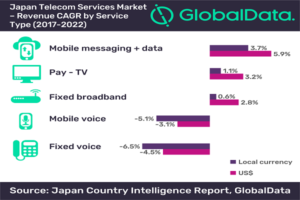

Driven by growth in mobile data, fixed broadband and pay-TV, the total telecom and pay-TV services revenue in Japan is expected to grow at a CAGR of 2.2% over the forecast period of 2017-2022, according to leading data and analytics company GlobalData.

With a total of 168 million subscriptions in 2017, the Japanese mobile market is the fourth largest in the Asia-Pacific (APAC) region. GlobalData’s ‘Japan Country Intelligence Report’ states that the usage of mobile data will more than double over the forecast period, reaching 9.9GB/month by year-end 2022 underpinned by rising consumption of mobile video and social media content over smartphones.

Sandeep Kolakotla, Telecom Analyst at GlobalData, says: “Mobile data revenue will continue to rise and play a major role in the growth of total telecom service revenue to 2022 as a result of rising smartphone penetration, growing adoption of 4G LTE/LTE-A services and higher value data packs. In addition, the planned rollout of 5G services during the Tokyo Olympics in 2020 will create major opportunities for investors and vendors in the Japanese telecom market.”

GlobalData predicts that, at the same time, mobile voice usage will continue to drop due to rising adoption of over-the-top-based communications.

In the fixed services market, a steady rise in adoption of fiber to the home/building (FTTH/B), cable Internet subscriptions and growing average revenue per line (ARPL) for broadband connections will drive fixed broadband revenue, according to the report.

In the pay-TV market, GlobalData expects that growing Internet protocol television (IPTV) subscriptions and operator investments in high-definition (HD)/ ultra-high-definition (UHD) content technologies will boost revenue growth.

Kolakotla adds: “The expansion of FTTH services and deployment of next-generation broadband technologies, such as the G.fast ultra-broadband technology, will provide opportunities for (IPTV) service providers to bundle their offerings with fixed broadband lines and to introduce high-bandwidth applications such as 8K TV service.”

Kolakotla concludes: “A favorable regulatory environment under which the Ministry of Internal Affairs and Communications (MIC) plans to strengthen publicity and dissemination activities for consumers, increase transparency, permit new mobile operators to enter the market and promote fair competition for mobile services in Japan will support overall development in the Japanese telecom and pay-TV services market.”

For more information visit : GlobalData.com