The wait for 5G in India is almost over as on Oct 1st Prime Minister Modi is going to launch Commercial 5G services in India at IMC’s (India Mobile Congress) four-day event. Though it might not be available immediately 5G-related announcements from India Telecom are expected. Our Technical Editor, Pratibha Rawat, had a detailed conversation with Raj Radjassamy from ABB Power Conversion on 5G network infrastructure, challenges for power designers, and 5G Backhaul. He also discusses the 5G rollout in India and how ABB power conversion will enable a swift and seamless transition to 5G for Indian telecom companies.

What are the power requirements for 5G network infrastructure?

As we scale from 4G to 5G, we see power needs jump exponentially. While 4G only required about 6-7 KW, we now need 11-12 KW to power 5G’s higher-frequency equipment. Naturally, this impacts the power infrastructure we can use to support the network. As millimeter wave (mmWave) deployments for 5G become more widespread, we will begin to see communications service providers turn to small cell infrastructure to fill in the gaps between macro towers.

This small cell equipment is designed to be installed on existing street furniture, like power poles or lamp posts, and pull readily available power from those sources. They are more cost-efficient to build and install and can easily be placed in neighborhoods to increase coverage and cellular density.

How are power designers addressing the challenges associated with higher frequencies and small cells?

5G will operate in the mid and high band, making it optimal for small cell infrastructure. Small cells operate at line of sight, meaning they are often placed at street level, mounted on street furniture. From there, the small cell design can vary depending on AC or DC power input. If operating with AC, it can be tapped from a power line or mounted pole, whereas DC power will require it to be tapped and then locally rectified. When considering rectifiers, power designers must take care to help ensure resiliency to extreme weather conditions, convection-cooling capabilities, and adherence to industry safety standards for surge and EMI. Size and efficiency are two other two critical parameters that would be on the designer’s radar as they design the rectifiers for small cells.

What role do wide bandgap semiconductors play in it?

Wide bandgap semiconductors (WBGs) such as silicon carbide (SiC) and gallium nitride (GaN) could play an important role in reducing size and boosting efficiency to support the higher frequencies of 5G. The bigger question here is whether the cost of WBGs will limit their use in these instances as in some cases it may be more cost-effective to use existing technologies.

Kindly brief on 5G issues with backhaul considering wired, wireless and fibre.

Fiber-based backhaul is the backbone of 5G deployment. True 5G can unlock less than 1 millisecond of latency and 10 Gbps of upload/download speed. These capabilities necessitate large throughput and wide bandwidth at all stages in the network. If the backhaul cannot handle the massive bandwidth, it would become a bottleneck slowing down the whole network. Communication service providers will look to upgrade the existing backhaul from cable/microwave to fiber to provide the additional throughput necessary to bring the true benefits of 5G to fruition.

How should 5G mobile wireless networks address security issues (which can have catastrophic results)?

Security should be multilayered, from the tower to the backhaul to the central office – and even to the handsets. With the vastness of equipment types, from network equipment to power providers to radios, security should be at all levels interspersed as both hardware and software checkpoints in the network.

Since power is the ultimate enabler, security at the power infrastructure level should be of utmost consideration to help ensure continuity and resilience for 5G delivery. Power supplies like rectifiers and converters need to have the ability to detect an interruption or intrusion, self-heal, and connect to a backup or failsafe. Intrusion can be mitigated with monitoring software and by preventing access to features that can cause power equipment to be turned off inadvertently.

Which technology industry/sector will 5G drive the most?

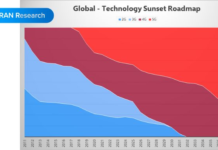

First and foremost, the telecom industry – data, communication, and wireless cell phones – would drive the transition to 5G from 3G/4G-LTE. It may seem obvious, but communications service providers will be the ones to drive the transition and attract consumer interest. On the enterprise side, the telecom industry will see success with 5G-powered offerings like private networks, secure and wireless LAN, and IoT for “smart” applications in building management and manufacturing.

Beyond telecom, 5G will unlock consumer-facing capabilities of the “future”: self-driving cars, remote medical diagnosis, and surgery, and the metaverse. All that said, the proof is in the pudding. The success of 5G depends on the success of the technology and ecosystems it enables.

5G mobile services will roll out in India soon. What are the major elements needed to introduce 5G at scale?

Consumers will be the biggest beneficiaries of 5G in India, with mobile service applications. Local communication service providers like Reliance Jio and Bharti Airtel are ready to enable 5G, but the rollout cannot happen right away. The ecosystem and infrastructure still need to be developed before it can be deployed for India’s market of around 1.1 billion mobile consumers.

To start, the macro network will need to be upgraded to transition from 4G to 5G radios. As will the associated power infrastructure. 5G small cells will need to be rolled out for neighborhoods, malls, and stadiums, and many existing units will need to be upgraded to manage higher frequencies.

What future do you see for 5G in India?

The transition from 4G to 5G in India will happen successfully. The opportunity for telecom services in India is significant and presents a powerful vector for economic growth. Not only will it support India’s telecom industry, but it will also advance economic drivers like smart factories and smart cities. I predict we will see a continued focus on rolling out optical fiber to towns and villages in India to support the transition to 5G, bridge the rural divide, and support local enterprises’ operations.

What is the unique value/selling proposition of ABB Power Conversion for 5G and offerings in 5G for Indian telecom companies?

With our latest launch of Class 2 Power Express combiners, we are ready to support the broadband and telecom customers that seek more accessible, efficient, and compact power infrastructure to address new 5G use cases such as enterprise private network.

ABB Power Conversion has extensive experience helping to advance previous mobile generations in India’s telecom sector. We have the technology, customer support expertise, and capabilities in power infrastructure to help enable a swift and seamless transition to 5G for Indian telecom companies. Our products exceed our customers’ expectations for reliability and efficiency, and our equipment is built to cater to conditions across the Indian market – from the extreme heat of the Thar Desert to the frigid cold of the Himalayas. That is why ABB Power Conversion is a trusted partner to power the most mission-critical applications.