According to Yole Développement (Yole), the global LiDAR systems’ market for automotive applications, is showing an impressive growth between 2017 and 2023. From US$726 million to US$5 billion, it should reach a huge 43% CAGR during this period. In addition, the growth should continue until 2032 with a US$ 28 billion market value, for the automotive market segment only.

Today, LiDARs and new applications are developing simultaneously. Thus the LIDAR market is directly linked to the development of ADAS solutions and robotic vehicles. Both domains show high growth rates and tremendous enthusiasm.

Yole’s analysts announce so huge opportunities in the automotive sector but not only. Indeed diverse industries such as aerospace, archaeology, construction, and wind farms and more will be also part of the market landscape.

“In the past two years, more than US$800 million has been invested in LiDAR companies,” announces Alexis Debray, Technology & Market Analyst at Yole. “Therefore, there is clearly a strong excitement around these technologies.”

But is it a dream? Or could we think about a real market potential? Some companies, despite being created only a few years ago, have received millions in investments. For example, Blackmore, founded in 2016, recently received US$18 million from BMW and Toyota. And Quanergy, launched in 2012, received US$180 million in 2017. Such investments testify to LiDAR technologies’ immaturity. Start-ups, industrial players, Tier1s, and automotive OEMs are all investing in different approaches with no guarantee of success – but this is the price they must pay for a chance to be part of the automotive grade market for LiDAR technologies, seen by many as the “Holy Grail”.

“In the past two years, more than US$800 million has been invested in LiDAR companies,” announces Alexis Debray, Technology & Market Analyst at Yole. “Therefore, there is clearly a strong excitement around these technologies.”

But is it a dream? Or could we think about a real market potential? Some companies, despite being created only a few years ago, have received millions in investments. For example, Blackmore, founded in 2016, recently received US$18 million from BMW and Toyota. And Quanergy, launched in 2012, received US$180 million in 2017. Such investments testify to LiDAR technologies’ immaturity. Start-ups, industrial players, Tier1s, and automotive OEMs are all investing in different approaches with no guarantee of success – but this is the price they must pay for a chance to be part of the automotive grade market for LiDAR technologies, seen by many as the “Holy Grail”.

“In the past two years, more than US$800 million has been invested in LiDAR companies. Therefore, there is clearly a strong excitement around these technologies.”

“In the past two years, more than US$800 million has been invested in LiDAR companies. Therefore, there is clearly a strong excitement around these technologies.”

(Alexis Debray, Technology & Market Analyst at Yole)

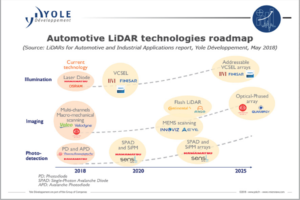

On the technology side, diversity is the key word. Therefore the range of offers is equally impressive. Most current products, such as those proposed by Velodyne, use a macro-mechanical scanning of laser beams at wavelengths between 830 – 940 nm. However, MEMS scanners are expected to be the next evolution of automotive LiDAR, promising to be smaller and cheaper. The next step after this should be the optical phased-array, as proposed by Quanergy, in which no moving part is present – thus becoming even cheaper, smaller, and safer. This technology stems from optical fiber communications. Some players like Continental and Xenomatix propose flash LiDAR, in which the whole scene is illuminated simultaneously with no moving part. Other players propose different solutions: Cepton and Luminar have revealed mechanical scanning technologies, while Neptec employs Risley prisms. Although many players use a wavelength from 830 – 940 nm because corresponding optical components are more widespread, some are investigating the 1550 nm wavelength for which a higher laser power can be used, because the laser maximum’s permissible exposure is roughly 100x higher and also because dust robustness is better. These players include Blackmore, Neptec, Aeye, and Luminar.

And the diversity continues, with most LiDAR development companies using a direct LiDAR type called pulse LiDAR, in which a pulse of light is sent to the target; the time it takes to return to the photodetector confirms the distance. A few companies are investigating continuous-wave ranging methods which allow for heterodyne detection, and therefore much higher sensitivity. IFM and Benewake are investigating the phase-shift ranging method, while Blackmore and Oryx are investigating the frequency modulation ranging method.

The market research and strategy consulting company, Yole invites you to discover the LiDAR industry for automotive and industrial applications: LiDARs For Automotive & Industrial Applications.