Covesting copy trading is all about profits first and foremost, both for followers and strategy managers. But what good is making profits that aren’t ever booked because risk management was poor? In many ways, risk management is even more critical to a trader’s capital growth and success than profitability.

All the profits in the world don’t matter if they are immediately lost, or never actually booked in the first place. As such, the Covesting developers, a licensed and regulated team out of Europe, have added several key metrics that are recorded and tracked, each awarding users on the platform with one of five stars.

With five-star rating systems being used everywhere as a simple way to understand quality at a glance, it made perfect sense for the Covesting leaderboards as a way for followers to determine safety when not focusing solely on total profits as a key performance indicator.

What Is Covesting Copy Trading?

The Covesting copy trading module is a peer-to-peer trading community where followers and strategy managers gather together and profit on the same platform. Strategy managers must trade in today’s competitive markets, while also beating out other hungry traders who are seeking to outrank them in the Covesting global leaderboards.

Strategy managers who rise the ranks of this leaderboard via total profits attract the most followers possible. Followers are welcome to put capital behind any of the strategies they are most interested in, and copy any trades they make – win or lose.

Followers make a profit each time the strategy manager is successful, which creates incentive for followers to review all risk and success metrics carefully and choose which strategy or strategies to follow. Strategy managers also have plenty of incentive to stay trading and do well, as they earn a cut of followers’ success fees. And with more success, more followers will pile in, which means a greater overcall cut and more profits than otherwise possible.

What Is The Five-Star Rating System All About?

Deep within the Covesting leaderboard system are a diverse range of risk and success metrics that followers can use to find strategies that best fit their profit goals or risk appetite. The riskier the strategy is, the more profits they may have, but there is a greater chance for losses.

Followers must balance greed and not focus solely on profits, and instead include a layer of fear and consider any risks. Risk can be further mitigated using the stop loss feature for followings, which limits unwanted drawdowns. A take profit feature also ensures all profits are booked, which is essential to proper capital management as well.

The best way to prevent risk is to never allow it to appear at all, or trying to limit it upfront as best as possible. Followers can do this by focusing exclusively on finding Covesting traders with as many stars unlocked as possible.

What Are The Five Stars Of Covesting?

The first of five stars are awarded for a trader having 0.5 BTC in trading account equity minimum. More is allowed. The second star is given for strategy managers that have been active more days than they haven’t, within a sixty-day period. This means that a trader must be active for a minimum of thirty days in the sixty-day timeframe.

The third star is provided for proper margin usage, and ensuring a strategy manager never plunges below the green-coloured “safe zone” on the chart. The fourth star requires the win to lose ratio to favour profitability to the tune of 70% to 30%. This win rate must be maintained for a full thirty day period to achieve.

For the fifth and final start, a strategy has to be more active than a 50 BTC turnover within a thirty-day phase. No individual star is out of reach, yet obtaining them all at once is a feat that few have been able to achieve. The ones that do, are like diamonds in the rough. They don’t have the same massive profits to boost as the top-ranked traders do, but they also don’t lose their gains for their followers.

New Margin Allocation Chart Update Now Live

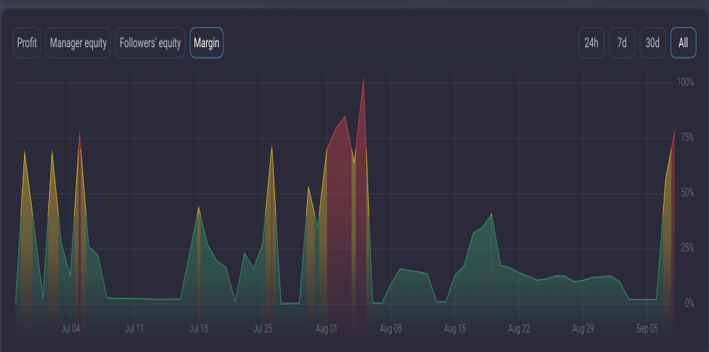

Covesting has recently rolled out a new update to the margin allocation chart, which deserves its own call-out in this guide considering we’ve now mentioned the margin allocation star it is associated with.

The latest update to the Covesting copy trading module user interface includes an updated view of the margin usage chart, which indicates how much of a strategy manager’s margin has been allocated toward positions.

If the chart, previously grey only, stays in the green that means the margin is in the safe zone and the account is not at any risk of liquidation or a margin call. If the chart turns yellow, this means it is time to take caution. The strategy is at this point either protecting positions or taking too large of a risk comparative to their capital size.

Finally, the chart turning red means that the strategy manager is no longer playing it safe, and could be making dangerous decisions with followers’ capital on the line. As a follower, this updated chart with more clarity is one of the most helpful tools for preventing the risk associated with too high stakes of a trader.

Conclusion: Covesting Prepares Traders For Profits And Safety

That’s what is so great about Covesting. The platform sets everyone up for success, one way or another. Strategy managers have access to stop-loss orders when margin trading cryptocurrency, take profit tools, and charting software, while followers can limit max drawdowns and book profits on followings as well. With plenty of risk and success metrics to choose from beyond just total profits alone, followers can make informed decisions about who they follow and hold strategy managers more accountable. Only with Covesting and the fully transparent global leaderboard system can followers be sure that what they see is what they get when it comes to the traders they follow online.