The banking and financial system is going through an unprecedented digital transformation and taking advantage of this, malicious attackers pose a serious threat to the stability and integrity of the system. Disruptive and destructive attacks and incidents that corrupt the integrity of financial data have been increasing rapidly. As financial institutions rely on their digital infrastructure to deliver financial transactions it is important to ensure their networks are secure, reliable, and perform as planned to their specific needs. Investing in a robust and secure network infrastructure and performing regular assessment and validation enables organizations to minimize the risk of downtime and proactively addresses the increasing onslaught of security vulnerabilities.

Test lab modernization and automation is key

BFSI enterprises are pushed to test more complex systems, while facing multiple regulatory compliance requirements. The current state of testing cannot keep pace, where multiple labs/environments are segregated by technology and vendors. This includes siloed labs/environments that reside both on customer premises and vendor facilities. Added to this, typical lab set-up time can be weeks, requiring multiple lab techs. To address these challenges, a test lab modernization and automation strategy is essential to manoeuvre the objectives and requirements of the banking & financial sector. Test lab modernization for financial enterprises is a sophisticated, proven program that delivers the following components:

- Lab automation. Build and integrate key automation capabilities from the start

- Test automation. Agile iTest development to capture, design, develop, and automate manual test cases

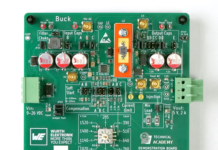

- Physical design. Inventory, architecture design, pre-commissioning, configuration installation and validation of network infrastructure connectivity

- Network implementation. Integration of all L1/L2/L3 devices, fabric architecture design, configuration, installation, and validation

The lab modernization solution provides a centralized development environment which allows test teams to build automated test suites, and the controls to execute them, with results populated into a centralized reporting engine that tracks testing progress. The benefits include: accelerated time to market via streamlined test cycles, optimized tool and human resource management with efficient utilization of lab resources and reduced capex with efficient sharing, device utilization and full automation of common functions.

Proactive assessment and validation

Banking & Financial institutions must have a strong and comprehensive assessment and validation strategy to maintain security, performance, and access in current architectures. Cyber resilience and protecting the network of financial system is primarily an organizational challenge. Testing for regulatory compliance, security, and performance has been built up over years and is highly siloed and manual. Also, the testing is often too simplistic and doesn’t accurately mimic real-world conditions. As a result, IT teams can’t easily scale up to support new compliance and security testing needs and aren’t able to keep up with the rapid pace of technology releases. This slows time-to-market of new products and services, and can lead to costly outages, service degradations and regulatory actions.

Areas where proactive assessment and validation offer major benefits include:

- Cyber threats: Cyber threats are on the rise, and mission-critical enterprises are a prime target due to the sensitive data they hold. These threats include phishing attacks, malware, exploits, and ransomware. Assessing the network infrastructure can help banks identify vulnerabilities and develop appropriate measures to protect against cyber threats ahead of the curve.

- Protecting sensitive information and business continuity: Financial institutions deal with sensitive customer information, such as financial transactions and personal details, on a daily basis. Security breaches can lead to financial loss, reputational damage, and legal consequences. Regular testing of the network infrastructure is essential to identify vulnerabilities and potential security breaches. Assessing the network infrastructure helps identify potential weaknesses and develop a disaster recovery plan to minimize disruption of their services and ensure business continuity.

- Reduced Downtime: Network downtime can cost millions in lost revenue, depending on the severity of the outage. By identifying and addressing potential network issues proactively, financial institutions can minimize the risk of downtime and save money and customer trust.

- Improved Network Performance: A poorly performing network can impact the speed and efficiency of financial transactions, resulting in frustrated customers and lost revenue. By testing and optimizing the network, organizations can improve network performance, reduce transaction times, and ultimately save costs.

- Regulatory Compliance: Financial institutions are subject to regulatory requirements. Regulatory bodies require BFSIs to adhere to specific security and compliance standards. By proactively validating and addressing potential security vulnerabilities, organizations can ensure compliance and avoid costly penalties.

- Automated Testing: Testing is not a one-off activity. A strong assessment strategy may require testing hundreds of device elements or large lab-based or digital twin environments. By leveraging an automation approach, more can be accomplished with less labour, equipment, and power requirements, all leading to major cost savings.

Continuous testing and assessment is vital

Although network equipment manufacturers test and validate performance of their equipment or software, they can’t possibly verify it on every unique enterprise network, under their specific architecture and usage scenarios. Vendors may even have gaps in their testing when leveraging open source code or newly acquired technology that may not have been thoroughly vetted.

It is essential that banking and financial institutions regularly test their networks to ensure they’re secure, reliable, performant, compliant and user-friendly. Test lab modernization and CyberThreat Assessment (CF CTA) evasion tools emulates a wide range of hyper realistic hacker behavior, including encrypted attacks & evasion techniques and automates IT network and security testing, reducing costs, and increasing energy efficiency, while improving productivity.

To achieve effective protection of the banking and financial system against cyber threats and strengthen cyber resilience, industry-leading assessment solutions that cover devices, infrastructure, cloud infrastructure, networks, network applications, security and assurance, all powered by state-of-the-art lab and test automation helps implement the right test strategies along with in-depth assessments and reporting. Such industry expertise maximizes solution capabilities and ensures that financial institutions deliver their product and services to market on time and with optimal quality.