IDBI net banking facilities allow you to access the internet with a lot of ease. It can be set up very easily and quickly and can be managed anywhere and anytime in a safe environment. You can carry out a range of actions starting from tracking your account balance, getting an IDBI Bank Statement, loan installments, transactions, and cheques, requesting chequebooks, opening fixed deposits, renewing fixed deposits, paying utility bills, and managing your Demat accounts. Nowadays, everything has become digitalized and people are more interested in cashless transactions so internet banking has become a must. Like other banks, IDBI bank’s Internet banking facility enables its customers to access banking processes at their fingertips.

Features of IDBI Bank Net Banking Services:

- Account Information

- With the help of IDBI Net Banking, you can easily know and access Account Balance.

- All account-related inquiries and statuses are now easily available with the help of IDBI Net Banking, you don’t have to think about visiting a Bank branch and Bank Timings.

- With the help of IDBI Net banking, banking transactions are easily traceable along with their history.

- Now after IDBI Net banking you can easily access loan installments and the flow of your funds can also be easily tracked.

- Earlier in older times customers had to physically go to the bank branch to know what was going on in their account. But now with the help of Net banking, their statements can be accessed within a fraction of a second.

- With the help of IDBI Net banking cheque status can be known very easily.

- Demat Particulars –

- You can easily access your demat account details through internet banking. You can access the name, address, and account numbers that are associated with the said account

- Holding Statements are available which show the details of the DEMAT scrip with the relevant ISIN code, scrip name, and balance

- You can easily know about all the transaction that is happening in your account. Details of security and balances for specific periods.

- The billing statement of your account can be accessed easily, and details of the charges against specific transactions can be known with the help of IDBI net banking.

- Instructions and Requests – Online

- You can easily request for cheque book by using IDBI net banking.

- If you want to stop any payment from your bank account then it can be easily done through IDBI net banking.

- Starting or renewing a Fixed Deposit or Recurring Deposit can be done through IDBI net banking.

- Recharge of mobile or DTH can be done through IDBI net banking.

- Application for IPO through ASBA can be done through IDBI net banking.

- Online Payments Facilities –

- Net Banking provides an online payment facility that is linked to various merchant websites/e-commerce sites through the bank’s direct payment gateway facility.

- Net Banking facility available to online merchants or service providers who need online payment service options like e-commerce merchants

- Online share trading can be done through IDBI net banking.

- AMC selling option is created with the help of IDBI net banking.

- Mutual Funds

- Bill Payment –

- Electronic Bill Presentment and Payment (EBPP) option available for IDBI Bank customers

- EBPP allows online payment of utility bills like electricity bills, insurance, water bills, etc.

How to Register To IDBI Bank Net Banking?

The steps to register and activate IDBI Bank net banking are as follows:

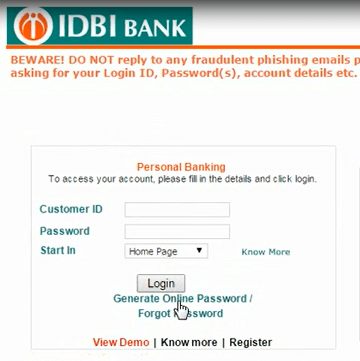

- Go to IDBI Bank’s internet banking page

- Click on ‘Continue to Login’ after entering the Login ID and Captcha

- Click on ‘Generate Online Password’ on the next page.

- Next, put in the details such as customer ID, account number, the mobile number that is linked to your account, and the customer ID on your cheque book and passbook.

- After this, you will see the ‘Generate New Password option select that and click on the ‘Proceed’ option.

- In the given option you have to enter your 16-digit debit card number, ATM PIN, and expiry date.

- Then you will see the “Generate OTP” option click on it, after accepting the terms and conditions.

- On the next page, you must key in your 16-digit debit card number, ATM PIN, and the card expiry date.

- Click on ‘Generate OTP’ post accepting the terms and conditions

- Check your phone for OTP and request ID.

- Enter the details in the blank columns and click on the Confirm option.

- On the following page, create new Login and Transaction passwords. You must select the Enable Transaction Facility also. Click on ‘Confirm’ to finish the registration process.

- Now, you will be able to log in to the net banking portal with the help of the Customer ID and Login password.

Criteria to Be Kept in Mind to Register Safely on IDBI Bank Net banking

Some of the criteria that you must keep in mind for safe registration on IDBI Bank net banking are:

- You should verify the email that you are receiving whether they are authentic or not. Sometimes it could be phishing emails that may take your data. You should also request account holders to update passwords, ATM PINs, Login IDs, etc.

- You must be aware of such tricky emails that ask to verify the account holder’s identity or immediate login to instantly activate the services by clicking on the attached link.

- Banks will never ask you for such information, so never reply to these emails and delete them immediately.

- Genuine URLS always have “https” just before the website URL. So, you can make out the authenticity of the URL by the https symbol.

- Normally, when the address bar opens it will be in green color. It will be green in all the web browsers including Mozilla, Firefox, Google Chrome, IE7, and above.

- You should also avoid logging into IDBI net banking from sources that are not trustworthy.

- You should also avoid accessing net banking pages sitting in cafes, as it can be dangerous. These cafes and shops are not virtually protected and secured.

- You can also try using a virtual keyboard on the login page while entering passwords.

- You can also try using a virtual keyboard on the login page while entering passwords.