The coronavirus crisis increasing the threat of global recession. Omida, the research firm, forecast decline in the global semiconductor business in 2020- despite soaring demand for chips from the medical sector.

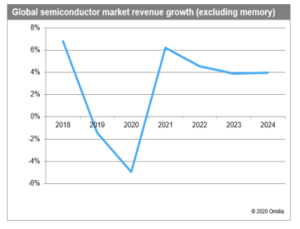

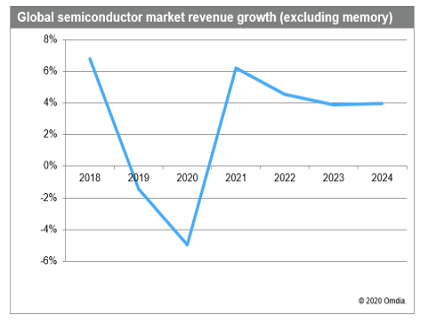

Omdia Application Market Forecast Tool (AMFT) report predicts, excluding memory ICs market, the worldwide semiconductor market will face decline by 5 percent in 2020,

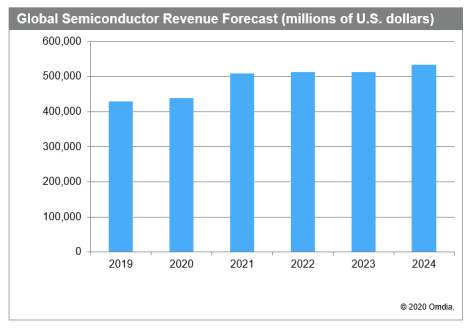

With memory included, global revenue for the overall market will total $439.3 billion in 2020, up 2.5 percent from $428.5 billion in 2019. This is a significant reduction from the previous Omdia forecast of 5.5 percent growth for this year.

“Omdia has cut its semiconductor forecast substantially as the ramifications of the coronavirus on the global economy have come into sharper focus,” said Myson Robles-Bruce, research analyst, semiconductor value chain, at Omdia. “With Japan already in recession and economists expecting the U.S. and Europe to enter recessions in the second quarter, demand is weak in every region and almost every market. The pandemic has negatively impacted supply chains and market demand across all component categories.”

The wireless segment is a major factor behind the weak market conditions this year, with market revenue for wireless equipment set to decline by 4.7 percent compared to 2019. This has prompted Omdia to cut its growth forecast for wireless chips to 2 percent, down from 4.8 percent previously.

“The outbreak of Coronavirus will negatively impact the smartphone market in 2020,” Robles-Bruce said. “The modest growth of 2.4 percent predicted earlier in the year has turned negative. As of March 2020, Omdia expects smartphone shipments to reach 1.2 billion units in total for this year.”

Automotive also represents a major drag on the semiconductor market, with motor vehicle production expected to decline by 12.4 percent for the year. This will result in a 7.5 percent decline in semiconductor revenue in the automotive market in 2020.

Industrial/medical market gets coronavirus boost

The industrial semiconductor market is expected to expand by 2.5 percent in 2020. This increase will be fueled by the medical sector, where chip demand will rise by 5.9 percent for the year.

“COVID-19 is causing rapid reallocation of priorities and funding in the medical sector,” Robles-Bruce said. “The consequences are both direct, with an increase in demand for medical ventilators and surgical supplies, and indirect, with a boost in telehealth caused by the postponement or cancellation of routine appointments.”

The medical electronics semiconductor market will total $6 billion in 2020, up from $5.6 billion in 2019.

A major growth driver for medical semiconductors will be ventilator equipment used to treat coronavirus patients. Worldwide ventilator shipments are projected to reach a total of 691,840 units for the year, up 60 percent from 430,843 units in 2019. In revenue terms, the ventilator market this year will be worth $4.6 billion, a hefty increase of 71 percent from $2.7 billion in 2019.

Semiconductors are an integral component for many medical devices used in hospitals today, including ventilators. Omdia expects that the medical end use market will account for $5.8 billion in total semiconductor sales in 2020, roughly 11 percent of the global industrial semiconductor market, and up 8.1 percent from 2019.

Medical ventilator semiconductor revenues have been given a short-term boost in 2020 by the COVID-19 pandemic. Omdia has doubled the forecast for ventilator chip revenue 2020, with growth expected to continue into 2021.

“Medical ventilators have been in use for more than 70 years and in that time, they have evolved from simple electromechanical designs to complex electronically-controlled systems with multiple microcontrollers, brushless DC motor controllers, touchscreen interfaces, and USB or wireless connectivity,” said Paul Pickering, senior analyst, industrial semiconductors, Omdia. “As a result, these devices are driving significant semiconductor consumption as shipments rise to meet the coronavirus challenge in 2020.”

The medical semiconductor segment will continue to grow faster than the overall industrial semiconductor market in 2021 and beyond, driven by long-term trends such as the aging population, the increasing use of telehealth, the move to portable and wearable devices, and the rise of artificial intelligence (AI).