This is the third of six blog posts that examine how the Automotive industry will be impacted by Blockchain in the near and not so distant future. In this post I elaborate two use cases that have huge potential for Manufacturer Finance.

Treasury Operations

Today’s largest Automotive companies operate less like single monolithic command and control structures and more like a set of self-organising entities with corporate headquarters at their core providing strategic direction and funding.

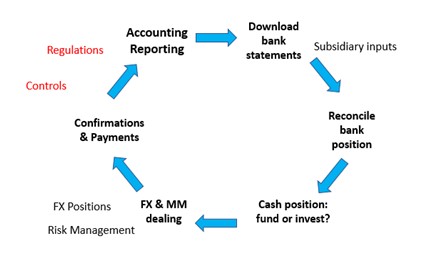

Treasury Operations is one of the core functions of the Finance department; managing the cash flow and short-term financing needs by buying and selling currencies, options and debt instruments and distributing funds to different subsidiaries around the world. Trading is frequent, use of manual processes and spreadsheets are extensive and calculating changes to the company’s overall financial position at end of day/month/quarter/year is time consuming.

A Blockchain based system would eliminate the need for scheduled download processes and would ensure that all transactions are recorded and are traceable. Smart contracts could be used to ensure compliance with Treasury policies and to streamline the verification process. Reconciliation and audit could be performed more efficiently and at lower cost; reducing bank’s exposure to risk of fraud and default.

Treasury operations

Treasury operations

Supply Chain Finance

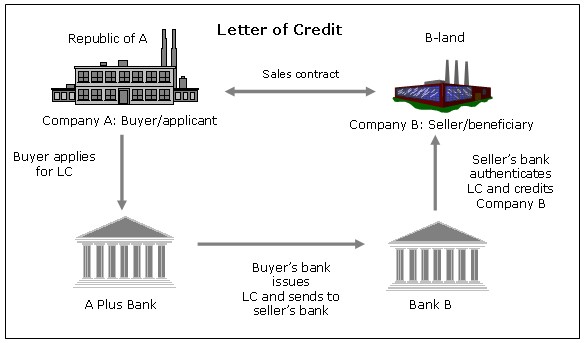

Automotive companies regular manufacture in one country and then export finished products (parts or vehicles) to dealer groups or fleet buyers in other parts of the world.

The issuing and exchange of Letters of Credit is a time consuming and costly business process requiring many paper forms to be completed, emails exchanged, faxes sent and supervisors’ approval. A Blockchain based system would provide a common ledger for Letters of Credit; allowing both parties to see the same validated record of transaction and fulfillment. Processing time could be reduced from days/weeks to less than 24 hours.

Software based workflow would enable automation of many of those manual steps and allow the finance provider to offer new, value added services, such as fractional payments so that a buyer’s bank releases a proportion of funds to the seller’s bank after a certain percentage of goods have arrived in good condition at port of export. An Automotive company that teamed with a supply chain or trade finance bank to digitize these processes would recognise significant savings.

Letter of Credit

Letter of Credit

By: www.ibm.com