New technologies, digital devices and the pace of innovation are impacting the banking industry’s operating models and influencing the banking ecosystem. The most prominent of these innovations include cloud computing, big data analytics, artificial intelligence and machine learning, robotic process automation, blockchain and the Internet of Things (IoT). Many of these technologies are interrelated.

By building on early success with mobile technology, banks and other financial firms are experimenting with new ways to:

- Improve the customer experience

- Provide enhanced insights from a risk and CX perspective

- Increase agility and speed to market

- Strengthen customer engagement

- Reduce operating costs

- Increase revenues

- Banking and the Internet of Things (IoT)

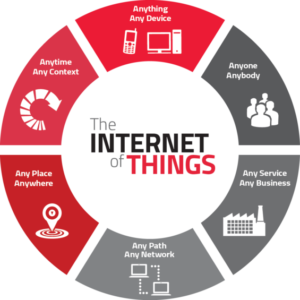

The world of IoT is a network of Internet-connected sensors that can be embedded into physical devices that collect data and share it across the web with people, applications and other devices. The ability to measure and apply insight contextually has the potential to augment and disrupt commerce and entire industries. The question is whether the banking industry will have a prominent role in this interconnected world.

How does banking develop a roadmap or strategy when early forays into IoT are so varied and the value proposition is so difficult to ascertain? Experts predict that up to 25 billion Internet of Things devices will be in place within a few years. That represents between 4 to 6 devices for every person on earth. Tata Consultancy Services (TCS), in a survey of bankers, found that average IoT per-company spending in banking would grow to $153.5 million by 2018, up nearly 31% from $117.4 million in 2015.

But not all banking organizations have jumped on the IoT bandwagon. International Data Corporation (IDC) found that just 43% of bankers were familiar with the IoT. Despite this relative lack of knowledge, the same study found that 58.4% of finance-industry decision makers viewed the IoT as a “strategic” initiative, compared with 20% who believed it was “transformational.” Perhaps more significant, only 5.6% of respondents said it was unimportant.

“By enabling the collection and exchange of information from objects, the IoT has the potential to be as broadly transformational to the financial services industry as the Internet itself,” said Jim Eckenrode, executive director of the Deloitte Center for Financial Services.

For more information visit:https://thefinancialbrand.com/63285/banking-internet-of-things-iot-data-analytics-payments/