The tipping point of the Si photonic industry is only at the very beginning, since there is massive, ongoing global development geared towards further integration. Indeed, Si Photonics today is restricted to the data center market and still competes with VCSEL, which continues to improve In parallel, metropolitan/long-haul applications are not still the main Si photonic targets since the cost is still too high. Long-haul require reliable components and volumes that are not interesting for SiPh. However, as FTTH specifications would converge to Metropolitan networks, this application could also be accessible to Si photonic solutions:

• The recent involvement of large IC foundries is a very encouraging sign that portends big things for Si photonics. They include: TSMC with Luxtera, GlobalFoundries with Ayar Labs…

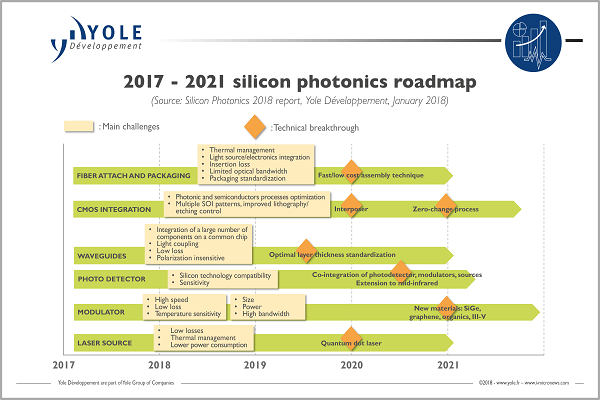

• The “zero-change”: it means manufacturing optical components without making any changes to a CMOS process. This processes currently in development target future inter-chip optical interconnects that could represents a huge market volume.

• Datacom and telecom are not the only applications. As silicon photonics is an integration technology platform, it can also be used for sensing application where volume/small form factor are required: medical and automotive applications.

The analysis will not be completed if GAFAMs were not part of the game. Therefore, in development for years, Si photonics is still pushed hard by these major companies, due to their impressive advantages including low cost, higher integration, more embedded functionalities, higher interconnect density, lower power consumption, and better reliability compared with legacy optics and more. Big OEMs like Facebook, Google, and Amazon develop their own optical data center technology in partnership with chip firms. Indeed, while traffic continues to increase between users and data centers across the internet, more and more data communication is taking place within the data center. Current data center switching and interconnects make it difficult and costly to cope with this increasing flow. In this context, new approaches are necessary…

“Si photonics growth is now confirmed”, announces Dr. Eric Mounier from Yole Développement (Yole). “Therefore, the development of Si photonics technologies is especially driven by the intra & inter data center applications. Silicon photonics is today one of the most valuable answers to high data rate/low cost for distances beyond VCSEL’s reach.”

The market research and strategy consulting company, Yole investigates the Si photonics sector for years now and was already announcing its take-off in 2017. This year, the trend is confirmed, strongly supported by the needs of data management and performances. Si photonics market forecasts are impressive: Yole’s analysts announce a US$560 million market value at chip level and an almost US$4 billion market at transceiver level, both in 2025. The Si photonics technology has reached its tipping point with lot of positive signs: Yole announces transceiver volume-shipping via two major players, Luxtera and Intel as well as a maturing supply chain. In addition, Yole’s analysts highlights the development of new startups and additional products reaching the market, mostly for 100G but soon for 200/400G. At the end, the market is showing very encouraging signs in terms of growing investments from the VC community.

A detailed description of this report is available on i-micronews.com, photonics reports section.