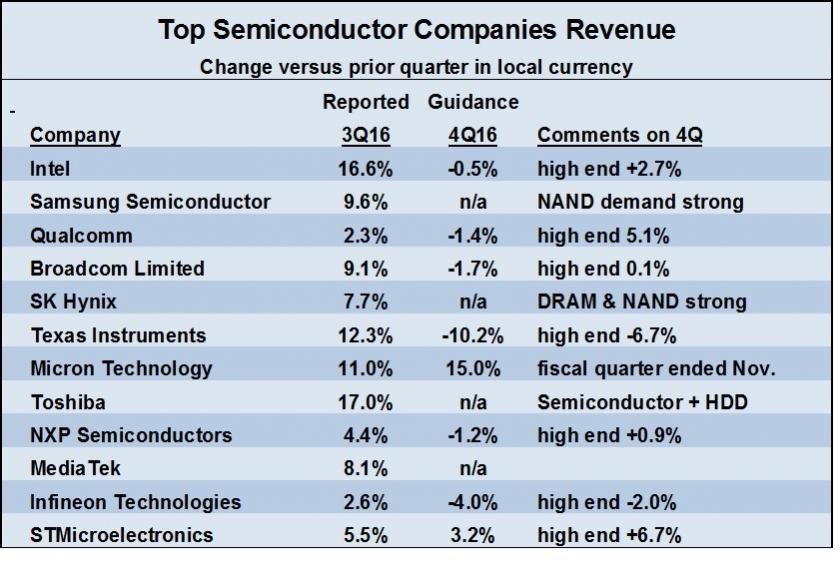

After 11.6% growth in Q3, companies are expecting a flattish Q4. For 2016 the outlook is flat, just as it was in 2015.

Q4 looks weak based on the guidance from the above companies. Six companies projected declines in Q4 revenue based on mid-point guidance, but the upper end of guidance from four of these companies (Intel, Qualcomm, Broadcom and NXP) is for Q4 growth.

Only Micron and ST are guiding for increases based on midpoint guidance.

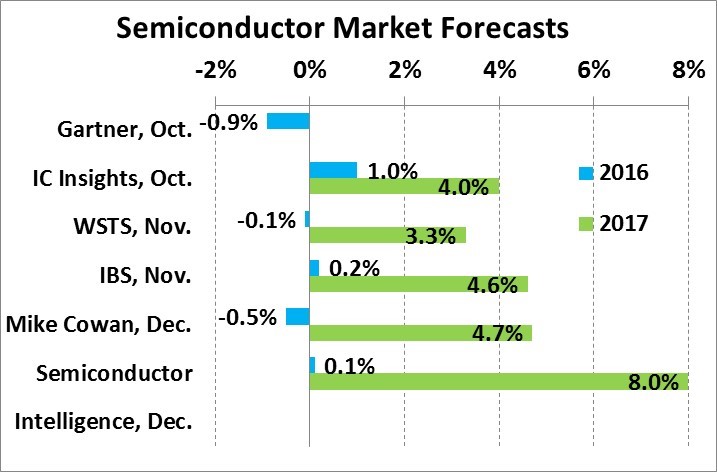

SI’s 8% growth forecast is based a moderate improvement in end demand for electronics, the quarterly trend driven by 2016 and a modest inventory recovery.

In October, Gartner projected the total units of PCs plus tablets would decline 0.7% in 2017 after an 8.7% decline in 2016 and that total mobile phones should move from a 1.6% decline in 2016 to a 1.2% increase in 2016.

IC Insights in November called for a slight acceleration in smartphone unit growth from 4% in 2016 to 5% in 2017. Thus no strong growth in key electronics devices in 2017, but an improvement from 2016.

Annual change 2016 2017 Source

PC + tablet units -8.7% -0.7% Gartner, Oct. 2016

Mobile phone units -1.6% 1.2% Gartner, Oct. 2016

Smartphone units 4% 5% IC Insights, Nov. 2016

World GDP 3.1% 3.4% IMF, Oct. 2016.

The world economy should show modest improvement in 2017, with GDP growing 3.4% compared to 3.1% in 2016 according to the International Monetary Fund IMF.

Among advanced economies, improved GDP growth from the U.S., Canada and Japan will more than offset weaker growth in the UK and Euro Area countries.

In emerging and developing economies, steady growth in India and southeast Asia and recoveries in Russia and Latin America should more than compensate for slowing China growth.

Downside risks to the forecast are significant:

The impact of Brexit is difficult to estimate.

U.S. President-elect Donald Trump has threatened high tariffs against China. A trade war between China, the largest electronics producer, and the U.S., the second largest electronics consumer after China, would negatively impact the electronics and semiconductor markets in the near term.

The continuing conflicts in the Middle East and global terrorism threats could also disrupt the economy.

Despite these risks, the overall global economy is healthy and should show modest improvement in 2017.

Source: http://www.electronicsweekly.com/