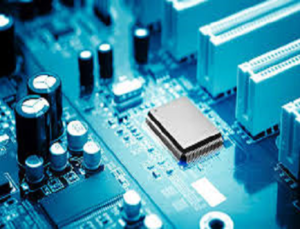

Since late 2020 there has been disruption within the supply chain of semiconductors to the automotive sector. Pressure built as the industry recovered from the widespread lockdowns implemented in the first half of 2020 and that recovery cycle clashed with increasing demand from the wider consumer electronics sector, which was itself recovering strongly late in the year, building stocks for the holiday season.

As a result, vehicle manufacturers are finding increased disruption to the supply of systems using semiconductors in the first quarter. We do not have every major OEM identified so additional risk would sit there, and that can be applied to almost all regions, although the visibility in Japan is close to comprehensive.

The semiconductor supply chain for MCUs normally has 12 to 16 weeks lead time from order to delivery to OEM/Tier 1. So, today’s issues in the semiconductor production have approximately doubled the normal lead time to at least 26 weeks. We expect the situation to hit bottom around the end of March, although the supply chain will still be constrained into Q3. In our volume assessment, we have only considered the impact in Q1.

Relative to chip supply, however, based on known factors today, IHS Markit analysts anticipate the bottom of the chip shortage crisis likely towards the end of March for MCUs. Beginning in April, we anticipate MCU supply will improve but still not meet OEM demand In the third quarter, it appears MCU supply could meet the OEMs ongoing demand at that time, but perhaps not make up the missed demand from the first half of 2021. It is anticipated that MCU supply in the fourth quarter could be able to meet OEMs ongoing demand and start making up the missed demand from the first half of 2021.

Eventually all OEMs will be impacted by the MCU supply constraints, those with more inventory in their supply channel — for examples smaller OEMs or some Japanese OEMs because of their use of distributors to hold inventory — may be less impacted until their inventory is consumed.

As a result of this situation, integrated circuit (IC) vendors will need to revisit working with foundries, either by diversifying their foundry supply chain relationships lessen their dependencies on a single region or single foundry. This is possible for MCUs and for analog where there is a wide range of foundries, creating some opportunities for other foundries to step in.

In addition, there may be some slight steps for chip manufacturers to bring back more in-house wafer processing, but IHS Markit does not expect a total reversing of the “fab-light” strategy which prevails in the industry to save on CAPEX. Especially for advanced nodes, the dependance on TMSC and UMC will remain.

The situation remains highly fluid and we continue to track the impact of these developments alongside our assessment of the recovery in production since the outbreak of the COVID-19 pandemic. Currently there are varying estimates as to the length of the semiconductor shortage, with some suggestions that the situation will improve from the second quarter onwards, while some of the lower level disruption could even be recovered within the current quarter.

Overall, the global light vehicle production volume at risk has risen to nearly a million units for the first quarter. At this level, we still expect the majority of volume can be recovered across the balance of the year, so we expect of the current shortages to be more of a seasonal impact, with volume lost in the first quarter, displaced to later in the year, rather than an absolute reduction to the 2021 calendar year forecast. However, as we move closer to the million-unit mark and as plants building high-demand programs are brought into the mix, it could become more challenging to entirely offset production losses within the calendar year.

Although the current situation is expected to be limited mostly to 2021, it has brought concerns over the supply chain in certain areas to the forefront. Both European Union and the Biden Administration in the US are considering ways to address the shortage and reduce the dependence on the supply chain from Asia with more localized production.

Quote from Mark Fulthorpe: “At this stage, while we anticipate a million vehicles will be delayed from production in the first quarter, we expect the industry to recover later in the year, with little expected risk to the full year forecast of 84.6 million units at this time. We are continuing to monitor, however, and the situation remains fluid.”

Quote from Phil Amsrud: “It will get worse before it gets better. Short term all that can be done is juggling priorities in the foundries to make more automotive MCUs instead of products for other markets. Longer term, the automotive industry needs to make supply assurance as high a priority as cost savings to incentivize the supply chain to be more diverse. Moving to more advanced process nodes makes the industry even more susceptible to a limited number of foundry options.”