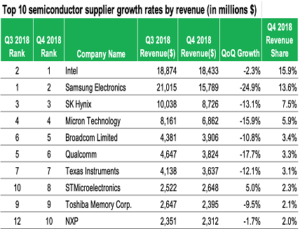

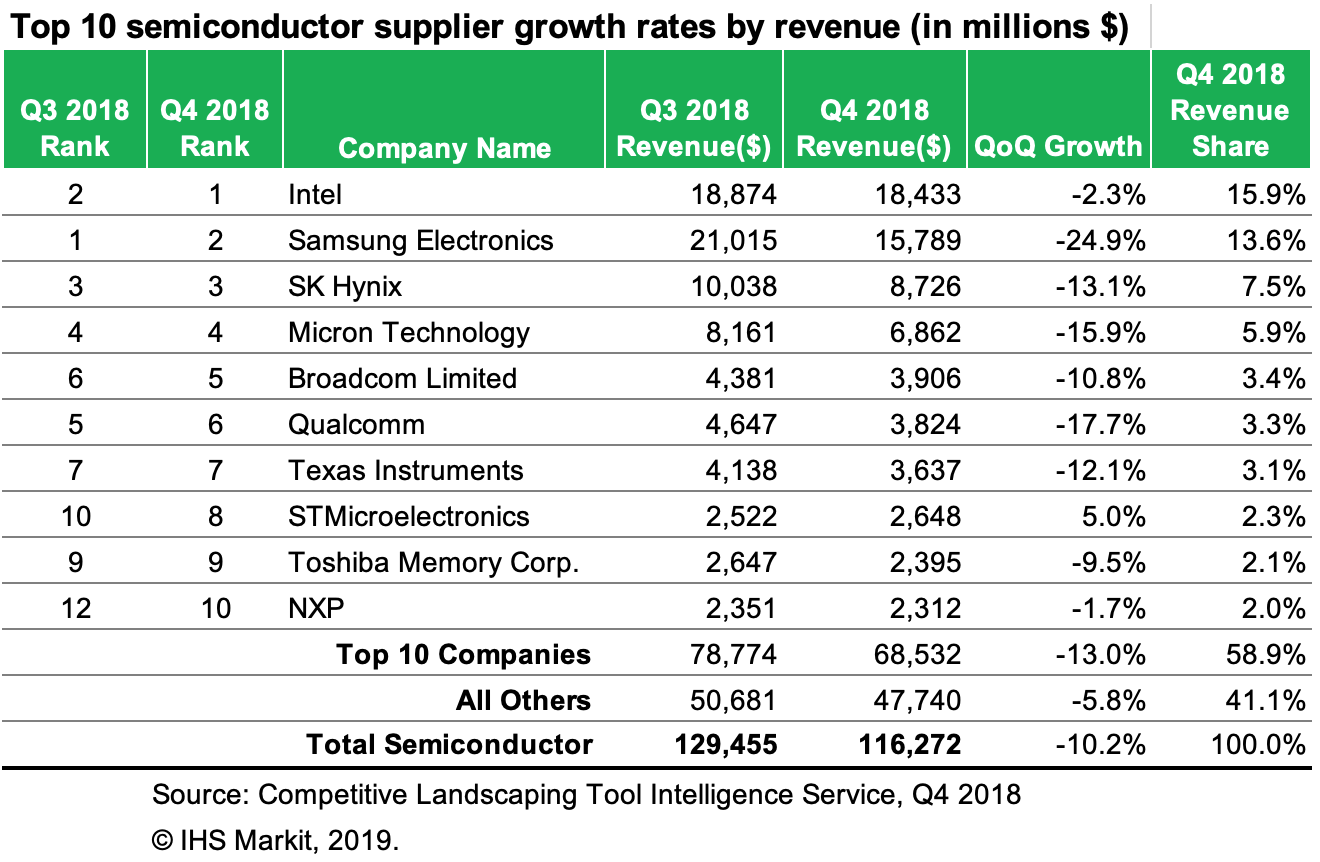

The declining market for semiconductors used in mobile handsets and enterprise servers led to a realignment in the company market-share ranking for semiconductor manufacturers. While Samsung led semiconductor sales for the past five quarters, Intel outpaced Samsung in the fourth quarter. Intel’s semiconductor sales revenue reached $18.4 billion in the fourth quarter, compared to $15.8 billion for Samsung. While quarter-over-quarter Intel semiconductor sales declined by 2.3 percent in the fourth quarter of 2018, Samsung fell 24.9 percent, according to IHS Markit .

“Samsung has traditionally been far more dependent on memory chip sales than Intel, so when mobile handset sales slowed dramatically last year, so did the company’s memory chip sales,” said Ron Ellwanger, senior analyst, semiconductor manufacturing, IHS Markit. “The last time the memory market decreased more was in the fourth quarter of 2008, at the height of the global financial crisis.”

Intel last held a quarterly lead in semiconductor sales in the second quarter of 2017. Samsung overtook Intel in the third quarter of 2017, due to a shortage of memory chips used in the growing cell phone and server markets, which Samsung was able to fill.

Samsung still led overall 2018 sales

Samsung annual semiconductor revenue rose 20.3 percent, year over year, reaching $74.6 billion in 2018. Intel’s semiconductor revenue increased by 13.4 percent, to reach $69.9 billion. Nearly all (87 percent) of Samsung semiconductor sales in the fourth quarter were memory chips, compared to just 6 percent for Intel.

The overall semiconductor market declined 10.2 percent in the fourth quarter of 2018, with all market applications and market device segments shrinking. “The reasons for the declining semiconductor market were manifold,” Ellwanger said. “Memory chip prices continued to fall, due in large part to an oversupply of memory chips caused by excess capacity and high semiconductor chip inventory.”

To read Q3 semiconductor player report click here