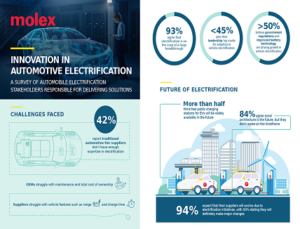

Molex released the results of its latest global survey of automotive stakeholders to identify top trends and roadblocks impacting innovation in Electrified Vehicles (EVs). As a major catalyst for change in the complete vehicle architecture, including charging stations, successful electrification requires greater collaboration among automotive OEMs and their suppliers, increased R&D and capital investments, as well as the design, development and delivery of breakthrough technologies in power control and battery management.

“Automobile electrification is a complex undertaking, involving much more than transitioning from internal combustion to electric engines,” said Kevin Alberts, SVP and GM, Power & Signal Business Unit (PSBU), Molex. “The quickening pace of innovation across all aspects of electrification is being propelled by highly sophisticated engineering and fully integrated manufacturing that leverages ultrasonic welding, sustainable production and automation to speed delivery of next-generation electrification solutions.”

Molex commissioned Dimensional Research to conduct the Innovation in Automotive Electrification survey in October 2021, polling 204 participants at automotive companies, Tier 1 or 2 suppliers, as well as charging station providers in North America, EMEA and APAC in various roles; spanning R&D, engineering, product, innovation, strategy, manufacturing and supply chain. Survey participants responded to questions relating to electric vehicles and electric systems inside vehicles (e.g., power electronics, wiring, sensors, battery management systems, etc.) and outside-the-vehicle electrification solutions (e.g., charging stations).

Key findings include:

● 94% of those polled agree that electrification goes well beyond a move to electric motors; 93% believe electrification is on the cusp of a huge breakthrough

● Top-three growth factors identified by respondents include the increase in pro-electrification government policies, improved battery technology and a wider selection of electric/hybrid cars

● Focus on electrification among automakers and their suppliers has increased dramatically over the past two years in relation to customer experience (55%), business results (51%), executive attention (50%) and expected speed of market delivery (48%)

● Despite momentum, 92% of those surveyed report their design teams face difficulties with electrification while 91% report challenges finding much-needed expertise

Top Features Poised for Innovation

Respondents agree that innovations in electrification will yield widespread improvements in vehicle features, including autonomous and driver assistance (53%), safety (43%), total cost of ownership (41%), vehicle charging time (39%) and vehicle range (37%). Still, challenges persist in improving vehicle charging time (31%), vehicle range (29%) as well as autonomous and driver assistance (29%). Participants also report progress with battery cells, modules or packs (51%); electric motors (47%) and powertrain electronics (45%). However, they’re struggling to innovate controller units (37%); wiring, connectors and busbars (34%); cameras and sensors (33%); and powertrain electronics (26%).

Zonal Architecture to Become Standard

According to 84% of those surveyed, zonal architectures will become standard within the next five years or more as automobile makers and suppliers strive to support electrical/electronic (E/E) architectures. Not only does zonal wiring reduce the web of wires associated with traditional vehicle architectures, but this innovation will dramatically decrease the number of Electronic Control Units (ECUs) in the vehicle, while reducing wire length, weight and cost.

Collaboration is Critical to Electrification Success

Survey participants face a wide range of issues in attaining much-needed expertise to drive their innovation efforts. Traditional automotive Tier 1 or 2 suppliers often lack electrification expertise while automotive OEMs find increasing competition from technology titans exacerbating their internal hiring objectives. Automotive OEMs ranked greater collaboration with suppliers as the biggest innovation driver; suppliers ranked increased investments in R&D and capital (e.g., tools, machinery, plants) as most likely to propel advancements.

Molex Power & Signal Expertise

Molex’s proven portfolio of innovative interconnect products and solutions is enabling the development of next-generation electric powertrain motor control units, electronic control units and battery management systems. With more than 30 years of experience serving leading automakers and suppliers in the automotive industry, Molex is furthering its mission to design and deliver critical electronic, power and signal, and connectivity solutions that form the central nervous system of tomorrow’s electrified vehicles.