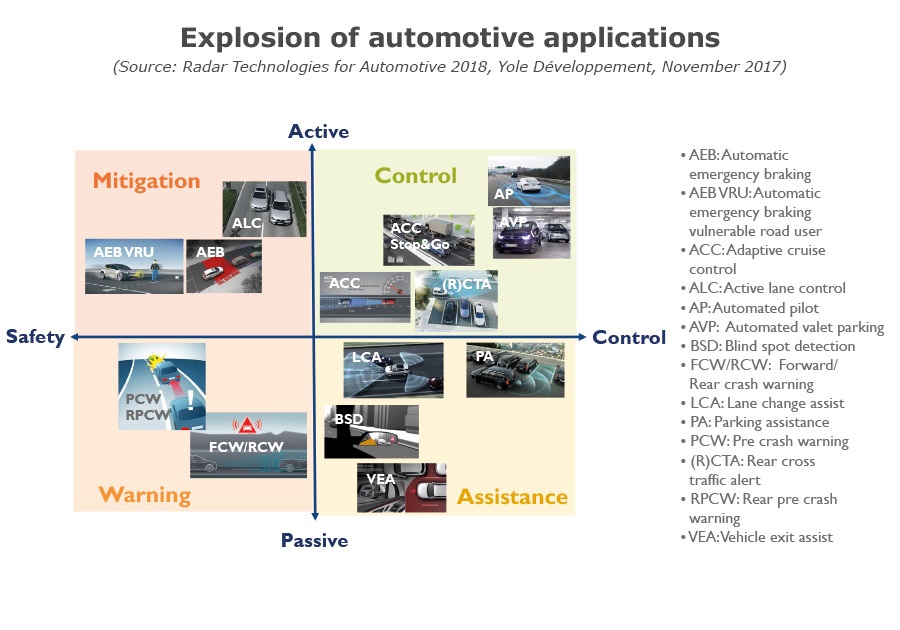

AUTOMOTIVE IS EXPERIENCING AN EXPLOSION OF NEW HIGH-TECH APPLICATIONS

Automatic emergency braking, adaptive cruise control, and lane-change assist are some examples of these new applications. Spurred by the New Car Assessment Program, OEMs are designing cars with numerous sensors that enable applications like these. And since most of these new applications are safety-related, the sensors must be highly accurate. This means very tight specifications for object detection and classification, as well as being ultra-reliable: operable in every weather condition, in poor lighting, near or far, and with a wide field of view. Radar technology is well-suited to fulfill most of these requirements. We say “most” because object classification is not currently possible with radar, but certain companies are moving quickly to unlock this capability in imaging radar.

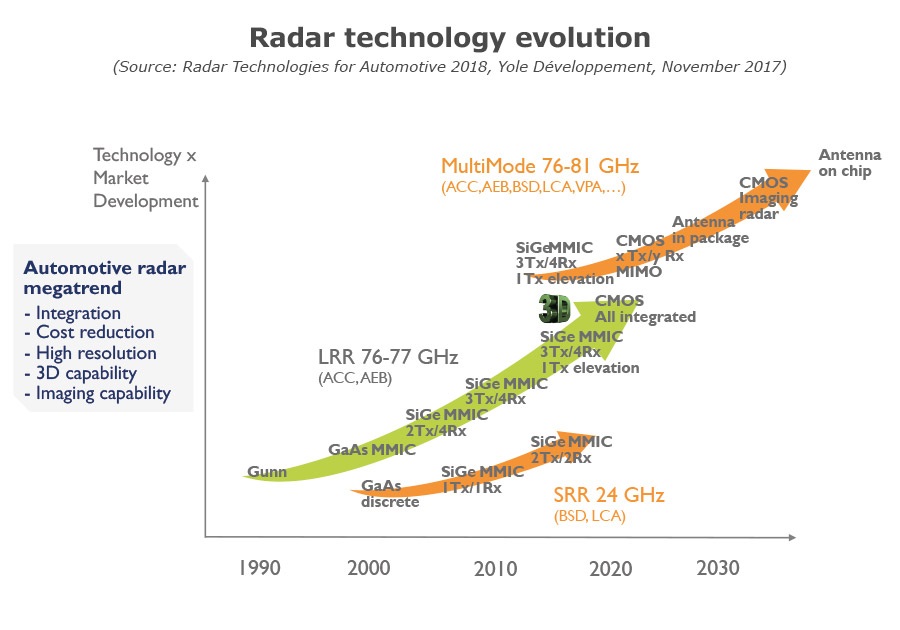

Radar has an impressive technology roadmap allowing for huge resolution improvement as well as device miniaturization and cost reduction. Despite small growth (~3%) in global car sales until 2022, Yole Développement expects an average growth rate of 23% for radar module sales, and an average growth rate of 22,9% for radar chip sales over the next five years – with autonomous driving being the next long-term driver for radar technology growth.

Radar has an impressive technology roadmap allowing for huge resolution improvement as well as device miniaturization and cost reduction. Despite small growth (~3%) in global car sales until 2022, Yole Développement expects an average growth rate of 23% for radar module sales, and an average growth rate of 22,9% for radar chip sales over the next five years – with autonomous driving being the next long-term driver for radar technology growth.

IN THIS HIGHLY DYNAMIC MARKET, MILLIMETER WAVE TECHNOLOGY IS AT THE EPICENTER

77 GHz radar in W band development is overtaking the current mainstream 24 GHz offer in the unlicensed ISM (industrial, scientific, medical) band. 77 GHz radar combines better range coverage (thanks to its “full power” mode) and larger available bandwidth, thus improving range resolution and accuracy by a factor of 20x. Other benefits include its 3x smaller form factor and improved velocity resolution.

Radar architectures have reached a new level of complexity, requiring innovation in antenna design, complex modulation techniques, and target resolution algorithms. Multi-beam, multi-range requirements have led to complex antenna arrays that are multiplying transmit-and-receive paths and adding 3D detection capability. Chipmakers have developed new chips to support these stringent requirements, increasing the number of channels that a single chip can handle.

Integration is another big area for exploration. A battle is underway between the well-established SiGe technology and the more recent RFCMOS platform, which is quickly becoming a reality thanks to players like Texas Instruments – which has spent the last decade developing RFCMOS technology.

A WELL-ESTABLISHED SUPPLY CHAIN IS FACING UNPRECEDENTED COMPETITION

Innovative startups like Metawave and Uhnder, which are proposing disruptive technologies for very high resolution electronic steerable antennas and imaging radar, are competing head-to-head with well-established module makers like Continental and Bosch. Regarding automotive 77 GHz radar chips based on a 130nm SiGe platform, NXP and Infineon are the top suppliers, with other big semiconductor companies like Texas Instruments and ADI offering products based on advanced CMOS nodes (down to 28nm). Foundries are also positioning themselves in this ecosystem. For example, GLOBALFOUNDRIES and its 22FDX platform, TOWERJAZZ and its 180nm SiGe platform, and UMS too. It is exciting to see such a wide diversity of technology offerings, a clear confirmation of the automotive radar market’s traction. However, penetrating the automotive market with new technologies is no easy task. On the contrary, entering and maintaining a position in the automotive supply chain is a long, trust-based process.

We are certainly entering a new “radar age”, with many developments, disruptive technologies, and new entrants positioning this technology as the primary sensor – along with imaging (cameras) for ADAS and autonomous vehicles. For detailed analysis click report