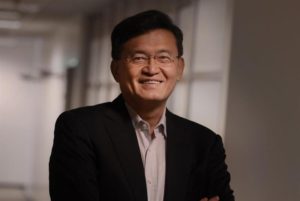

Lip-Bu Tan is CEO of Cadence Design Systems, one of the world’s biggest companies providing software and hardware for designing integrated circuits, systems on chips and printed circuit boards.

He is also chairman of Walden International, a venture capital firm he founded in 1987 and which has been active in investing in Indian semiconductor startups.

On a visit to Bengaluru, where Cadence has a large R&D centre, Tan and India MD Jaswinder Ahuja spoke to TOI. Excerpts:

Give us a sense of the emerging opportunities and challenges in the semiconductor industry.

Tan: Semiconductors are the foundation of all the killer apps. There is a lot of innovation required for some of the emerging areas of opportunity. Machine learning, deep learning are very big areas. Self-driving is machine learning.

Today, people are trying to see if a device can look at your eye ball and understand what you are looking at, so that you don’t have to use a keyboard, mouse or voice (to perform an action).

Where the eye is looking can also be where the target advertising is placed. Some universities are doing even more advanced research, looking at how the brain functions. These kind of deep learning can help in medical applications, predicting heart attacks, and a host of other areas.

There is work happening to reduce the latency in video, given that AR/VR (augmented/virtual reality) is taking off. All these are going to drive a lot of in novation in the semiconductor side, but there are also a lot of challenges in the semiconductor ecosystem.

It is kind of frustrating that most of the venture firms are not interested in investing in semiconductor firms. Most of them try to invest on the next WhatsApp, or other social media apps.

How do you see India in the semiconductor space?

Tan: India is very important for us. About 25% of our manpower is in India, our R&D side is very big here. But it can become much more effective for the country if, like China, India becomes self-sufficient in terms of providing the silicon for the country’s growth.

The Chinese government decided semiconductor is very important for them. They didn’t want to depend on US companies to provide their semicon requirements. If you depend on them, you don’t get the attention or the service you need, because of the distance, and because of the dominance of a few players.

Their standard products may not suit local requirements. Besides, getting attention is very important especially if you have a unique idea and have customized requirements.

So China poured $100-plus billion to build and acquire companies like infrastructure business H3C and phone image sensor company OmniVision to create the capacity. The Indian government has been talking, and I have just encouraged the government to do it quickly, because you shouldn’t miss the whole boat.

What should the government do?

Ahuja: The government put together the National Policy on Electronics back in 2011, it’s a very comprehensive roadmap. It acknowledges that we need to have homegrown Indian fabless semiconductor companies, that we need to set up incubation facilities. But the implementation is extremely slow.

Where are the incubation centres? Where is the Electronic Development Fund, which was to be the fund of funds (EDF was to participate in professionally managed ‘daughter funds’ which in turn would provide risk capital to companies developing new technologies in the area of electronics)?

These were things that were called out five years ago.

Can’t private industry take the lead? Like the way it’s happening in software.

Tan: Significant investment is required, and that’s where things like VC funding supported by the government becomes absolutely critical. And VCs are more interested in consumer apps, like you said, and not in semicon…

Ahuja: Well, other than Lip-Bu, who else is there? Also, incubators in the semicon space are different from other incubators because it’s not just about space. They need big investments in tools, test equipment.

How are your investments in India through Walden doing, like Ineda? Are you expanding that initiative?

Tan: Ineda is doing well. We have invested in Aura (Bengaluru-based Aura Semiconductor). Aura is a great team. So we are excited to continue to fund more of this. Very good two or three investments are in the pipeline. We now have a local industrial group joining us.

We would like to see more of industry participating with us, and then the government participating with us, so that we kind of build the necessary ecosystem.

You are saying Ineda, Aura and others could do much better with more funds?

Tan: Yes, they have got more opportunities. We love them dearly. There are not too many companies in India that have their own product. If you have your own product, I think that is the next stage of development for the country .

You have been investing significantly into R&D in India…

Tan: Yes, it’s exciting. And we have everything under one roof now in Bengaluru.This is the third largest site for Cadence after San Jose and Noida. We have five sites in India, and together we have over 1,700 of our global strength of 7,000 here.

Ahuja: We have been growing very, very rapidly. Two years ago in Bengaluru we were 500 people. Today we are 750. I expect that in the next few years, we will continue to grow like this. This new facility here can hold 1,000 people.

Source: http://tech.economictimes.indiatimes.com/