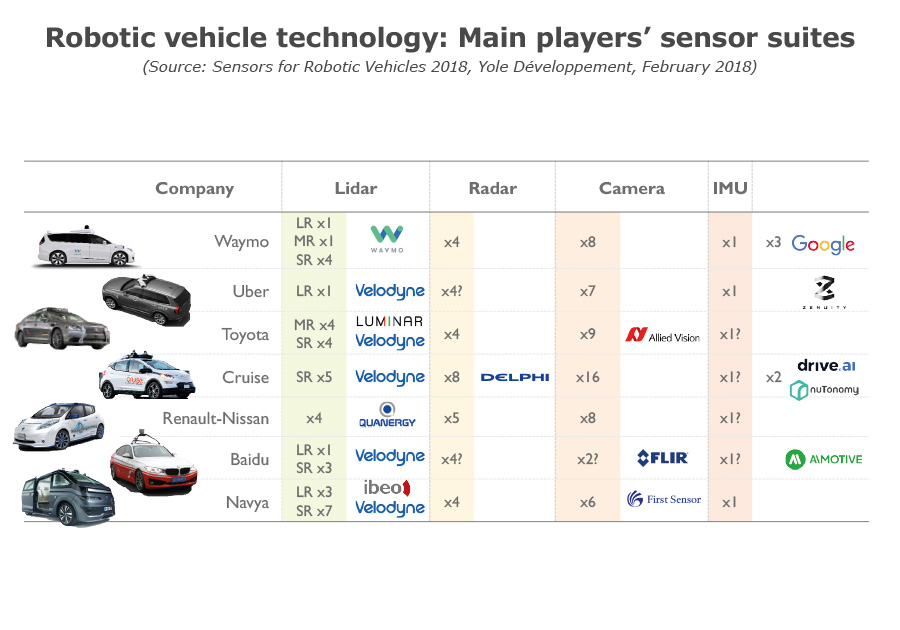

2018 will most probably be the initial launch year for robotic taxis in several cities around the globe. The move has direct consequences for technology providers in high-end sensing and computing equipment. The vehicle count that we can collect suggests several tens of thousands of vehicles on the road worldwide before end of 2022. Each robotic vehicle will be equipped with a suite of sensors encompassing Lidars, radars, cameras, Inertial Measurement Units (IMUs) and Global Navigation Satellite Systems (GNSS). The technology is ready and the business models associated with autonomous driving (AD) seem to match the average selling prices for those sensors. We therefore expect exponential growth of AD technology within the next 15 years, leading to a total paradigm shift in the transportation ecosystem by 2032. This will have huge consequences for high-end sensor and computing semiconductor players and the associated system-level ecosystems as well.

Within the robotic vehicle technology stack, high-end industrial sensors will play a key role. There are key differences between automotive ADAS technology and equipment that will fit into early robotic vehicles. Yole warned about this very persistently in our previous reports on automotive technology. “Robotic vehicle report provides the missing piece with which to complete your AD market understanding”, explains Pierre Cambou.

Automotive ADAS has to focus on reliability and cost issues serving a market with sales of millions of units. The technologies to serve the robotic vehicle market will be mainly driven by performance and availability and will serve a market of only tens of thousands units by 2022. The orders of magnitude are in fact totally different between the two worlds. To generalize broadly, high end industrial sensors will win in the early robotic vehicle sensor suite.

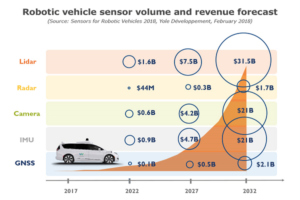

The consequences for existing players and technologies will be huge: some high-end markets such as LiDARs or industrial grade IMUs will more than double in the next few years. The impact will also be strongly felt by industrial camera makers. Therefore, technologies are expected to specialize by 2022 and possibly merge partially with ADAS by 2027. Technology-wise 2032 is expected to be another world, with a complete paradigm shift. It is not often that the industry is facing such deeply transformative changes powered in part by sensing technologies. The robotic revolution is underway and Yole’s report is a thorough analysis of its market and technology implications.

Sensors for robotic vehicles will become industries of their own”,announces Yole Développement (Yole), the market research & strategy consulting company in its new analysis named Sensors for Robotic Vehicles. Growth rates are expected to be impressive. In 2017 production of robotic vehicles was in the range of a few hundred worldwide. Today, Yole is expecting production volumes to reach 3.1 million units annually, with cumulative production of 10.5 million units, by 2032. That market growth in excess of 2,500-fold, or 58% CAGR for the next 15 years.

Yole presents today it new technology & market report Sensors for Robotic Vehicles. This analysis provides a comprehensive scenario for sensors within the dynamics of the robotic vehicle market including market metrics such as ASP, revenue, volume and shipment. It also proposes a relevant description of the overall applications on the sensor suite: LiDAR, Radar, Cameras, IMU , GNSS , and associated computing. In this report, Yole’s analysts provides in-depth understanding of the related ecosystem & players.

Who are the players? What is the robotic vehicle ecosystem? Who are the key suppliers to watch? Which technologies are today available? What will be the tomorrow’s technologies? Yole proposes you today to discover a picture of our future.