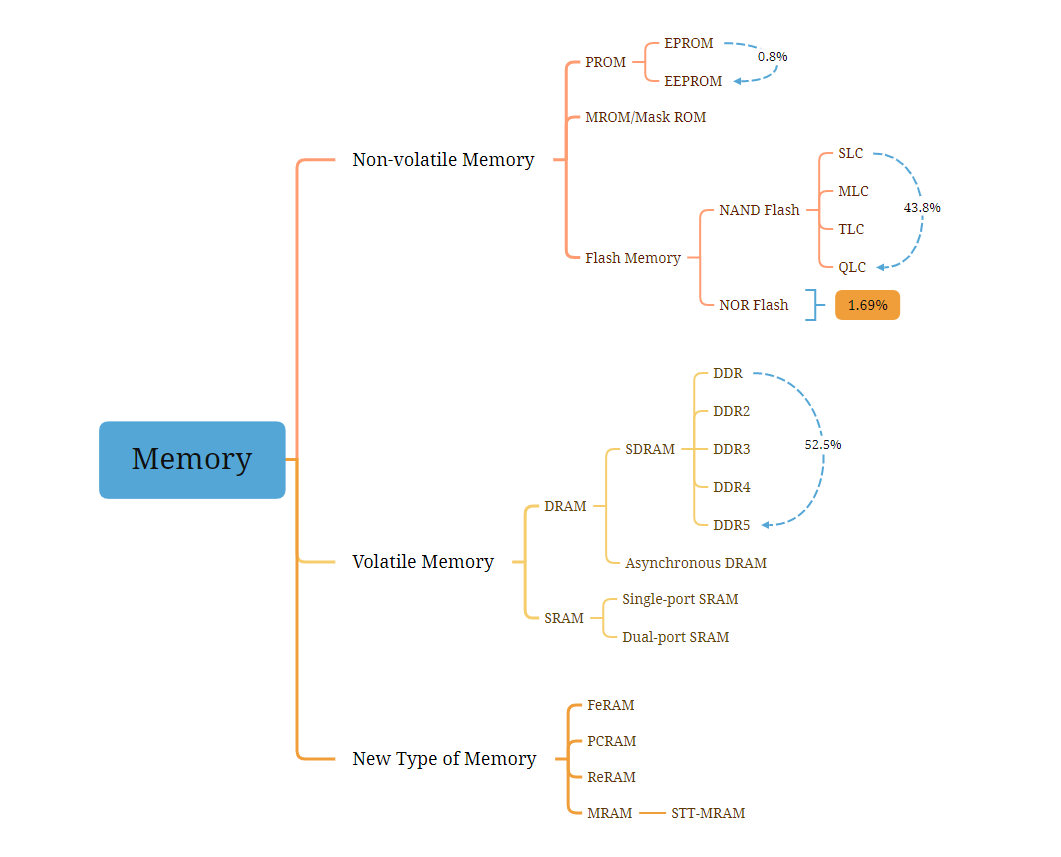

Memory is an integral part of semiconductor components and its market size accounts for approximately one third of the overall semiconductor market. Memory can be divided into NAND Flash (40%), NOR Flash (1%), DRAM (58%) and others (1%).

Different Types of Memory

DRAM entered the commercial market from the 1970s and became the largest branch of the storage market with its extremely high read and write speeds; the emergence of feature phones ushered in the explosion of the NOR Flash market; the PC era saw an increasing demand for storage capacity, making low-cost, high-capacity NAND Flash the best choice.

DRAM is dynamic random memory, which is volatile, meaning that it needs to be refreshed and charged every once in a while, otherwise the internal data will disappear, and is generally used in computer memory, mobile phones and mobile devices. NAND Flash, also known as flash memory, is a non-volatile memory and is widely used in the eMMC/EMCP, USB flash drives, solid state drives and other markets. NOR Flash, on the other hand, has a lower storage density compared to NAND, is slower to write and slightly more complex to operate, and is more commonly used in automotive electronics.

The market is currently dominated by NAND Flash, Nor Flash and DRAM memories. As technologies continue to evolve and improve, more and more types of memory are becoming available, with more difficult technical requirements and higher performance. These include ferroelectric memory (FRAM), phase change memory (PRAM), magnetic memory (MRAM), resistive memory (RRAM) and, most recently, UltraRAM.

Global Memory Market Size and Growth Rate

Today, semiconductor memory has become the largest market segment in the semiconductor industry, accounting for approximately one-third of the global semiconductor industry. IC insights forecasts that semiconductor memory will continue to grow at a CAGR of 6.8% over the next five years.

The global memory chip market has maintained an upward trend amidst fluctuations, with the market size increasing from US$54.6 billion in 2005 to US$122.9 billion in 2020, at a compound growth rate of 5.6%. IC Insights expects the global memory chip market size to grow by 22% year-on-year in 2021 and to exceed US$200 billion in 2023.

Status and Future Trends of the Memory Industry

With the advent of the era of everything smart, emerging applications such as artificial intelligence and smart cars will have higher requirements for data storage in terms of speed, power consumption, capacity and reliability, prompting the rapid development of new memories and influencing the future memory market pattern.

Although DRAM is fast, it has high power consumption, low capacity and high cost, and is unable to save data in case of power failure, limiting the use of scenarios; NOR Flash and NAND Flash have low read and write speeds, and storage density is limited by the process. The market is in need of memory products that can meet new scenarios, and new memories with breakthroughs in performance are about to explode.

Currently, there are four main types of new memories.

Phase-change RAM represented by 3D Xpoint, jointly developed by Intel and Micron.

Ferroelectric RAM, represented by the companies Ramtron and Symetrix.

Magnetic RAM, represented by Everspin (USA).

Resistive RAM, represented by Panasonic, Crossbar and Xinyuan Semiconductor.

MRAM has the best read/write rates and lifetime, and theoretically has the opportunity to replace existing memory and external memory, but due to the quantum tunneling effect involved, large-scale manufacturing is difficult to ensure uniformity, and storage capacity and yields are slow to climb. Until further breakthroughs are made in the process, MRAM products are mainly suitable for special applications with low capacity requirements and the emerging IoT embedded storage sector.

The main problem with the current products is that the storage density is too low to replace NAND Flash in terms of capacity, and the cost and yield of Intel 3D Xpoint is one of the bottlenecks, judging from its continued losses. Current PCM products are mainly used as persistent memory and SSD cache in low latency storage.

FRAM has the advantage of fast read and write speeds and good lifetime, but its memory cells are based on dual transistors, dual resistor cells, cell size is at least twice that of DRAM, storage density is limited and cost is high. And its reads are destructive and must be offset by subsequent writes after each read to restore the content of that bit to its original state. In terms of materials, the current ferroelectric crystal materials PZT and SBT both suffer from fatigue degradation and environmental pollution, and perfect commercialisation has yet to be found. Two companies, Ramtron and Symetrix, are currently leading the development of FRAM.

ReRAM is fully compatible with CMOS in terms of process and can be scaled up to advanced process nodes relatively easily. However, due to the random nature of the conductive channels in the storage medium, it is difficult to guarantee homogeneity of large scale arrays in binary storage. It is also because of this feature that ReRAM is generally considered to have a unique advantage in neural network computing. There is an opportunity for future ReRAM-related products to be used in the field of acceleration chips for specific algorithms.

The new storage industry is not yet mature, and the opportunities outweigh the challenges. Compared to traditional DRAM and NAND Flash, the new storage industry has not yet formed an industry monopoly, and the product lines are not clear enough. Technologically, the future storage technology route is not yet clear, and there are opportunities for technology to catch up or even overtake. On the market, with the rapid development of countries in emerging fields such as 5G and artificial intelligence, storage demand is showing explosive growth and there is a broad enough potential market for new types of storage.

More specific Memory information can be found here.