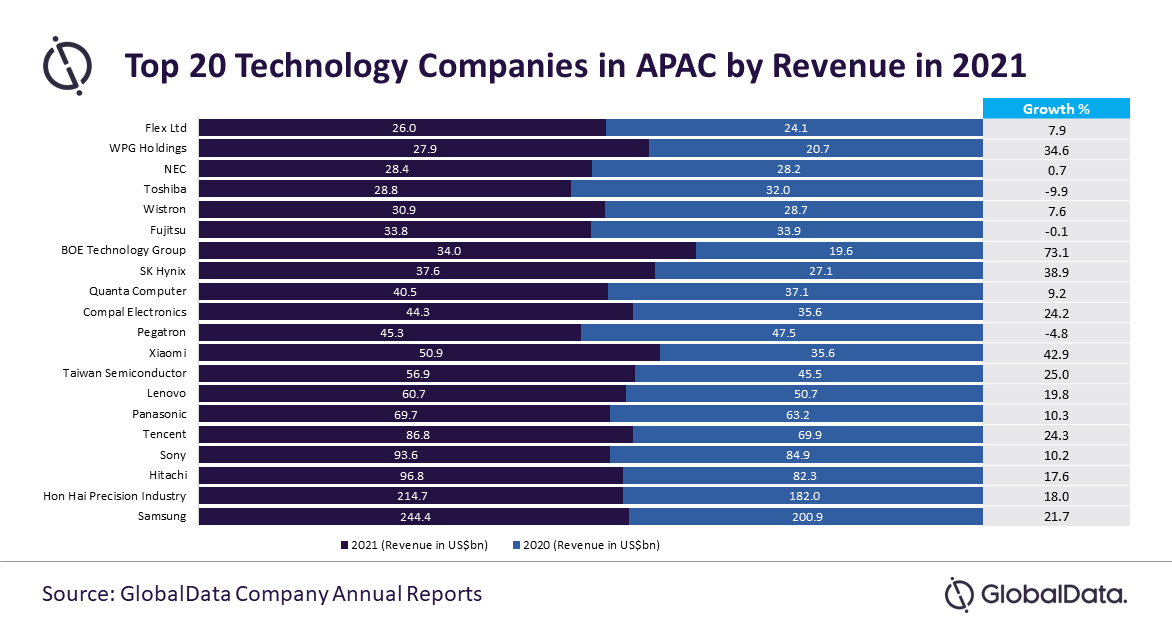

Despite inflationary pressures and COVID-19 induced supply chain disruptions, approximately 85% of the top 20 Asia-Pacific (APAC) technology companies witnessed year-on-year (YoY) cumulative revenue growth in 2021, finds GlobalData, a leading data and analytics company.

Ragupathy Jayaraman, Business Fundamentals Analyst at GlobalData, comments:”Taiwan continues to lead the list of the top 20 APAC technology companies based on revenue with seven firms, followed by Japan (6), China (4), South Korea (2) and Singapore (1). Among the top 20 tech companies, 85% reported YoY growth in their revenue with 13 companies reporting double-digit growth in FY2021. BOE, Xiaomi, TSMC, WPG and SK Hynix – topped the table with each registering more than 25% YoY revenue growth.”

Chinese IoT giant BOE Technology Group topped the list with a 73.1% YoY increase in 2021, driven by rise in prices of major products and capacity improvements.

Meanwhile, Chinese smartphone giant Xiaomi reported a double-digit YoY increase and a five-year CAGR in revenue. The company’s sales largely benefited from increased smartphone shipments globally which reached 190.3 million units. Continuing its core ‘Smartphone × AIoT’ strategy in the previous fiscal as well, its IoT and lifestyle products segment registered 26.1% YoY revenue growth in 2021.

Jayaraman continues: “South Korean tech major SK Hynix surpassed its previous highest revenue growth recorded in 2018 (34%), with 38.9% YoY revenue growth in 2021. Strong sales of DRAM and NAND flash products resulted in the company’s revenue growth.”

For WPG, growth stemmed from strong demand for semiconductor and electronic components, especially PCs, laptops, communication components, base stations, cloud and servers. Strong demand for its advanced and specialty technologies resulted in a 25% YoY revenue growth for global semiconductor giant, TSMC.

Toshiba, Pegatron and Fujitsu are the only companies in the top 20 list that witnessed negative revenue growth rates in 2021. Toshiba’s revenue declined by 9.9% YoY due to a fall in its logistics services and battery cells and packs businesses. Pegatron reported a 4.8% YoY revenue decline due to weak demand in its computing and consumer electronic segments during Q2 and Q3 2021. Fujitsu reported a marginal 0.1% YoY decline in revenue.

*Technology companies include software and hardware developers, IT service providers (including internet-based service providers), and manufacturers of electronics including semiconductors, mobile devices etc.