The global energy industry is facing major challenges from the ongoing environmental issues, changing regulations, low oil prices, and high capital and operating costs. They are forcing energy firms, which are traditionally considered conservative, to undergo a great deal of innovation and adopt disruptive technologies, according to leading data and analytics company, GlobalData.

The company’s report ‘Technology Trends in Energy’ casts a lens over the technology trends affecting the energy industry, with a special focus on the oil and gas landscape.

Amir Boubaker, Associate Analyst for Digital Industries at GlobalData, says: “The oil and gas industry is lagging behind others in terms of adopting digital technologies. Now, a host of firms find themselves on the brink of a large-scale digital transformation, primarily due to the looming threat of consistently low crude oil prices, ageing infrastructure and, outdated machines and equipment.”

With an increasing pool of potential use cases growing bigger each day, oil and gas companies are implementing Internet of Things (IoT) in all components of the value chain. More specifically energy firms are looking to connect previously separate assets together, which is referred to as the Industrial IoT, to enable collaboration between machine, device and worker.

Shell Nigeria implemented such a system, connecting oilfield devices and equipment such as wellhead monitoring and pipeline surveillance within the Niger Delta, and was able to save over $1m in a short space of time.

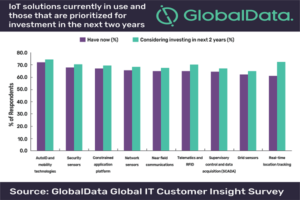

According to GlobalData’s IT Consumer Insight survey, 72% of energy companies are currently using AutoID and mobility technologies and close to 68% firms currently use security sensors. Even more percentage of energy firms is considering investment in the solutions over the next two years.

Boubaker explains: “The industry is no stranger to vast amounts of sensors decorating the equipment and machines, but the data captured has previously only be crudely manipulated for marginal boosts in operational efficiencies. But as sensors become cheaper and the ability to manage their data and gain insights from it becomes more mature, energy companies are looking to take their investments to the next level in order to gain a real advantage from this data.”

The survey further reveals that 72.5% of energy companies are interested in investing real-time location tracking technologies over the next two years.

Boubaker comments: “Deployment of affordable real-time tracking technologies can be paired up with the already low-cost sensors, which can then be IoT-enabled and managed by an AI system to streamline production and enhance operational efficiencies.”