Electronic Shelf Label Market

The global electronic shelf label market is expected to reach USD 3.99 Billion by 2028, according to a new report by Reports and Data. Electronic shelf labels (ESLs) are observing an escalation in demand for their use in exhibiting product prices in retail stores. These are generally affixed to retail shelves’ front edge and employs LCD or E Ink displays and centralized pricing system (to align and coordinate fluctuations in pricing across different levels) to present the current product prices to the customers. Further, ESLs allow for dynamic pricing that adapts to several factors such as an increase in price to consider low inventory; or drop in price to get a competitive edge or allow for the rapid sale of items that are approaching their expiration date.

The growth of the organized retail sector in emerging nations is one of the significant factors influencing the market growth, owing to robust macroeconomic factors, as well as the proliferation of the internet in countries like India and China. Shifting lifestyle and growing organized retail sector are causative of the growing necessity for in-store automation, thereby driving the Electronic Shelf Label Markets’ demand. The other benefits of using an electronic shelf label are it is cost-efficient, fast, and secures the price labeling. Moreover, growing emphasis by the retailers for providing better customer experiences about precise and consistent pricing is boosting the market demand. For instance, according to a study, increasing internet penetration in India, along with several global retail firms commencing their operation in the country, the organized retail market share is estimated to surge from nearly 12.0% in the year 2017 to around 22.0% to 25.0% by the year 2021.

COVID-19 Impact

The COVID-19 pandemic is having a significant impact on the Electronic Shelf Label Market industry. Demand for the product is suffering severe shocks across the retail sector, worldwide supply chains are upset, and the competitive order of manufacturers/producers has witnessed a change. A dip in sales in the physical retail stores has fast-tracked the global ESL suppliers into an oversupply situation. Movement restrictions appear to be a direct and immediate effect, and once the necessary social distancing ends, it is expected things would get back to normal conditions.

For more exclusive insights, access Free Sample here:

https://www.reportsanddata.com/sample-enquiry-form/1104

Further key findings from the report suggest

- By type, LCD contributed to the largest market share in 2019. The electronic shelf label based on LCD is a reasonably low-cost system. The demand for this type of display is primarily from small and medium-sized retail firms attributed to its cost advantage and short term of ROI.

- By technology, near field communication (NFC) technology is estimated to grow at a significant rate in the forecast period attributed to a surge in the sale of in the NFC-supported smartphones, as well as cost-efficient and energy-efficient benefits. Before purchasing an item, the NFC communication technology may be beneficial in offering timely information about the product, along with the real-time offer to the shoppers.

- By component, batteries held a considerable market share 2019, as battery-operated electronic shelf labels are highly versatile, convenient to use, and can be installed in narrow compartments on shelves or peg wall hooks.

- Europe held the largest market share in 2019 and is likely to grow at a rate of 23.1% in the forecast period. This is mainly attributed to the early adoption of the product in the region in compliance with the implementation of the European Commission’s consumer protection cooperation regulation, which offers protection to consumers against deceits and misrepresentative product information and prices. Moreover, the retail industry in Europe is a significant contributor to the overall GDP, which is a significant contributor to market dominance in the region.

- Key participants include Pricer, Displaydata, Samsung Electro-Mechanics, Diebold Nixdorf, SES-Imagotag, M2communication, Teraoka Seiko, E Ink Holdings, Panasonic Corporation, and Clearink Display, among others.

- In September 2019, Panasonic Corporation, a leading market player, made an announcement about the introduction of Electronic Shelf Labelling (ESL) solution in the retail sector in India to facilitate retail firms for swift updation of the information on shelving signage wirelessly and in an efficient manner. The unprecedented technology of Panasonic Electronic Shelf Labelling ascertains the secure transfer of data through an encrypted radio communication technology.

For the purpose of this report, Reports and Data have segmented the global Electronic Shelf Label Market on the basis of type, technology, component, store type, and region:

Type Outlook (Revenue, USD Million; 2018-2028)

- LCD

- Segmented E-Paper

- Full Graphic E-Paper

Technology Outlook (Revenue, USD Million; 2018-2028)

- Radio Frequency

- Infrared

- Near Field Communication

- Others

Component Outlook (Revenue, USD Million; 2018-2028)

- Displays

- Batteries

- Microprocessors

- Transceivers

- Others

Store Type Outlook (Revenue, USD Million; 2018-2028)

- Super Markets

- Hyper Markets

- Specialty Stores

- Non-Food Retail Store

- Others

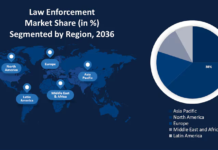

Regional Outlook (Revenue, USD Million; 2018-2028)

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Benelux

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- MEA

- Saudi Arabia

- UAE

- Rest of Middle East and Africa