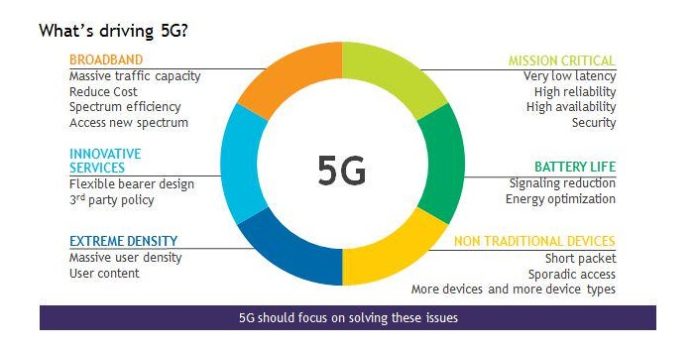

The excitement about new technology usually comes from two different directions: the vendors that are driving the technology development and the operators that use the new technology to offer new services and reach new customers. Traditionally, this has been the norm, but we are quickly finding out that 5G is breaking a lot of norms.

Research into the 5G market will have to be far more nuanced than 4G or any of the preceding Gs. Why? Because 5G encompasses the widest scope of technology and capabilities to come out of the wireless industry. From massive IoT connections, to ultra-low latency, to gigabit download speeds, not to mention mmWave/cmWave and shared/unlicensed spectrum and network slicing, there are parts of the 5G specification that will never touch the other segments.

One aspect of the ACG Mobility Program will be to clearly identify use-case requirements and the role of standards in addressing these needs. Elements of the 5G standards that have been well defined and set from the beginning, such as 1ms delay targets for Ultra Low Latency Communications (uLLC) are now being expanded to 2-5ms by industry groups, for example, which calls into question the feasibility of 1ms as the uLLC target.

Failure to clearly separate the different 5G markets clouds the size, value, progress, and focus of the 5G solution use-cases, which are incredibly broad and far reaching. Slow growth or fast grown in one segment, say 5G FWA, has no impact on the ultra-low latency robotic control solutions and will use very different technology to accomplish each deployment. Therefore, an overly broad forecast is interesting from a numbers perspective but not very useful.

A recent Wireless Week article stated that 5G connections will grow from approximately 1 million in 2019 to an astounding 1.4 billion in 2025 for an annual growth rate of 232%. (Source: https://www.wirelessweek.com/data-focus/2017/08/report-china-us-will-lead-5g-connections-grow-14b-2025). Even for an industry that throws around big numbers like candy at a parade, these are heady numbers. Not the first time we’ve seen forecasts for billions of connections, for example, see Ericsson’s numbers for IoT for instance (1.4 billion cellular IoT connections out of 18 billion IoT connections by 2022). I’m not even going to try at this point to figure out the 5G IoT connections from these numbers. Why? Look at a few 5G presentations and a few IoT presentations: IoT is almost always in the 5G decks, but 5G is almost never a part of IoT presentations.

But let’s not forget the comments from the leaders at some of the largest global MNOs on their views of 5G monetization and cost. There is a gap between the prognosticators and the implementers that we need to come to terms with.

Let’s start with the 5G forecast and these numbers, which are over exuberant if you could not already tell. Let’s do some basic math take a simplistic view of the challenge (and per the forecast US, China, and Japan are expected to represent 55% of all 5G connections providing further concentration of installation). If 5G installations start Jan 1, 2018, and end Dec 31, 2024, to reach these 1.4 billion 5G connections the industry would have to:

- Make 200 million 5G connections annually from 2018 through 2024. That is 16 million 5G connections a month or 45,600 connections a day, every day, for 7 years starting Jan 1, 2018. In the US, where 30% of all 5G connections are forecast, this breaks down to 420 million connections in 7 years or 60 million connections every year for 7 years. By days that is 13,698 5G connections installed every single day for 7 years, starting in a little over 4 months.

- Have the ecosystem in place to deliver the materials for 1.4 billion 5G connections in the next 7 years. How many connections are we expecting in 2018 and 2019, given what will of course have to be a ramp up for delivery?

But it is not just the simple numbers that is a cause for concern. Technology adoption is not exactly a given. GSA has identified as barriers to LTE adoption the lack of appropriate devices (despite that GSA reports there are 8,623 LTE devices available as of July 2017) and a lack of digital literacy. 5G does nothing to address either of these issues, and in many use-cases, 5G use-cases are concentrated in high-value services (AR/VR, robotics and autonomous driving) rather than low-cost, mass market connectivity, which will likely further draw out the deployment and widespread adoption of 5G.

Ovum reports there were 2.16 billion LTE subscriptions globally at the end of Q1, 2017. As a reminder, LTE was first launched by Telia Sonera in Dec 2009. Worldwide, in about 7 years, we’ve reached 2.1 billion LTE devices with nearly 600 networks deployed. Compare that to the GSA saying that 22 operators have been identified as launching 5G networks between now and 2021.

One problem may be in how we are defining 5G. With the earliest of 5G services in the US expected to be fixed-wireless access in the mmWave spectrum bands, can we really say that these pre 5G standard connections are really 5G? Or is this simply a case of updated P2P microwave services?

Let’s also remind ourselves of the challenges that are increasingly being widely acknowledged for 5G.

Leading operator CEOs and CTOs are pushing back on the hype around 5G but is the industry listening?

MobileWorldLive published a blog in July (https://www.mobileworldlive.com/blog/blog-presenting-the-5g-business-case/) highlighting many such comments. Although primarily European focused, the concerns expressed represent global challenges. An edited summary of the comments from that blog:

- BT’s Howard Watson, CEO of technology services and operations, proclaimed “5G will have a lot to live up to,” outlining the company’s plans to continue to invest in its 4G network for the near future.

- Deutsche Telekom’s Uwe Janssen, VP of innovation and research, bemoaned the massive infrastructure spend it would require to deploy 5G. He also suggested shareholders were not entirely happy with the returns generated from capital deployed: “They are always challenging us to improve,” he said.

- Telenor Norway CEO Berit Svendsen warned the industry is “already in big trouble because there has not been increases in revenue for many years.” To address this, she urged the industry to identify a strong business case and use case for 5G. Telenor Norway will head into 2020 with a keen focus on developing autonomous driving, remote surgery and fish farming.

- Matt Beal, Director in Vodafone Group’s Technology for Innovation and Architecture, pointed out the industry is often “criticized for its speed” and IoT was one specific 5G use case the industry should “quit waiting on.”

The hype around 5G follows the typical pattern in the industry of over exuberance for new technology, but in the case of 5G, the industry continues to get ahead of the standards as well as strong business cases. The leading telecom vendors Cisco, Ericsson, Huawei, Nokia, Samsung and ZTE are dealing with replacing the revenue from a global market that has built out most of its LTE networks, as well as a shifting from purpose-built platforms to increasingly virtualized and cloudified platforms.

5G is the logical next step, but the rationalization that cellular technologies have about a 10 year life-cycle is being constantly challenged by the continued development and strength of that 4G technology that was originally designed to be for Long Term Evolution. For better or worse, LTE is certainly living up to its name. There is still a lot that is being accomplished with LTE, including continued developed of LTE-A (see https://www.mobileworldlive.com/asia/asia-news/singtel-initiates-massive-mimo-lte-a-upgrade/ ). Consequently,

LTE is taking market share away from 5G on both ends of the service spectrum: NB IoT and Cat M are taking IoT share from expected IoT developments while increasing the number of gigabit LTE services being announced. The market for 5G is narrowing somewhat and that is positive.

Stay tuned to ACG’s mobile research service for a continued reality check on a wide range of mobile-related technologies: 5G, LTE-A, Small Cells, Multi-Access Edge Computing/Mobile Edge Computing, and the intersection of licensed and unlicensed spectrum for service provider and enterprise networks. I’ll be discussing where the opportunities are for each of the technologies and where the hype is not warranted. It will be a fun ride. Hop aboard.

By: Chris Nicoll