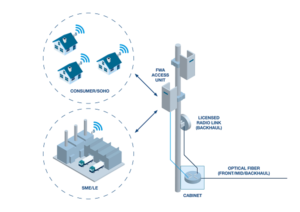

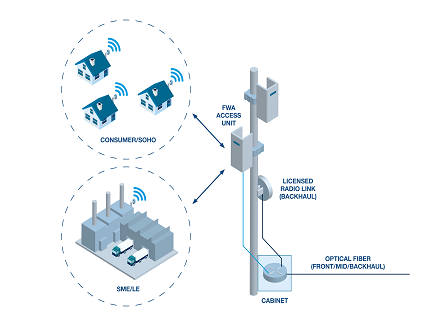

Fixed Wireless Access (FWA) has been identified by industry experts as one of the key areas where 5G mobile communication will be able to make early inroads. Thanks to the bandwidth that 5G wireless technology can support, performance levels that are comparable to fibre connectivity may be achieved – something that the previous generation LTE mobile technology simply was not capable of doing. This means that 5G FWA will allow the deployment issues and considerable expense that wireline arrangements have associated with them to be avoided, with installation costs generally being less than half of what would be needed for a fibre-based equivalent and the time involved being far shorter too.

The inherent convenience of 5G FWA has led to mobile network operators (MNOs) starting to offer such services to enterprise and residential customers, competing with the incumbent wireline broadband providers for market share. This should provide them with a much-needed early revenue stream while more widespread infrastructure roll-out (which was already expected to take time and has been slowed down further by the COVID situation) gets fully underway. Operators will look to bolster their FWA capabilities significantly – with them providing these services to the much greater customer base that access ultra-high-speed cellular connectivity will certainly open up while upgrading their existing LTE FWA deployments to 5G technology too.

Figure 1: Schematic showing a typical FWA configuration

5G FWA Market Potential

5G FWA will have particular value in relatively inaccessible rural areas, many of which have not been adequately supported by fibre-based broadband services. This should help to level the playing field, getting rid of the geographical variations that are currently witnessed (with a large proportion of the focus being on high-density towns and cities). As a result, the ‘digital divide’ will become less distinct – with the social and economic benefits of faster data rates being brought to the whole population, not just those fortunate enough to be located in urban environments.

Analyst firm Market & Markets has forecast that 5G FWA will constitute around $87 billion worth of business by 2026, with the APAC region being identified as the epicentre of deployment activity (especially in areas that are more sparsely populated). This is certain to drive a lot of hardware sales. FWA relies on cellular customer premises equipment (CPE) to deliver broadband connectivity – with demand for it is set to ramp up substantially in the coming years, as 5G-based deployments become increasingly commonplace. Projections recently made by ABI Research suggest that the 5G FWA CPE market will experience a 48% compound annual growth rate (CAGR) between now and 2025, with approximately 41 million units being shipped annually by that stage.

The CPE involved in 5G FWA can be deployed indoors or outdoors, depending on the specific application requirements. Implementations can rely on the use of two different frequency bands. The sub-6GHz frequency band will provide a decent range, but the data throughput levels that can be attained will be lower. Conversely, utilisation of the mmWave frequencies (28GHz and above), in conjunction with beamforming techniques, will allow elevated data rates that almost match those of fibre. However, mmWave is only able to support considerably shorter propagation distances (with real difficulty passing through materials like glass and concrete). This is why the installation of indoor CPE will be vital in many use cases.

Verizon, T-Mobile, and AT&T are among those to have already announced their 5G FWA capabilities (with services being rolled out across many North American cities), and MNOs in both Asia and the Middle East are now following this lead. It should be noted though that some of the services provided are not as yet fully living up to the potential of 5G in terms of speed, since they are mostly based on sub-6GHz (with very little mmWave infrastructure involved so far). As mmWave technology, which it must be acknowledged is still in its infancy, continues to mature in the coming years then its role in 5G FWA will become more prominent.

The Residential Use Case

Changes to people’s working behaviour, caused by the COVID pandemic, have been a factor in heightening interest in 5G FWA. A greater proportion of people’s working day now consists of them telecommuting, as opposed to going to office buildings. The main implication of this is that demands to provide better broadband services to homes have been greatly accelerated – and bringing such services into action is much quicker and easier to achieve if it is done wirelessly.

From a consumer perspective, residential 5G FWA is also a very attractive concept. Firstly, in more remote places, where broadband was simply never a viable option, it will allow such services to finally be accessed. Secondly, it will mean that suburban and semi-rural households have more broadband choices, rather than being stuck with services from what can often be a very limited number of providers. The greater competition this leads to is likely to result in a reduction in the monthly fees that subscribers must pay.

Though it will be applicable in rural and suburban areas, 5G FWA probably won’t be able to compete with wireline in an urban context. Here concentrated populations, and the number of potential customers encompassed, will make the costs of laying fibre justifiable. Also, the short propagation range that is endemic of mmWave transmissions will pose a problem. It means that antenna densities would need to be very high if the service is to be effective, to combat the presence of obstacles like tall buildings, etc. So there are not going to be any opportunities for gaining significant 5G FWA revenues here before the full-scale infrastructure roll-out needed for other services has been completed. The focus will therefore be on addressing the underserved customer base living outside of towns and cities, where quick wins seem assured.

Enterprise/Industrial/Commercial Use Cases

FWA is now front and centre for many MNOs’ 5G roadmaps. It represents an important route for them to recoup some of the huge investments that they have already ploughed into 5G development. This will allow them to generate early 5G incomes ahead of widespread 5G subscriber adoption, which is certain to still be several years further on. Moving forwards, MNOs may even look to bundle residential FWA and mobile subscriptions together to increase the appeal to consumers.

To support the cellular industry in addressing the opportunities that stem from 5G FWA, equipment vendors need a reliable and responsive sourcing partner through which they can acquire cutting-edge technology. Mouser Electronics provides just this, with its constant introduction of new products and supply chain expertise both proving to be invaluable. A broad portfolio of products targeted at 5G FWA that are available direct from stock. These include sub-6GHz RF modules from Quectel, the latest mmWave MMIC amplifiers from Qorvo and Infineon, plus Molex antennas.