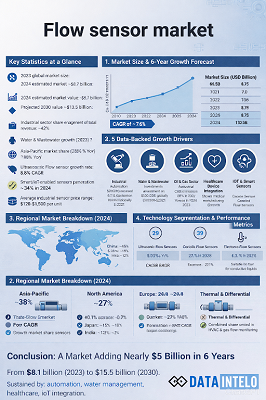

Key Statistics at a Glance

- 2023 global market size: ~$8.1 billion

- 2024 estimated market value: ~$8.7 billion

- Projected 2030 value: ~$13.5 billion

- CAGR (2024–2030): ~7.6%

- Industrial sector share: ~42% of total revenue

- Water & wastewater segment growth (2023): 9.2% YoY

- Asia-Pacific market share (2024): ~38%

- Ultrasonic flow sensors growth rate: 8.8% CAGR

- Smart/IoT-enabled sensors penetration (2024): ~34%

- Average industrial sensor price range: $120–$1,500 per unit

1. Market Size & 6-Year Growth Forecast (2024–2030)

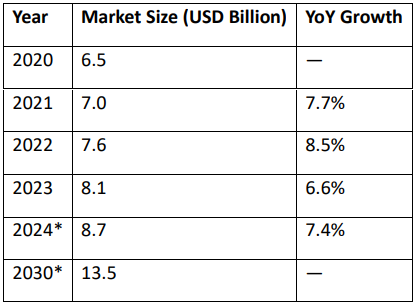

In 2020, the global Flow Sensors Market stood at approximately $6.5 billion. By 2023, it reached $8.1 billion, representing a compound annual growth rate (CAGR) of 7.5% during 2020–2023 despite supply chain disruptions.

Year-by-Year Revenue Growth

Between 2024 and 2030, the market is forecast to grow at 7.6% CAGR, adding approximately $4.8 billion in incremental revenue over six years.

2. 5 Data-Backed Growth Drivers

- Industrial Automation Expansion

- Industrial automation spending exceeded $200 billion globally in 2023

- Smart factories adoption increased by 12% YoY

- Flow monitoring is used in 70% of automated fluid handling systems

Industries including oil & gas, chemicals, and food processing are replacing mechanical meters with digital sensors, improving flow measurement accuracy from ±2% (mechanical) to ±0.5% (digital ultrasonic).

2. Water & Wastewater Infrastructure Investment

Governments allocated over $300 billion globally (2021–2023) for water infrastructure upgrades.

- Smart water monitoring deployments increased 14% annually

- Flow sensors reduce leakage losses by 8–15%

- Municipal utilities adopting digital flow monitoring reported 12% operational cost savings

In 2023 alone, the water & wastewater segment contributed roughly $1.6 billion, representing nearly 20% of total market revenue.

3. Oil & Gas Sector Recovery

Following the 2020 downturn:

- Global upstream capex rose 11% in 2022

- Pipeline monitoring investments increased 9.4% in 2023

- Coriolis and ultrasonic flow sensors dominate with 55% share in hydrocarbon applications

High-precision Coriolis meters reduce measurement uncertainty to ±0.1%, critical for custody transfer transactions valued in billions.

4. Healthcare & Medical Device Integration

Flow sensors are integral in ventilators, infusion pumps, and dialysis machines.

- Medical device manufacturing grew 8% in 2023

- Healthcare accounts for ~11% of flow sensor demand

- During 2020–2022, medical flow sensor shipments increased by 18% cumulatively

Miniaturized MEMS flow sensors priced between $25–$80 per unit dominate portable equipment.

5. IoT & Smart Sensor Penetration

In 2024:

- Approximately 34% of newly installed flow sensors are IoT-enabled

- Predictive maintenance reduces downtime by 20–30%

- Wireless sensor deployment grew 16% YoY

Smart sensors generate 3–5x more operational data, enabling AI-based analytics for process optimization.

3. Regional Market Breakdown (2024)

Asia-Pacific – 38% Market Share

The Asia-Pacific region leads with an estimated $3.3 billion market value in 2024.

Major contributors:

- China: ~45% of regional revenue

- Japan: ~18%

- India: ~12%

Industrial expansion and urban water management projects are primary growth catalysts.

North America – 27% Market Share

Valued at approximately $2.35 billion in 2024:

- Oil & gas accounts for 31% of regional demand

- Smart utility upgrades grew 10% YoY

- Regulatory compliance drives digital sensor adoption in 65% of new industrial projects

Europe – 24% Market Share

Worth about $2.1 billion in 2024:

- Environmental compliance investments increased 9% in 2023

- Germany represents ~28% of European market revenue

4. Technology Segmentation & Performance Metrics

Ultrasonic Flow Sensors

- Market share: ~29%

- CAGR: 8.8%

- Accuracy: ±0.5%

- No moving parts → reduces maintenance costs by 15–20%

Coriolis Flow Sensors

- Market share: ~24%

- Accuracy: ±0.1%

- Cost range: $1,000–$10,000 per unit

Electromagnetic Flow Sensors

- Market share: ~21%

- Suitable for conductive liquids

- Lifespan: 8–12 years

Thermal & Differential Pressure Sensors

- Combined share: ~26%

- Used in HVAC and gas flow monitoring

- HVAC demand rose 6% in 2023

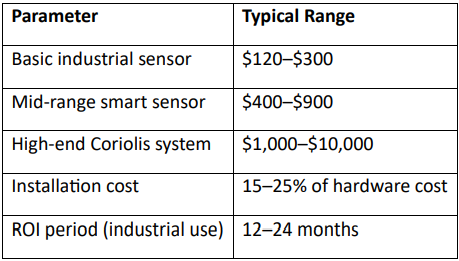

5. Cost Benchmarks & ROI Metrics

Industrial plants deploying smart flow monitoring systems report:

- 8–12% energy savings

- 10–18% reduction in fluid waste

- Up to 25% maintenance cost reduction

6. Competitive Landscape & Market Concentration

The top 10 global manufacturers collectively account for approximately 55–60% of total revenue.

Large players invest 6–9% of annual revenue into R&D, focusing on:

- Miniaturization

- AI-enabled diagnostics

- Wireless communication protocols

- Cybersecurity integration

Mergers & acquisitions activity increased by 13% in 2023, indicating consolidation.

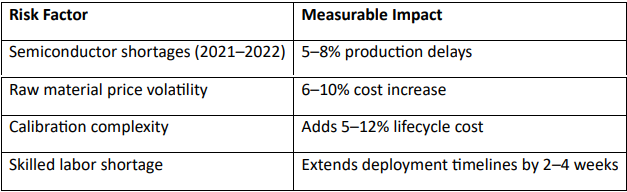

7. Risks & Market Constraints (Quantified)

Despite these risks, demand resilience remained strong with overall industry growth staying above 6% annually.

8. 2030 Outlook: What the Numbers Suggest

By 2030:

- Market expected to exceed $13.5 billion

- IoT-enabled sensors could represent 50%+ of installations

- Asia-Pacific likely to reach 40% global share

- Industrial automation integration rate may exceed 80% of new facilities

Environmental regulations targeting 15–25% water loss reduction in urban systems will further accelerate adoption.

Conclusion: A Market Adding Nearly $5 Billion in 6 Years

The Flow Sensors Market is not just growing — it is expanding with measurable momentum:

- From $8.1 billion (2023) to $13.5 billion (2030)

- Sustaining ~7.6% CAGR

- Driven by automation, water management, healthcare, and IoT integration

- Delivering quantifiable ROI: 8–12% energy savings, 10–18% waste reduction, 25% lower maintenance costs

With nearly $4.8 billion in new revenue expected by 2030, increasing smart sensor penetration, and rising infrastructure investment worldwide, flow sensing technologies will remain central to industrial efficiency and sustainability goals.

For stakeholders evaluating entry or expansion, the numbers clearly indicate: this is a structurally expanding, data-driven market with sustained long-term growth potential.

For more information, visit dataintelo.com/report/flow-sensors-market