The total annual demand in GWh for Automotive Battery Packs will increase five-fold from 2021 to 2027

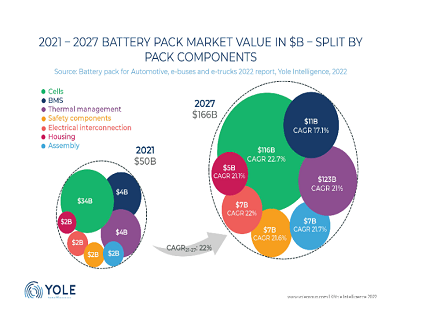

The total annual market for Li-ion Automotive Battery Packs (for BEV , PHEV , electric buses, and electric trucks) is forecast to grow from US$50 billion in 2021 to around US$ 166 billion in 2027, with a 22% CAGR2021-2027. The total annual demand for battery packs will reach around 1295 GWh by 2027. The growth rate for different applications varies, as their market dynamics have different drivers. The demand is mainly driven by full BEVs, which represent around 90% of the total demand in GWh by 2027.

Battery cells will make up the largest part of the global battery pack market at about 68% by 2027. The second largest part will be thermal management, followed by the BMS…

Automotive Battery Packs

In this dynamic context, Yole Intelligence has developed a dedicated technology & market report to deliver a comprehensive overview of the Li-ion battery packs and components industry. It includes battery management systems, thermal management, and safety components for PHEVs, BEVs, electric trucks, and buses. In its new Battery pack for Automotive, e-buses and e-trucks 2022 report, the company, part of Yole Group, highlights the strong, consistently growing potential for power electronics players, including suppliers of power ICs , batteries, battery modules, fuses, sensors, and thermal management -, battery management solutions in the automotive business based on Li-ion battery technology. This Automotive Battery Packs study analyzes the battery pack supply chain and discusses market opportunities. This report also provides technical insights into the different though related technologies.

According to Dr. Shalu Agarwal, Ph.D., Senior Analyst specializing in Power Electronics & Batteries at Yole Intelligence, Part of Yole Group: “There is no big technology breakthrough expected in the coming years for battery cells and other battery pack components. The main trends will involve existing technology solutions. The main innovations in the battery pack market are driven by the need to reduce battery pack weight and volume, improve battery reliability, and lower battery pack assembly costs.”

The most common approach to integrating cells into the vehicle is the modular approach. Another approach to making a battery pack is the cell-to-pack approach, where battery cells integrate directly into a pack without intermediate modules. Today, many battery manufacturers – such as BYD, CATL, and LG Energy Solution – are exploring this approach. The latest way of integrating cells into a vehicle is the cell-to-chassis approach, integrating cells directly into vehicle bodies.

The Li-ion Automotive Battery Packs performance depends on many factors, such as its battery chemistry, energy and power density, its charge/discharge efficiency, cycle life, and the battery pack’s components, including cells, BMS, thermal management system, interconnections, and safety components.

The most common battery chemistries are lithium-NMC and lithium-NCA for high-range EVs. In addition, low-cost cobalt-free LFP batteries are also gaining popularity.

As of 2022, battery cell supply is dominated by Asian players such as CATL and BYD in China, Samsung SDI, LG Energy Solution and SK in South Korea, and Panasonic in Japan. However, almost all these leading players are expanding their business into Europe and the US by constructing new battery manufacturing facilities to access local vehicle makers easily. Battery pack manufacturers are concentrated mainly in countries that produce battery cells, especially integrated cell/pack companies, and in countries with EV/HEV car manufacturing facilities. Most battery pack suppliers are vehicle manufacturers themselves. They purchase battery cells mainly from leading suppliers like CATL, LG Energy Solution, Panasonic, and Samsung SDI, and build their battery pack using other key components. Vehicle makers are increasingly involved in battery cell design and, in some cases, cell manufacturing, such as Tesla and Daimler. There are many new partnerships, joint ventures, and acquisitions within the supply chain to reduce competition, secure access to strategic materials such as lithium and battery cells, ensure growth, and ease entry to new markets.

For more information on Automotive Battery Packs report click: Automotive battery pack: attractions & improvements