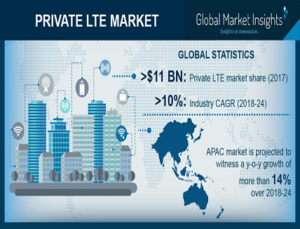

The private LTE market growth is attributed to the massive surge in connected devices that generate the need for secure and reliable communication between devices. To overcome network connectivity issues faced by the connected industrial systems, the private LTE networks play an important role.

Another factor driving the market is the extensive deployment of public safety wireless networks that enable first responders to share information for situational awareness. The public safety agencies are embracing these networks to ensure a coordinated response, offer actionable data insights, and improve response time. Huge investments by the government agencies and global telecom operators in the LTE-A and 5G-ready networks that ensure better connectivity, low latency in the industrial control systems, and mission-critical services will drive the private LTE market growth.

As per the infrastructure type, EPC segment held a dominant private LTE market share amounting to around 40% in 2017. As mobile networks are becoming more complex with the introduction of LTE networks and multiple radio access technologies, the demand for EPC solution to manage network payload will increase over the forecast timeline. The eNode install base is projected to increase over 330,000 units by 2024. Increasing deployment of private LTE networks for public safety applications is expected to majorly influence the growing installations of eNode base stations over the forecast timeline.

The IoT modules segment in private LTE market is projected to grow at a CAGR of around 15% over the forecast timeline. The rapid adoption of these modules is supported by the growing IoT and M2M applications that require such devices that allow physical objects to connect to wireless networks. The growing usage of IoT platforms in smart city application will also drive the growing adoption of IoT modules.

North America is estimated to hold the largest private LTE market share of over 40% by 2024 due to the growing need for high-speed and low latency network for mission-critical communications and industrial IoT applications. For instance, in June 2017, Redline and Future Technologies partnered to offer Redline’s mobile LTE product line to the military customers of Future Technologies. Under the partnership, both the companies executed their commercial LTE pilot for a military customer for use in disaster recovery and tactical deployments. Also, the penetration of smart connected systems in sectors such as transportation, manufacturing, and public safety is expected to increase the demand for private LTE networks.

The mobile core solution providers are offering LTE solutions to operators and enterprises that require private cellular networks to maximize the effectiveness of their communications infrastructure. For instance, in July 2018, Quortus partnered with Fujitsu on cellular core network technology for private LTE. Under the deal, Fujitsu deployed Quortus’ network products as a part of its private LTE solutions for enterprises, telecom operators, and large organizations in Japan. In August 2016, SK Telecom and Nokia completed the development of mission-critical LTE system, Public Safety-LTE (PS-LTE) for first responders. The system is equipped with a base station, core network, and PTT solutions, offering a wider usage in disaster relief & emergency operations by instantly setting up an independent LTE network.

Some of the prominent players operating in the private LTE market are Nokia, Qualcomm, Huawei, Ericsson, ZTE, Future Technologies, Verizon, Cisco, Netnumber, Druid Software, Casa Systems, Ruckus Networks, SpiderCloud, PDV Wireless, General Dynamics Mission Systems, Boingo, Samsung, Motorola, Sierra Wireless, AT&T, Rivada Networks, and Tait.