Robotics has a long, colorful history, but its applications have only recently impacted the healthcare industry. YoleDéveloppement (Yole), the “More than Moore” market research and strategy consulting company is investigating this domain to identify the evolution of the healthcare industry and its needs and understand the related technology challenges.

In 2000, the field’s current main player, Intuitive Surgical, was one of the first firms to bring a surgical robot to market. At the time, the company’s marketing was centered on remote surgical procedures. However, the ensuing years have seen the applications of this life-changing technology increase exponentially, to the point where the possibilities enabled by today’s medical robots are endless. Each “participant” sees added value in this technology: minimal invasiveness for the patient, enhanced microsurgery and precision capabilities for the surgeon, and cost optimization for the healthcare system due to patients’ shorter recovery time.

“The medical robotics market will experience an impressive 17% CAGR , from US$3.7 billion in 2016 to US$9.3 billion in 2022,” announces Dr. Marjorie Villien, Technology & Market Analyst at Yole. “This growth will be mainly driven by the surgical robots segment, which represents about 94% of the medical robotics market in revenue in 2016. However, due to a big difference in ASP , rehabilitation and prosthetics robots, along with hospital and ambulatory care robots, represented 87% in terms of units sold.”

For more than a decade, Intuitive Surgical has had a quasi-monopoly on the field of minimally invasive robotic surgery. But newcomers like Cambridge Medical Robotics and TransEnterix are now entering the market with new technologies. Also, in the last few years Medtronic has made two major moves into surgical robotics: its acquisition of Covidien for US$50 billion, and its emergence as Mazor Robotics’ lead investor. Medtronic-Covidien owns an extensive patent portfolio in the surgical robotics field, and the company should be watched closely over the next few years since they are probably working on a new product.

In December 2015, Google’s Alphabet and Johnson & Johnson announced the formation of Verb Surgical, the offspring of a strategic partnership between Ethicon, a medical devices subsidiary of Johnson & Johnson, and Verily Life Sciences, formerly known as Google Life Sciences. Verb Surgical is building a digital surgery platform combining robotics, advanced visualization, advanced instrumentation, data analytics, and connectivity. Verb surgical will certainly be an important challenger to Intuitive Surgical.

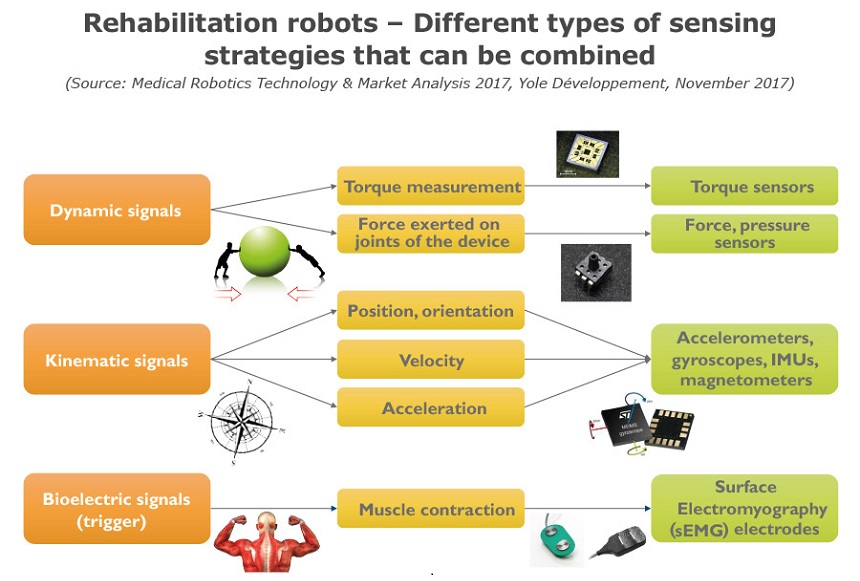

A robot is a machine that senses, thinks, and acts. But how will the medical robotics industry impact the sensors industry? “Numerous sensors are required for a robot to function and sense its environment”,comments SébastienClerc, Technology & Market Analyst at Yole. “They include position and torque sensors for the articulations, gyroscopes and accelerometers for positioning as well as moving parts, pressure sensors, image sensors, surface electromyography and neuronal implants as a trigger signal for the exoskeleton, and many other sensor types. Such devices can be divided within two families: the key enabler sensors, and the other sensors not specifically developed for medical robotics applications,” analyzes SébastienClerc from Yole.

In the field of surgical robotics, surgeons want technology that allows them to “feel” the body’s tissue remotely, a process called “haptic sensing”, as well as better camera-image quality since the surgical robot functions as the surgeon’s hands and eyes. Both issues can be addressed using new sensor types: haptic sensors and high-resolution CCD or CMOS cameras.

Another trend, already observed in the endoscopy market, is the move towards disposable image sensors to achieve a disposable laparoscope. This trend is not yet visible in the surgical robots market, but it will probably surface in the future as regulations evolve towards more disposable scopes. This would completely change the number of cameras sold to surgical robot-makers, shifting from a single camera per robot to as many as one camera per surgery.

In the field of rehabilitation robotics and prosthetics, different sensor strategies have been identified and can be used separately or combined together: dynamic control with torque and force sensors, kinematic control with inertial sensors, and trigger control with myoelectric sensors. Thus, a single rehabilitation robot can embed dozens of sensors.

Yole’s experts announce a US$ 9.3 billion market in 2022 in its new report, Medical robotics technology & market analysis

Under the new report, Yole’ analysts explain the challenges linked to medical robotics, and their current and future applications. The MedTech team proposes a technical and economical segmentation and gives an overview of medical robots’ history, from first developments to present day. This report also includes furnish market data, forecasts, and analysis, and explore the different present and future business models for each segment… What are the needs of the medical industry? How will robots reshape the healthcare system? Are sensors key enablers of this technology? What can end-users expect? The market research and strategy consulting company offers today a snapshot on this promising market.