Key Highlights from Mercom India Research’s Q3 2017 India Solar Market Update:

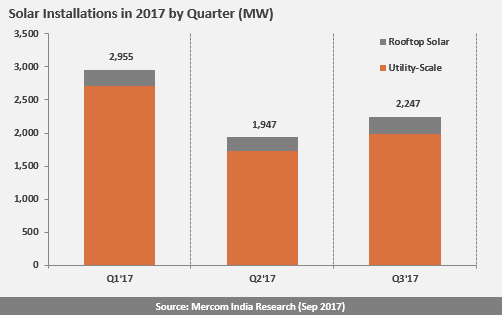

- India installed 2,247 MW of solar projects in Q3 2017, up 15 percent from Q2 2017

- With over 7 GW of cumulative installations in the first nine months (9M) of 2017, solar is now the leading new energy source in India, accounting for 39 percent of total new power capacity additions in 9M 2017

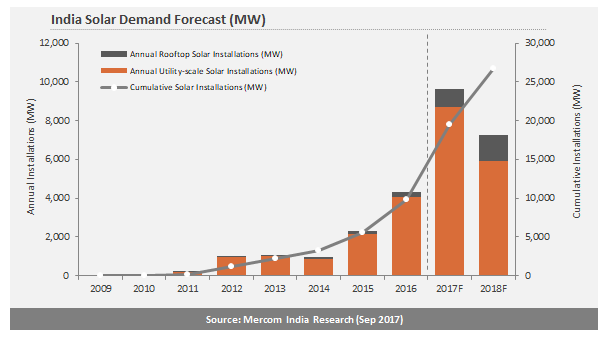

- The forecast for total solar installations in calendar year (CY) 2017 is expected to range from 9.5 GW to 10 GW

- Rooftop installations grew 18 percent quarter-over-quarter

- In the first nine months of 2017, 735 MW of rooftop capacity was added. Mercom forecasts that number will rise to 945 MW of new rooftop capacity for the full CY 2017

- Cumulative solar rooftop installations in India totaled ~1,345 MW

- Chinese module prices in India rose 14 percent compared to the previous quarter

- A low tariff of ₹2.65 (~$0.0413)/kWh was quoted during Q3 2017 in GUVNL’s 500 MW solar auction

- A total of 1,456 MW of solar was tendered and 1,232 MW of solar was auctioned in Q3 2017, down from Q2 2017 when 3,408 MW of solar was tendered and 2,505 MW of solar was auctioned

The India solar industry continued its recording-breaking year with a cumulative 7,149 MW installed at the end of Q3 2017. A total of 2,247 MW was installed in during the period, up 300 MW from the 1,947 MW installed during Q2 2017, according to the latest India Solar Market Update by Mercom India Research. Cumulative solar installations in India stood at 17 GW at the end of the third quarter.

In the third quarter, large-scale solar projects accounted for 1,982 MW and made up 88 percent of installations, while rooftop installations totaled 265 MW and accounted for the remaining 12 percent. Large-scale installations doubled year-over-year and rose 15 percent from the second quarter to the third quarter.

The pipeline of utility-scale projects currently stands at 11.5 GW with another 5.6 GW of tenders awaiting auction.

“Even though the Indian solar market is on pace for a record-breaking year, the momentum has definitely slowed,” said Raj Prabhu, CEO of Mercom Capital Group. “Just like the preceding quarter, we saw many project commissioning dates get delayed and postponed to next year. In addition, there are approximately 1 GW of large-scale solar projects that are complete but unable to get connected to the grid. These factors are likely to lead to a weaker-than-projected Q4.”

Growth in the large-scale solar market in Q3 2017 was underpinned by more than 1 GW of combined project installations in Telangana and Karnataka, followed by more modest installation totals in Maharashtra, Uttar Pradesh, and Rajasthan. Telangana was the only state that installed more than 500 MW during the quarter. In all, eight states accounted for 96 percent of large scale installations during the quarter.

With approximately 612 MW of solar installations during the period, Telangana surpassed Andhra Pradesh to become the state with most solar installations with a cumulative total of ~2.5 GW installed. Telangana was closely followed by Andhra Pradesh and Rajasthan, which each have cumulative installed capacities slightly greater than 2 GW. These three states together represent approximately 43 percent of the country’s total installed large-scale solar capacity.

According to the report, overall conditions in the Indian solar market became more challenging during Q3 2017 due to a 14 percent increase in Chinese module prices, the pending anti-dumping case, PPA renegotiations in some states, incomplete infrastructure, evacuation issues, port customs duty, and a lack of clarity surrounding the Goods and Services Taxes (GST). All of these factors led to an overall slowdown in installations and a slowdown in tenders and auctions, resulting in a reduction in the installation forecasts for 2017 and 2018.

The report forecasts that total solar installations in India will range from 9.5 GW to 10 GW in the full calendar year 2017 and approximately 7 GW in 2018.

“It has become challenging to pin down an installation number as so many projects that are completed are stranded and unable to commission due to evacuation delays. It will all depend on what can get connected to the grid by the end of the year,” said Priya Sanjay, Managing Director of Mercom India.

The report also notes that the future of module prices remains uncertain due to the initiation of an anti-dumping case against solar imports from China, Taiwan, and Malaysia. As of Q2 2017, the most recent quarter for which official government estimates were available, India imported solar modules and cells worth $1.23 billion (~₹79.4 billion). The industry expects that the Directorate General of Anti-Dumping (DGAD) will most likely recommend imposing tariffs.

“An extremely cost sensitive market like India will find it very tough to handle any aggressive imposition of tariffs. The developer community could adjust and model their bids accordingly, but we are concerned that state utilities who are already renegotiating PPAs so that they can procure solar power at the lowest possible prices will stop buying more solar if the tariff moves toward the ₹3.50 (~$0.054)/kWh level,” said Prabhu. The anti-dumping recommendation will most likely affect our future forecast, he added.

Even with these challenges, solar continues to be the leading new power generation in India. Compared to solar’s share of 31.9 percent in the first half of 2017, solar newly installed capacity additions accounted for 39 percent of total power capacity additions at the end of the third quarter.

For the complete report, visit: https://mercomindia.com/product/q3-2017-india-solar-quarterly-market-update/